Poll tax is a fixed tax levied on every eligible individual, regardless of income or wealth, and historically sparked significant controversy for its regressive nature. This form of taxation often disproportionately affected lower-income individuals, leading to widespread protests and reforms in many countries. Discover how poll tax shaped social and political landscapes by reading the rest of the article.

Table of Comparison

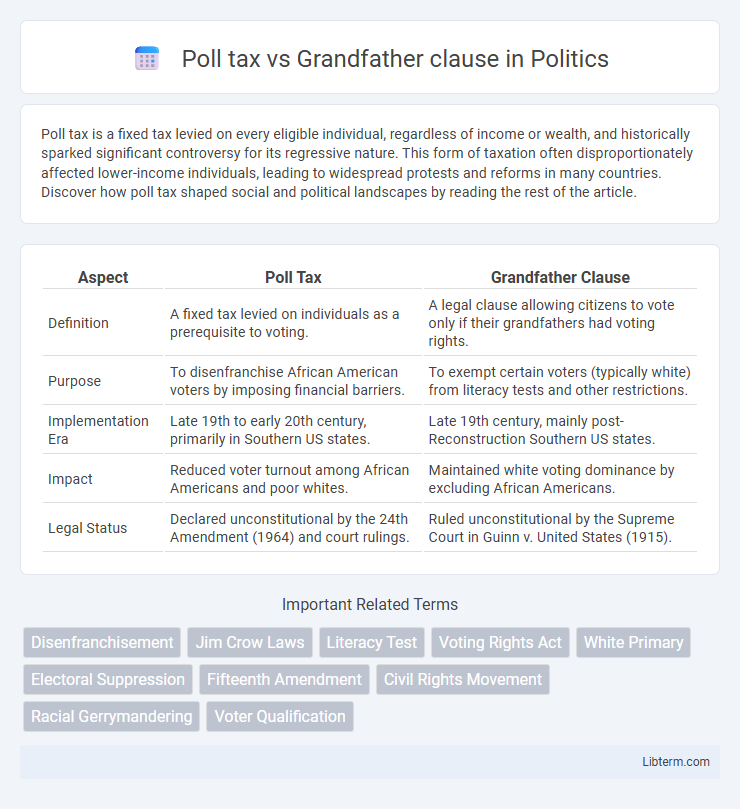

| Aspect | Poll Tax | Grandfather Clause |

|---|---|---|

| Definition | A fixed tax levied on individuals as a prerequisite to voting. | A legal clause allowing citizens to vote only if their grandfathers had voting rights. |

| Purpose | To disenfranchise African American voters by imposing financial barriers. | To exempt certain voters (typically white) from literacy tests and other restrictions. |

| Implementation Era | Late 19th to early 20th century, primarily in Southern US states. | Late 19th century, mainly post-Reconstruction Southern US states. |

| Impact | Reduced voter turnout among African Americans and poor whites. | Maintained white voting dominance by excluding African Americans. |

| Legal Status | Declared unconstitutional by the 24th Amendment (1964) and court rulings. | Ruled unconstitutional by the Supreme Court in Guinn v. United States (1915). |

Understanding Poll Tax: Definition and History

Poll tax, a fixed monetary fee required to vote, served as a tool for disenfranchisement primarily in Southern United States after the Reconstruction era by targeting African American and poor white voters. Originating in the late 19th century, poll taxes were established to circumvent the 15th Amendment, which aimed to protect voting rights regardless of race. The Supreme Court eventually invalidated poll taxes in federal elections with the 24th Amendment in 1964 and extended this prohibition to state elections in 1966 through the Harper v. Virginia Board of Elections ruling.

The Emergence of the Grandfather Clause

The emergence of the Grandfather Clause in the late 19th century was a strategic legal maneuver to circumvent the 15th Amendment by allowing only those whose ancestors had voting rights before the Civil War to vote, effectively disenfranchising African American voters. Unlike the poll tax, which required payment to vote, the Grandfather Clause linked voting eligibility to ancestry, skewing voter registration in favor of white citizens. This clause became a cornerstone of Jim Crow laws, reinforcing racial segregation and voter suppression throughout the Southern United States.

Legal Foundations: Comparing Poll Tax and Grandfather Clause

The legal foundations of the poll tax and grandfather clause stem from post-Reconstruction laws designed to disenfranchise African American voters while circumventing the 15th Amendment. Poll taxes required citizens to pay a fee to vote, disproportionately affecting low-income African Americans and poor whites, whereas grandfather clauses exempted individuals from voting restrictions if their ancestors had voting rights prior to the Civil War, effectively excluding formerly enslaved populations. Both methods were upheld by state laws and Supreme Court decisions until the mid-20th century, when landmark rulings and federal legislation, such as the Voting Rights Act of 1965, invalidated these discriminatory practices.

Political Motivations Behind Poll Tax Implementation

The poll tax was primarily implemented in the Southern United States to systematically disenfranchise African American voters and poor whites by imposing a financial barrier to voting, ensuring political control remained with white elites. Unlike the grandfather clause, which preserved voting rights for those whose ancestors had voted before Reconstruction, the poll tax targeted economically disadvantaged populations regardless of ancestry, reinforcing racial and economic segregation in political participation. This strategy solidified Democratic Party dominance during the Jim Crow era by suppressing opposition votes and maintaining white supremacy in elections.

Social Impact of the Grandfather Clause

The Grandfather Clause had profound social impacts by legally disenfranchising African American voters while maintaining voting rights for many white citizens, thereby reinforcing racial segregation and inequality in the post-Reconstruction South. This clause systematically excluded black people from participating in democracy, contributing to the persistence of white supremacy and social stratification for decades. Its social legacy entrenched racial divisions and limited access to political power and resources for African American communities.

Racial Disenfranchisement: Common Goals

Poll taxes and grandfather clauses were instruments used in the late 19th and early 20th centuries to disenfranchise African American voters and maintain racial segregation in the electoral process. Poll taxes required individuals to pay a fee to vote, disproportionately affecting Black citizens who were often economically disadvantaged. Grandfather clauses exempted those whose ancestors had voting rights before the Civil War from these taxes or literacy tests, effectively excluding newly freed African Americans while allowing poor and illiterate white voters to participate.

Geographic Prevalence and Regional Differences

Poll taxes were predominantly used in Southern states such as Alabama, Mississippi, and Virginia to disenfranchise African American voters during the Jim Crow era, while the Grandfather clause appeared mainly in Louisiana and other Deep South states as a legal loophole to exempt white voters from literacy tests or poll taxes. The geographic prevalence of poll taxes extended into border states like Kentucky and Oklahoma, whereas the Grandfather clause was less common outside the Deep South due to differing state voting laws. Regional differences highlight how Southern states tailored disenfranchisement methods to maintain white supremacy through varying legal mechanisms based on local political and demographic contexts.

Key Legal Challenges and Court Decisions

Poll tax and Grandfather clause faced significant legal challenges as instruments of racial discrimination in voting. The 24th Amendment (1964) and Supreme Court ruling in Harper v. Virginia Board of Elections (1966) invalidated poll taxes nationwide, declaring them unconstitutional under the Equal Protection Clause. Grandfather clauses were struck down earlier in Guinn v. United States (1915) for violating the 15th Amendment by effectively disenfranchising African American voters.

Long-Term Effects on Voter Participation

Poll tax laws systematically disenfranchised low-income and African American voters by creating financial barriers to voting, leading to significant declines in voter turnout among marginalized communities for decades. The Grandfather Clause temporarily exempted white voters from literacy tests, reinforcing racial discrimination and sustaining white political dominance in Southern states. Both mechanisms contributed to long-term voter suppression, delaying civil rights advancements and necessitating federal intervention with the Voting Rights Act of 1965 to restore equitable voter participation.

Legacy and Relevance in Modern Voting Rights Debates

Poll taxes and grandfather clauses were tools used to disenfranchise African American voters during the Jim Crow era, with poll taxes requiring payment to vote and grandfather clauses exempting those whose ancestors had voting rights before the Civil War. The legacy of these measures persists in modern voting rights debates, as they highlight systemic barriers and discriminatory practices that continue to influence voter suppression tactics today. Understanding their historical impact informs ongoing legal battles and policy discussions aimed at ensuring equitable access to the ballot box.

Poll tax Infographic

libterm.com

libterm.com