Line-item budgeting breaks down expenses into specific categories, allowing for precise tracking and management of financial resources. This method enhances transparency and control over your spending by detailing each cost individually. Explore the full article to learn how line-item budgeting can improve your financial planning and decision-making.

Table of Comparison

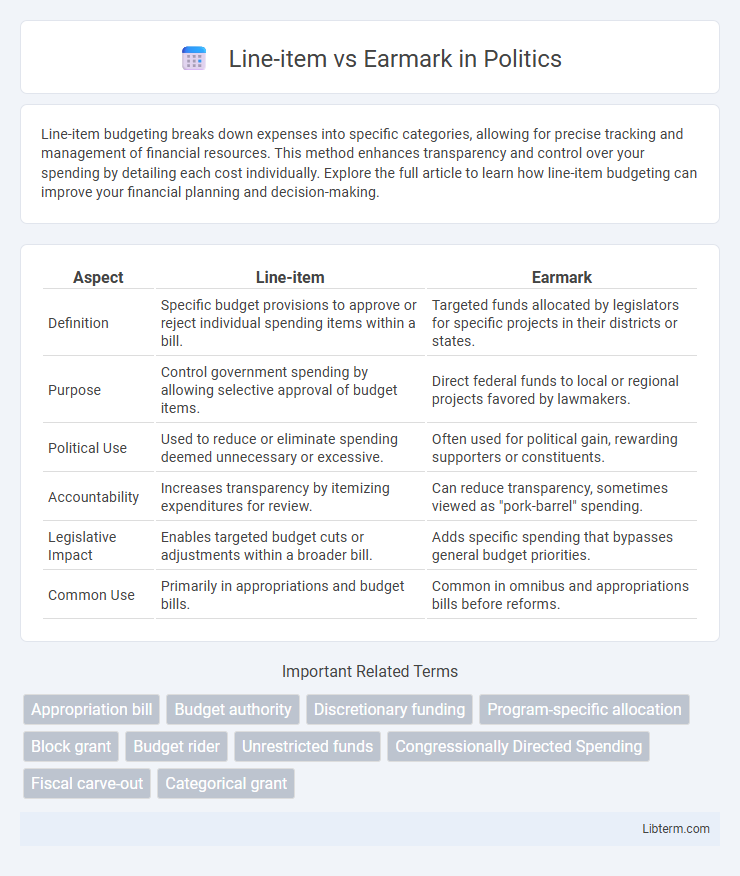

| Aspect | Line-item | Earmark |

|---|---|---|

| Definition | Specific budget provisions to approve or reject individual spending items within a bill. | Targeted funds allocated by legislators for specific projects in their districts or states. |

| Purpose | Control government spending by allowing selective approval of budget items. | Direct federal funds to local or regional projects favored by lawmakers. |

| Political Use | Used to reduce or eliminate spending deemed unnecessary or excessive. | Often used for political gain, rewarding supporters or constituents. |

| Accountability | Increases transparency by itemizing expenditures for review. | Can reduce transparency, sometimes viewed as "pork-barrel" spending. |

| Legislative Impact | Enables targeted budget cuts or adjustments within a broader bill. | Adds specific spending that bypasses general budget priorities. |

| Common Use | Primarily in appropriations and budget bills. | Common in omnibus and appropriations bills before reforms. |

Understanding Line-Item and Earmark: Definitions

Line-item refers to specific budget entries detailing individual expenditures within a broader financial plan, providing clear accountability for each expense. Earmark denotes funds designated by legislators for particular projects, often bypassing the standard competitive allocation process. Understanding the distinction between line-items and earmarks is crucial for grasping how government budgets are structured and controlled.

Historical Evolution of Budgeting Approaches

Line-item budgeting originated in the early 20th century, emphasizing detailed expenditure categories to increase fiscal control and accountability. Earmarking evolved later as a practice where specific funds are designated for particular purposes, reflecting political priorities and legislative influence over budget allocation. The historical shift from line-item to earmark approaches illustrates changing government transparency demands and the increasing role of stakeholders in directing public resources.

Key Differences Between Line-Item and Earmark

Line-items refer to specific budget entries detailing allocated funds for particular projects or expenses within an overall budget, ensuring transparency and itemization. Earmarks are designated funds within legislation that direct money to specific recipients or projects, often without competitive allocation or standard review processes. Key differences include line-items being part of the formal budgetary classification system, while earmarks are legislative provisions aimed at directing spending to targeted purposes, sometimes criticized for lack of oversight.

Advantages of Line-Item Budgeting

Line-item budgeting provides clear visibility and control over specific expenditure categories, enabling precise tracking of costs for items such as salaries, supplies, and equipment. This method enhances accountability and simplifies financial management by allocating funds to distinct budget lines, reducing the risk of overspending or misallocation. Governments and organizations benefit from improved transparency and easier auditing processes, which promote fiscal discipline and efficient resource utilization.

Benefits of Earmark Funding

Earmark funding ensures targeted allocation of federal resources directly to specific projects or entities, bypassing competitive grant processes to streamline implementation. It enhances local autonomy by allowing lawmakers to address region-specific needs and infrastructure improvements efficiently. These funds often lead to increased transparency and accountability since recipients and purposes are explicitly designated in legislative texts, reducing the risk of misallocation.

Drawbacks and Criticisms of Line-Item

Line-item budgeting is often criticized for promoting rigid financial planning, limiting flexibility in resource allocation and hindering responsiveness to changing needs. It encourages spending based on specific categories, which may result in inefficient fund utilization and reduced incentives for performance-based management. Critics argue that this approach can lead to unnecessary bureaucracy, stifle innovation, and diminish accountability by emphasizing adherence to allocated amounts rather than outcomes.

Controversies Surrounding Earmarks

Earmarks often spark controversies due to their association with pork-barrel spending, enabling legislators to allocate funds for localized projects without thorough scrutiny or competitive bidding. Critics argue earmarks can lead to wasteful expenditure, favoritism, and reduce transparency in the federal budgeting process. However, supporters claim earmarks facilitate negotiation and secure funding for critical district-specific infrastructure and community needs.

Real-World Examples of Line-Item vs Earmark

Line-item budgets specify individual expenditures, such as allocating $10 million for highway construction in Texas, providing clear oversight and spending categories. Earmarks direct funds to specific projects or recipients, exemplified by Congress approving $5 million exclusively for renovating a community center in Detroit. Both methods influence fund allocation transparency and political impact, with line-items offering detailed budget breakdowns and earmarks often tied to legislative priorities.

Impact on Transparency and Accountability

Line-item budgeting enhances transparency by clearly detailing individual expenditures, enabling stakeholders to track specific allocations and scrutinize spending decisions more effectively. Earmarks often reduce transparency as funds are directed toward predetermined projects without the same level of detailed review, which can obscure the rationale behind allocations and limit public oversight. The greater granularity in line-item budgets fosters stronger accountability by holding agencies responsible for precise spending, whereas earmarks may dilute accountability due to predetermined funding bypassing standard approval processes.

Choosing the Right Approach for Budget Allocation

Choosing the right approach for budget allocation requires understanding the differences between line-item and earmark budgeting methods. Line-item budgeting provides detailed breakdowns of expenses by specific categories, promoting transparency and control, while earmark budgeting allocates funds for specific projects or purposes, ensuring targeted use of resources. Decision-makers should evaluate organizational priorities, fiscal flexibility, and compliance requirements to determine the most effective budgeting strategy.

Line-item Infographic

libterm.com

libterm.com