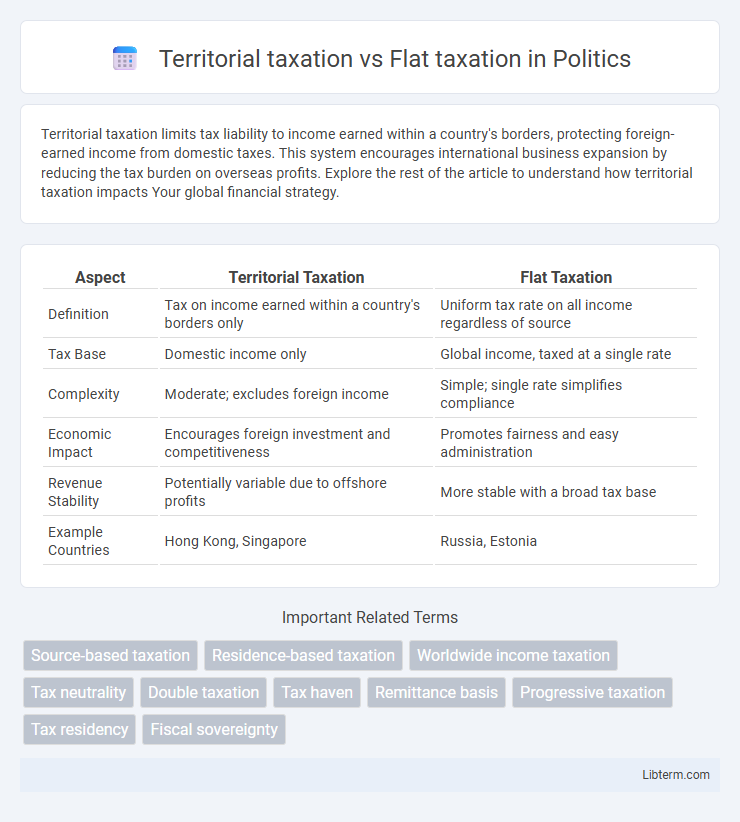

Territorial taxation limits tax liability to income earned within a country's borders, protecting foreign-earned income from domestic taxes. This system encourages international business expansion by reducing the tax burden on overseas profits. Explore the rest of the article to understand how territorial taxation impacts Your global financial strategy.

Table of Comparison

| Aspect | Territorial Taxation | Flat Taxation |

|---|---|---|

| Definition | Tax on income earned within a country's borders only | Uniform tax rate on all income regardless of source |

| Tax Base | Domestic income only | Global income, taxed at a single rate |

| Complexity | Moderate; excludes foreign income | Simple; single rate simplifies compliance |

| Economic Impact | Encourages foreign investment and competitiveness | Promotes fairness and easy administration |

| Revenue Stability | Potentially variable due to offshore profits | More stable with a broad tax base |

| Example Countries | Hong Kong, Singapore | Russia, Estonia |

Understanding Territorial Taxation: An Overview

Territorial taxation applies tax only on income earned within a country's borders, exempting foreign-sourced income to avoid double taxation and encourage domestic investment. This system contrasts with worldwide or global taxation models that tax global income regardless of its origin. Countries like Singapore and Hong Kong utilize territorial taxation to attract multinational corporations and boost economic activity through competitive tax structures.

What is Flat Taxation? Key Principles

Flat taxation implements a single, constant tax rate on all income levels without deductions or exemptions, ensuring simplicity and transparency in tax calculation. Key principles include uniform tax rates applied to both individuals' and businesses' gross income, promoting fairness and efficiency by eliminating progressive brackets and minimizing tax avoidance opportunities. This system supports economic growth by incentivizing investment and compliance through straightforward, predictable tax obligations.

Territorial vs Flat Taxation: Core Differences

Territorial taxation taxes only income earned within a country's borders, exempting foreign income, while flat taxation applies a uniform tax rate to all income regardless of its source. Territorial systems benefit multinational businesses by avoiding double taxation on overseas earnings, whereas flat tax regimes simplify tax compliance and administration with a single rate for all taxpayers. The core difference lies in scope: territorial tax focuses on the location of income generation, and flat tax emphasizes a consistent tax percentage on total income.

Impact on Individual Taxpayers

Territorial taxation limits income tax to earnings sourced within the country, reducing tax liabilities for individuals with significant foreign income and encouraging international business activities. Flat taxation applies a single tax rate on all income regardless of origin, simplifying compliance but potentially increasing the tax burden on expatriates or those earning abroad. Individual taxpayers benefit from territorial systems by excluding foreign-earned income from domestic tax, while flat systems offer predictability and ease in tax planning.

Implications for Businesses and Corporations

Territorial taxation allows businesses to exclude foreign-earned income from domestic tax, reducing the overall tax burden for corporations with substantial international operations and encouraging repatriation of profits. Flat taxation applies a uniform tax rate on all income regardless of source, simplifying compliance but potentially increasing tax liabilities for companies operating across multiple jurisdictions. Choosing between these systems affects corporate strategies on profit allocation, investment decisions, and financial reporting in global markets.

Tax Compliance and Administrative Efficiency

Territorial taxation limits tax liability to income earned within a country, simplifying compliance by excluding foreign income and reducing the need for complex international reporting. Flat taxation applies a uniform tax rate on all income, streamlining administrative processes through a straightforward calculation but potentially increasing compliance burdens for taxpayers with diverse income sources. Both systems impact administrative efficiency differently: territorial taxation reduces cross-border tax enforcement complexities, while flat taxation minimizes the complexity of tax brackets and deductions.

Economic Growth: Which System Performs Better?

Territorial taxation allows countries to tax only domestic income, encouraging multinational companies to reinvest profits locally, which can stimulate economic growth. Flat taxation imposes a uniform tax rate on all income, simplifying compliance and potentially attracting foreign investment through predictability and transparency. Empirical studies suggest that while flat tax systems can enhance growth by improving efficiency, territorial taxation often better supports economic expansion in open economies by reducing double taxation and promoting repatriation of profits.

Global Trends and Country Examples

Territorial taxation systems, favored by countries like Singapore and Hong Kong, tax only domestic income to attract foreign investment and enhance economic competitiveness. Flat taxation, implemented in nations such as Estonia and Russia, applies a single tax rate on personal and corporate income, simplifying compliance and promoting transparency. Global trends indicate a growing preference for territorial regimes to boost cross-border business activities while maintaining flat tax models to streamline fiscal policy and encourage entrepreneurship.

Pros and Cons of Territorial Taxation

Territorial taxation taxes income earned within a country's borders while exempting foreign-sourced income, promoting competitiveness for multinational corporations by avoiding double taxation and encouraging repatriation of profits. This system reduces compliance complexity and administrative costs but may incentivize profit shifting to low-tax jurisdictions and encourage tax base erosion. Critics argue it can create loopholes for tax avoidance and reduce government revenue, challenging fiscal sustainability.

Pros and Cons of Flat Taxation

Flat taxation offers simplicity by applying a single tax rate to all income levels, reducing administrative costs and easing compliance for taxpayers. However, it may disproportionately impact lower-income individuals by eliminating progressive rates that provide relief to those with less ability to pay. Critics argue flat taxes can widen income inequality while proponents highlight transparency and potential economic growth through incentivized earnings.

Territorial taxation Infographic

libterm.com

libterm.com