Allocated Loss Adjustment Expense (ALAE) refers to the specific costs an insurance company incurs directly related to investigating and settling a particular claim. These expenses include legal fees, expert witness fees, and other claim-handling costs allocated to individual claims rather than shared among multiple claims. Discover how understanding ALAE can impact your insurance costs and claims process by reading the rest of the article.

Table of Comparison

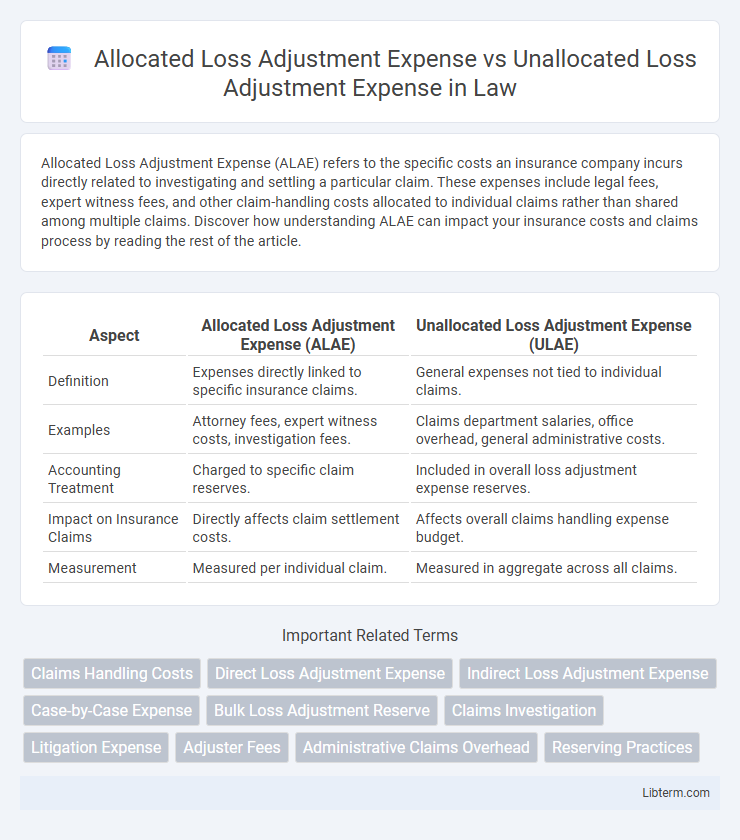

| Aspect | Allocated Loss Adjustment Expense (ALAE) | Unallocated Loss Adjustment Expense (ULAE) |

|---|---|---|

| Definition | Expenses directly linked to specific insurance claims. | General expenses not tied to individual claims. |

| Examples | Attorney fees, expert witness costs, investigation fees. | Claims department salaries, office overhead, general administrative costs. |

| Accounting Treatment | Charged to specific claim reserves. | Included in overall loss adjustment expense reserves. |

| Impact on Insurance Claims | Directly affects claim settlement costs. | Affects overall claims handling expense budget. |

| Measurement | Measured per individual claim. | Measured in aggregate across all claims. |

Introduction to Loss Adjustment Expenses

Loss Adjustment Expenses (LAE) represent costs insurers incur to investigate and settle claims, divided into Allocated Loss Adjustment Expenses (ALAE) and Unallocated Loss Adjustment Expenses (ULAE). ALAE are directly attributable to individual claims, such as payments to adjusters or legal fees, while ULAE encompass general claim handling costs not linked to specific claims, including salaries of claims department staff. Understanding the distinction between ALAE and ULAE is critical for accurate reserving, pricing, and financial reporting within the insurance industry.

Defining Allocated Loss Adjustment Expense (ALAE)

Allocated Loss Adjustment Expense (ALAE) refers to the specific costs directly associated with investigating and settling individual insurance claims, such as legal fees and expert witness expenses. These expenses are distinctly assigned to particular claims, differentiating them from Unallocated Loss Adjustment Expenses (ULAE), which cover general claims handling costs not attributable to any single claim. Accurately distinguishing ALAE enables insurers to precisely measure claim costs and improve reserve adequacy.

Defining Unallocated Loss Adjustment Expense (ULAE)

Unallocated Loss Adjustment Expense (ULAE) refers to the indirect costs associated with claims handling that cannot be attributed to a specific claim, such as salaries of claims department staff and overhead expenses. Unlike Allocated Loss Adjustment Expense (ALAE), which includes claim-specific costs like attorney fees or expert witness charges, ULAE covers administrative expenses necessary for overall claims processing. Properly distinguishing ULAE from ALAE is essential for accurate insurance loss reserving and financial reporting.

Key Differences Between ALAE and ULAE

Allocated Loss Adjustment Expense (ALAE) refers to the costs directly attributable to a specific claim, such as legal fees, expert witness fees, and investigation expenses, which are easily identifiable and assignable to particular claims. Unallocated Loss Adjustment Expense (ULAE) involves indirect expenses associated with the claims handling process, including salaries of claims adjusters, office rent, and administrative support, which cannot be linked to any single claim. The key difference lies in attribution: ALAE is claim-specific and variable, while ULAE is general overhead related to overall claims management.

Importance of Accurate Loss Expense Classification

Accurate classification of Allocated Loss Adjustment Expense (ALAE) and Unallocated Loss Adjustment Expense (ULAE) is critical for precise insurance claims reserving and financial reporting. Properly distinguishing ALAE, which directly relates to specific claims, from ULAE, encompassing general overhead costs, ensures more reliable loss cost projections and regulatory compliance. Misclassification can lead to distorted loss ratios, impacting underwriting decisions and premium setting accuracy.

Impact of ALAE and ULAE on Insurance Reserves

Allocated Loss Adjustment Expense (ALAE) directly correlates with specific claims, influencing insurance reserves by requiring precise estimations tied to individual loss events, which enhances reserve accuracy. Unallocated Loss Adjustment Expense (ULAE) encompasses indirect costs not linked to particular claims, necessitating broader reserve allocations to cover general claim adjustment processes. The differentiation between ALAE and ULAE is critical for insurers to maintain sufficient reserves, optimize capital allocation, and ensure regulatory compliance in loss liability management.

Methods for Allocating Loss Adjustment Expenses

Methods for allocating Loss Adjustment Expenses (LAE) differentiate between Allocated Loss Adjustment Expense (ALAE) and Unallocated Loss Adjustment Expense (ULAE) by specifically attributing ALAE to individual claims, often using direct assignment, proportionality, or claim count methods. ULAE is allocated using broader approaches such as claim count, paid loss, or exposure base methods to spread expenses across policies or accounts without direct linkage to specific claims. Accurate allocation methods enhance financial reporting and regulatory compliance by ensuring precise matching of expense categories to related losses.

Effects on Claims Handling and Settlement

Allocated Loss Adjustment Expense (ALAE) directly impacts claims handling by covering specific expenses tied to individual claims, such as legal fees and investigation costs, which can expedite settlement processes through targeted resource allocation. Unallocated Loss Adjustment Expense (ULAE) influences overall claims settlement efficiency by supporting general claims department operations, including salaries and administrative expenses, without being attributable to particular claims. Balancing ALAE and ULAE is crucial for insurers to optimize claims processing speed and cost-effectiveness, ensuring timely and fair settlement outcomes.

Regulatory and Reporting Considerations

Allocated Loss Adjustment Expense (ALAE) refers to expenses directly attributable to a specific claim, such as legal fees or investigation costs, and must be accurately reported for regulatory compliance to ensure proper reserve adequacy and loss cost evaluations. Unallocated Loss Adjustment Expense (ULAE) encompasses indirect costs like overhead and salaries not tied to individual claims, requiring separate tracking and reporting under regulatory frameworks to maintain transparency in financial statements. Regulatory bodies mandate distinct disclosure of ALAE and ULAE in insurance filings to facilitate risk assessment, premium calculation, and solvency monitoring.

Best Practices for Managing Loss Adjustment Expenses

Best practices for managing loss adjustment expenses involve distinguishing Allocated Loss Adjustment Expense (ALAE), which is directly attributable to specific claims, from Unallocated Loss Adjustment Expense (ULAE), encompassing overhead and general administrative costs. Effective management includes implementing detailed tracking systems to monitor ALAE for individual claims, ensuring precise cost control and claim evaluation. For ULAE, organizations should optimize operational efficiency through streamlined processes and automation to reduce overall overhead while maintaining high service standards.

Allocated Loss Adjustment Expense Infographic

libterm.com

libterm.com