Mortgage rates vary based on factors such as credit score, loan amount, and property type, impacting your overall loan affordability. Understanding key terms like fixed-rate, adjustable-rate, and amortization can save you money and stress during the borrowing process. Discover more about choosing the right mortgage and how to secure the best deal in the full article.

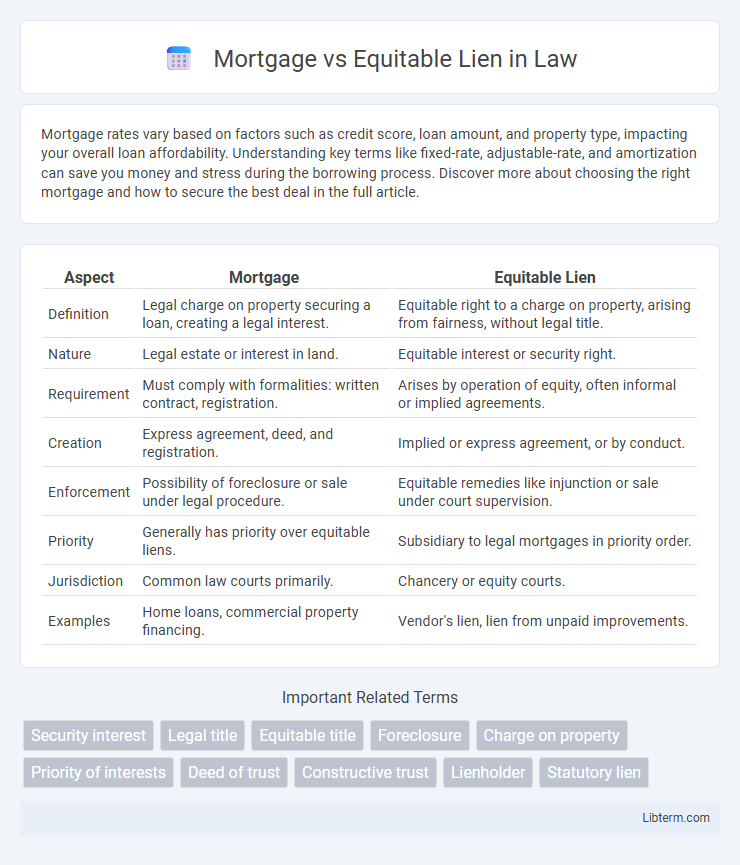

Table of Comparison

| Aspect | Mortgage | Equitable Lien |

|---|---|---|

| Definition | Legal charge on property securing a loan, creating a legal interest. | Equitable right to a charge on property, arising from fairness, without legal title. |

| Nature | Legal estate or interest in land. | Equitable interest or security right. |

| Requirement | Must comply with formalities: written contract, registration. | Arises by operation of equity, often informal or implied agreements. |

| Creation | Express agreement, deed, and registration. | Implied or express agreement, or by conduct. |

| Enforcement | Possibility of foreclosure or sale under legal procedure. | Equitable remedies like injunction or sale under court supervision. |

| Priority | Generally has priority over equitable liens. | Subsidiary to legal mortgages in priority order. |

| Jurisdiction | Common law courts primarily. | Chancery or equity courts. |

| Examples | Home loans, commercial property financing. | Vendor's lien, lien from unpaid improvements. |

Introduction to Mortgage and Equitable Lien

A mortgage is a legal agreement where a borrower pledges real property as security for a loan, creating a lien that enables the lender to enforce foreclosure if the debt is unpaid. An equitable lien arises from principles of fairness, imposing a charge on property to satisfy a debt or obligation without formal registration. While mortgages require written contracts and registration, equitable liens operate based on court recognition to prevent unjust enrichment.

Defining a Mortgage: Legal Framework

A mortgage is a secured loan agreement where the borrower pledges real property as collateral to the lender under a legally binding contract. Governed by statutory law and common law principles, mortgages create a lien that enables the lender to foreclose on the property if the borrower defaults on payments. The legal framework requires execution of a written agreement, registration of the mortgage in public records, and adherence to specific foreclosure procedures to protect both parties' interests.

Understanding Equitable Lien: Key Concepts

An equitable lien is a non-possessory security interest that arises by operation of law to prevent unjust enrichment when a party has contributed to the property's value but lacks a formal mortgage. Unlike a mortgage, which is a specific, consensual security interest recorded in public records, an equitable lien grants a claim based on fairness, allowing the claimant to enforce payment through the property's value. Courts impose equitable liens to ensure that parties who improve or finance property without formal documentation receive compensation, prioritizing equitable principles over strict legal title.

Legal Differences Between Mortgage and Equitable Lien

A mortgage creates a registered legal charge on property, granting the lender the right to sell the property if the borrower defaults, whereas an equitable lien provides a non-possessory, equitable security interest without transferring legal title. Mortgages require formalities such as written agreements and registration under property law, while equitable liens arise from principles of fairness and are typically enforceable through court orders without formal registration. The primary legal difference lies in the enforceability and priority; mortgages have statutory protection and priority over other claims, while equitable liens depend on equitable principles and may be subordinate to registered interests.

Creation and Validity: Process Comparison

A mortgage is created through a written agreement between the lender and borrower, requiring registration and exact formalities under property law for validity, whereas an equitable lien arises by operation of equity without formal registration, often to prevent unjust enrichment. Mortgage validity hinges on compliance with statutory requirements, including proper documentation and recording, while an equitable lien's validity depends on proof of a fair claim or agreement recognized by a court. The mortgage process ensures public notice and priority, whereas equitable liens protect equitable interests, often emerging from implied or constructive trusts.

Rights and Obligations of Parties Involved

A mortgage grants the lender a legal charge over the property, giving them the right to sell the property upon default to recover the debt, while the borrower retains possession and use of the property but must fulfill repayment obligations. An equitable lien, by contrast, provides the creditor a security interest recognized by equity, enabling them to claim a share of the proceeds from the property's sale without transferring ownership or possession. Mortgagors owe duties to maintain the property and uphold loan terms, whereas holders of equitable liens primarily have enforcement rights limited to equitable remedies without the procedural rights of a mortgagee.

Priority and Enforcement Mechanisms

Mortgages generally have priority over equitable liens due to their formal registration under property law, giving mortgage holders a superior ranking in debt recovery. Enforcement of a mortgage involves foreclosure proceedings, allowing the lender to sell the property to recoup the loan amount, while equitable liens require court intervention to enforce the security interest. Courts prioritize mortgages because of their explicit contractual and statutory framework, whereas equitable liens depend on principles of fairness and may be subordinate to registered interests.

Benefits and Drawbacks: Mortgage vs Equitable Lien

A mortgage provides the lender with a legal right to sell the property upon default, offering stronger protection and clear priority over other creditors, but it involves more formalities and registration costs. An equitable lien grants the lender an interest in the property without transferring legal title, allowing flexibility and easier creation but often lacks the enforceability and priority rights of a mortgage. While mortgages enhance security and marketability of the debt, equitable liens offer simplicity but may face challenges in competing with registered charges or third-party claims.

Common Scenarios and Practical Applications

Mortgages commonly arise in real estate purchases where borrowers secure loans against property to ensure repayment, allowing lenders to foreclose if default occurs. Equitable liens often emerge in situations involving unjust enrichment, such as when one party improves a property without formal agreements, granting the claimant a non-possessory security interest enforced in equity. In practical applications, mortgages provide clear priority and legal remedies, while equitable liens offer flexible relief in dispute resolutions without formal recorded documents.

Conclusion: Choosing Between Mortgage and Equitable Lien

Selecting between a mortgage and an equitable lien depends on the level of legal protection and priority the lender requires. Mortgages provide a registered security interest with clear priority and enforcement mechanisms, making them preferable for formal, long-term financing. Equitable liens offer flexible, unregistered security primarily based on fairness, suited for informal arrangements or situations lacking explicit agreements.

Mortgage Infographic

libterm.com

libterm.com