The 527 organization is a type of tax-exempt group in the United States created primarily to influence the selection, nomination, election, or appointment of public officials. These organizations operate under Section 527 of the U.S. Internal Revenue Code and often focus on political advocacy without directly supporting or opposing specific candidates. Discover how 527 organizations impact your political landscape by reading the full article.

Table of Comparison

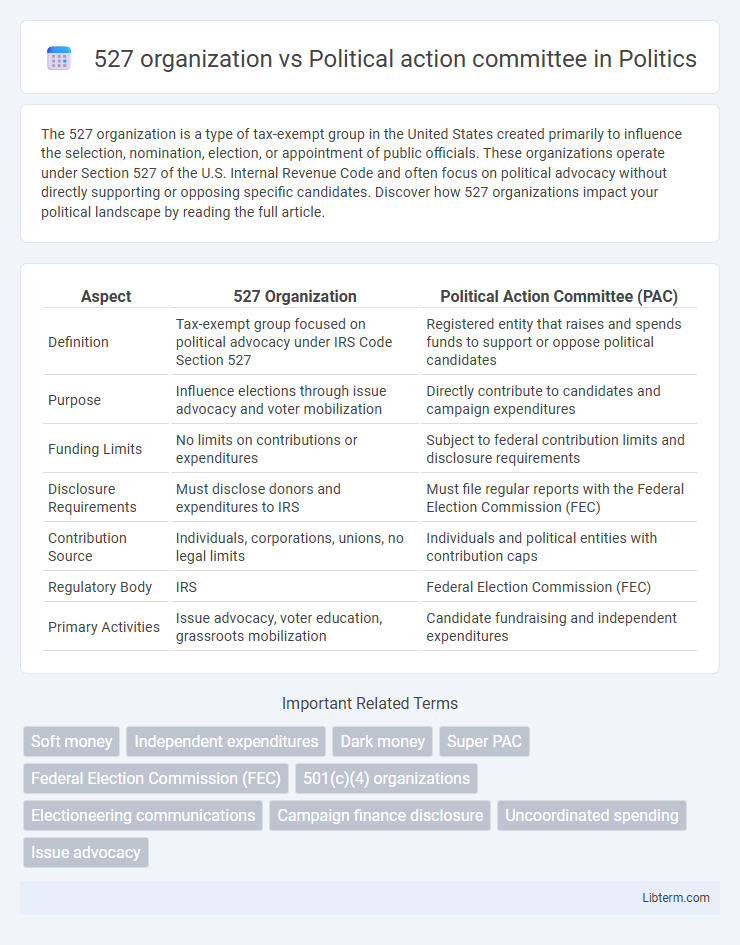

| Aspect | 527 Organization | Political Action Committee (PAC) |

|---|---|---|

| Definition | Tax-exempt group focused on political advocacy under IRS Code Section 527 | Registered entity that raises and spends funds to support or oppose political candidates |

| Purpose | Influence elections through issue advocacy and voter mobilization | Directly contribute to candidates and campaign expenditures |

| Funding Limits | No limits on contributions or expenditures | Subject to federal contribution limits and disclosure requirements |

| Disclosure Requirements | Must disclose donors and expenditures to IRS | Must file regular reports with the Federal Election Commission (FEC) |

| Contribution Source | Individuals, corporations, unions, no legal limits | Individuals and political entities with contribution caps |

| Regulatory Body | IRS | Federal Election Commission (FEC) |

| Primary Activities | Issue advocacy, voter education, grassroots mobilization | Candidate fundraising and independent expenditures |

Understanding 527 Organizations: Definition and Purpose

527 organizations are tax-exempt groups defined under Section 527 of the Internal Revenue Code, primarily established to influence the nomination, election, appointment, or defeat of candidates for public office. Unlike Political Action Committees (PACs), which directly contribute to candidates or campaigns, 527 organizations engage in issue advocacy and voter mobilization without coordinating with candidates. Their purpose centers on political activities that inform or persuade the electorate while maintaining tax-exempt status through compliance with federal regulations.

What is a Political Action Committee (PAC)?

A Political Action Committee (PAC) is an organization that collects and disburses contributions from members to support or oppose political candidates, legislation, or ballot initiatives. Unlike 527 organizations, PACs are subject to strict contribution limits and regulatory oversight by the Federal Election Commission (FEC), ensuring transparency in political financing. PACs play a pivotal role in financing election campaigns and influencing policy outcomes through coordinated fundraising and expenditures.

Legal Differences Between 527s and PACs

527 organizations operate under Section 527 of the Internal Revenue Code and are primarily tax-exempt groups involved in influencing elections, with fewer restrictions on contributions and spending compared to Political Action Committees (PACs). PACs are regulated by the Federal Election Commission and must adhere to strict contribution limits and disclosure requirements, making them subject to more rigorous legal oversight. While 527s focus on issue advocacy and voter mobilization without direct candidate coordination, PACs directly contribute to candidates or political parties, which triggers their specific legal compliance obligations.

Funding Sources: 527 Organizations vs PACs

527 organizations primarily receive funding through unlimited contributions from individuals, corporations, and labor unions, allowing for significant financial input without direct coordination with political candidates. Political Action Committees (PACs) are subject to contribution limits and disclosure requirements, receiving funds from members or donors to directly support candidates or legislation. The key difference lies in regulatory constraints, as PACs face stricter fundraising caps and transparency rules compared to the more flexible funding structure of 527 organizations.

Regulatory Oversight: IRS vs FEC Compliance

527 organizations are primarily regulated by the Internal Revenue Service (IRS), which mandates disclosure of donors and expenditures related to political activities but allows unlimited contributions for issue advocacy. Political Action Committees (PACs) fall under the jurisdiction of the Federal Election Commission (FEC), enforcing strict limits on contributions, detailed reporting requirements, and direct involvement in federal election campaigns. Compliance with IRS rules for 527 groups centers on tax-exempt status and reporting, while PACs must adhere to comprehensive FEC oversight to ensure transparency and enforce contribution limits.

Contribution and Spending Limits Comparison

527 organizations face no federal contribution limits, allowing unlimited fundraising from individuals, corporations, and unions, whereas Political Action Committees (PACs) have strict contribution caps, such as a $5,000 per individual per year limit for traditional PACs. Spending limits also vary: 527 groups can spend unlimited amounts on issue advocacy and voter mobilization, but cannot coordinate directly with candidates, while PACs can contribute directly to candidates and parties but must adhere to regulated spending ceilings. This distinction in contribution and expenditure frameworks makes 527 organizations a popular choice for independent political activities outside PAC regulations.

Disclosure Requirements for 527s and PACs

527 organizations must disclose donors and expenditures to the IRS through Form 8872, but their reporting requirements are less frequent and detailed compared to Political Action Committees (PACs), which file comprehensive, regular reports with the Federal Election Commission (FEC). PACs provide periodic detailed disclosures, including contributions and expenditures, ensuring transparency under federal election laws. Unlike PACs, 527s primarily focus on issue advocacy without explicit candidate coordination, leading to different regulatory and disclosure frameworks.

Influence on Elections: Strategies and Impact

527 organizations leverage unlimited soft money to influence elections by funding issue advocacy and mobilizing voters without direct candidate coordination, exploiting tax-exempt status under IRS code 527. Political Action Committees (PACs), subject to contribution limits and stricter regulations, directly support candidates through explicit campaign contributions and expenditures. Both entities impact electoral outcomes, but 527 groups often engage in more indirect, grassroots strategies while PACs provide targeted financial support to favored candidates.

Examples of Prominent 527 Organizations and PACs

Prominent 527 organizations such as the National Rifle Association (NRA) and MoveOn.org primarily influence elections through unlimited soft money contributions for issue advocacy, while Political Action Committees (PACs) like the American Israel Public Affairs Committee (AIPAC) and the National Beer Wholesalers Association (NBWA) contribute directly to candidates and campaigns with regulated donation limits. 527 organizations can operate independently from candidates, leveraging significant grassroots mobilization and voter education efforts, whereas PACs typically maintain closer coordination with candidates and political parties. The distinction in fundraising capabilities and regulatory oversight shapes their strategic roles in the American political landscape.

Which is More Effective: 527s or PACs?

527 organizations and Political Action Committees (PACs) differ in structure and regulatory constraints, impacting their effectiveness in influencing elections. PACs, regulated by the Federal Election Commission, can contribute directly to candidates and parties but face strict contribution limits, whereas 527s operate independently, often funding issue advocacy and voter mobilization without direct coordination with campaigns. The effectiveness of 527s versus PACs depends on campaign strategy: PACs are more impactful for direct candidate support, while 527s excel in shaping public opinion and policy debates through targeted grassroots efforts.

527 organization Infographic

libterm.com

libterm.com