A Special Needs Trust is designed to provide financial security and support for individuals with disabilities without compromising their eligibility for government benefits like Medicaid or Supplemental Security Income. This trust allows you to set aside funds that cover expenses not covered by public assistance, ensuring a higher quality of life for your loved one. Discover how establishing a Special Needs Trust can protect your family's future by reading the rest of the article.

Table of Comparison

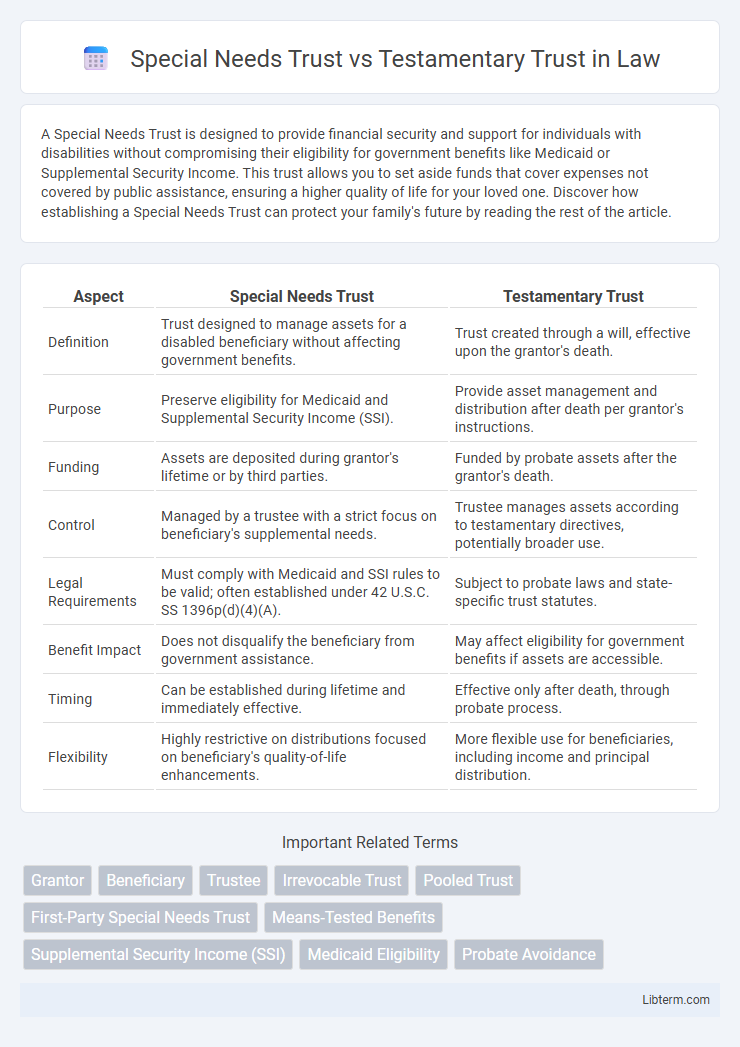

| Aspect | Special Needs Trust | Testamentary Trust |

|---|---|---|

| Definition | Trust designed to manage assets for a disabled beneficiary without affecting government benefits. | Trust created through a will, effective upon the grantor's death. |

| Purpose | Preserve eligibility for Medicaid and Supplemental Security Income (SSI). | Provide asset management and distribution after death per grantor's instructions. |

| Funding | Assets are deposited during grantor's lifetime or by third parties. | Funded by probate assets after the grantor's death. |

| Control | Managed by a trustee with a strict focus on beneficiary's supplemental needs. | Trustee manages assets according to testamentary directives, potentially broader use. |

| Legal Requirements | Must comply with Medicaid and SSI rules to be valid; often established under 42 U.S.C. SS 1396p(d)(4)(A). | Subject to probate laws and state-specific trust statutes. |

| Benefit Impact | Does not disqualify the beneficiary from government assistance. | May affect eligibility for government benefits if assets are accessible. |

| Timing | Can be established during lifetime and immediately effective. | Effective only after death, through probate process. |

| Flexibility | Highly restrictive on distributions focused on beneficiary's quality-of-life enhancements. | More flexible use for beneficiaries, including income and principal distribution. |

Introduction to Trusts: Special Needs vs Testamentary

Special Needs Trusts are designed to provide financial support for individuals with disabilities without disqualifying them from government benefits, ensuring ongoing care and quality of life. Testamentary Trusts are established through a will and activate upon the testator's death, managing and distributing assets according to specific instructions to beneficiaries. Both trusts serve distinct purposes in estate planning, with Special Needs Trusts prioritizing beneficiary protection and Testamentary Trusts focusing on asset management and distribution.

Defining a Special Needs Trust

A Special Needs Trust (SNT) is a legally established fund designed to provide financial support for individuals with disabilities without affecting their eligibility for government benefits such as Supplemental Security Income (SSI) or Medicaid. Unlike a Testamentary Trust, which is created through a will and takes effect after the testator's death, a Special Needs Trust can be established during the grantor's lifetime or upon death, offering ongoing management of assets tailored to the beneficiary's specific needs. The primary purpose of an SNT is to enhance the quality of life for the disabled individual while preserving crucial public assistance benefits.

Understanding Testamentary Trusts

Testamentary trusts are established through a will and come into effect only after the grantor's death, providing controlled asset distribution according to specified terms. They offer flexibility in managing estate taxes and protecting beneficiaries, including those with special needs, by ensuring funds are used appropriately. Unlike special needs trusts, testamentary trusts are not designed solely to preserve government benefits but serve broader estate planning purposes.

Key Differences Between Special Needs and Testamentary Trusts

Special Needs Trusts are designed to provide financial support for disabled beneficiaries without compromising their eligibility for government benefits such as Medicaid and SSI, whereas Testamentary Trusts are created through a will and take effect only after the grantor's death. Special Needs Trusts allow for discretionary distributions to cover expenses that enhance quality of life, while Testamentary Trusts typically distribute assets according to predetermined terms outlined in the will. Key differences include timing of establishment, impact on government benefits, and the specific purpose of asset management, with Special Needs Trusts prioritizing long-term care and Testamentary Trusts focusing on general inheritance planning.

Eligibility and Beneficiaries

Special Needs Trusts (SNTs) are designed specifically for individuals with disabilities who qualify for government benefits, ensuring that trust funds do not jeopardize eligibility for Medicaid or Supplemental Security Income (SSI). Testamentary Trusts are created through a will and become effective upon the grantor's death, typically benefiting a broader range of beneficiaries and not always protecting government benefit eligibility. Eligibility for Special Needs Trusts requires the beneficiary to have a qualifying disability, while Testamentary Trusts can serve any named beneficiaries without strict eligibility criteria.

Asset Protection and Management

Special Needs Trusts provide robust asset protection by preserving government benefits while allowing a beneficiary with disabilities to access funds for supplemental needs without jeopardizing eligibility. Testamentary Trusts, created through a will and activated upon death, offer structured asset management but do not inherently protect government benefits or shield assets during the grantor's lifetime. Effective asset management in Special Needs Trusts includes professional trustee oversight tailored to disability-related expenses, whereas Testamentary Trusts primarily focus on broader estate distribution and control.

Impact on Government Benefits

Special Needs Trusts (SNTs) protect beneficiaries' eligibility for government benefits such as Medicaid and Supplemental Security Income (SSI) by holding assets without disqualifying the recipient. Testamentary Trusts, established through a will and activated after death, may jeopardize government benefits because assets transferred are often considered available resources. Carefully structuring trusts with the help of an attorney ensures the preservation of essential public benefits for individuals with disabilities.

Administration and Trustee Roles

Special Needs Trusts require trustees to manage assets meticulously to maintain beneficiary eligibility for government benefits, involving strict oversight of disbursements aligned with the beneficiary's needs. Testamentary Trusts, established through a will after the grantor's death, involve trustees administering assets according to the trust terms, often with broader discretion and less impact on government benefits eligibility. The administration of Special Needs Trusts demands specialized knowledge of public benefit regulations, while Testamentary Trust administration focuses on probate processes and fulfilling the deceased's estate plan.

Tax Implications and Considerations

Special Needs Trusts (SNTs) offer tax advantages by allowing income to be allocated specifically for beneficiaries with disabilities, often avoiding grantor trust status and reducing tax liabilities on distributions. Testamentary Trusts typically arise from a will and are subject to higher income tax rates at lower thresholds, potentially increasing the tax burden until assets are distributed to beneficiaries. Tax planning should consider the potential for trust income to be taxed at compressed rates in Testamentary Trusts, whereas properly structured SNTs can protect eligibility for government benefits while managing tax consequences effectively.

Choosing the Right Trust for Your Situation

Special Needs Trusts are designed to provide financial support to individuals with disabilities without affecting their eligibility for government benefits, while Testamentary Trusts are established through a will and come into effect after the grantor's death. Choosing the right trust depends on factors like the beneficiary's specific needs, timing of asset distribution, and the desire to maintain government benefits. Consulting an estate planning attorney can help determine which trust aligns best with your family's long-term financial and legal objectives.

Special Needs Trust Infographic

libterm.com

libterm.com