Ordering products online offers convenience and access to a wide range of options tailored to your specific needs. Seamless checkout processes, secure payment methods, and efficient delivery services enhance the overall shopping experience. Explore this article to discover tips and strategies for mastering your next order.

Table of Comparison

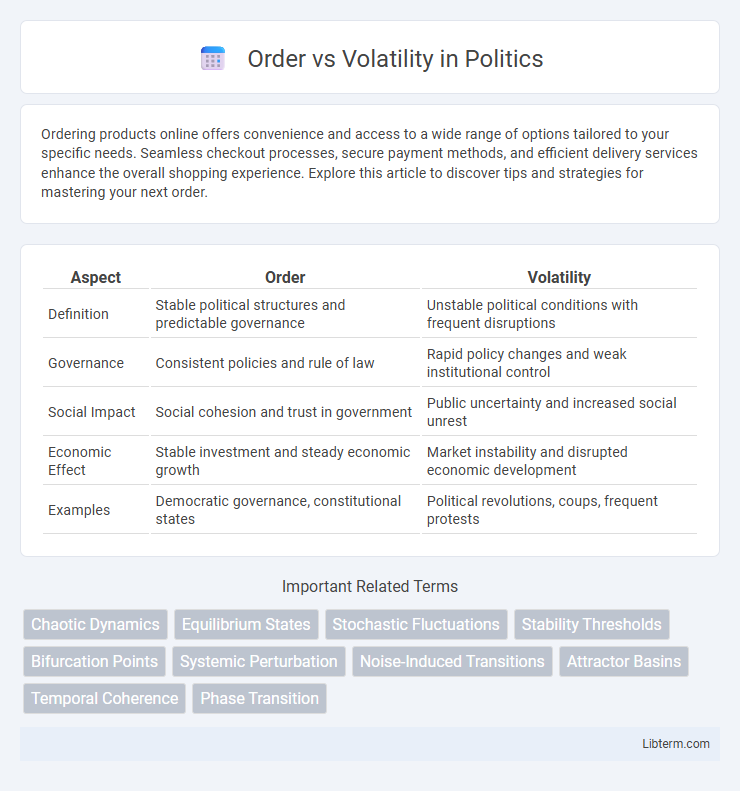

| Aspect | Order | Volatility |

|---|---|---|

| Definition | Stable political structures and predictable governance | Unstable political conditions with frequent disruptions |

| Governance | Consistent policies and rule of law | Rapid policy changes and weak institutional control |

| Social Impact | Social cohesion and trust in government | Public uncertainty and increased social unrest |

| Economic Effect | Stable investment and steady economic growth | Market instability and disrupted economic development |

| Examples | Democratic governance, constitutional states | Political revolutions, coups, frequent protests |

Understanding the Concepts: Order and Volatility

Order refers to the structured arrangement or sequence of elements within a system, providing predictability and stability. Volatility measures the degree of variation or unpredictability in a system, often seen in financial markets as price fluctuations over time. Understanding the balance between order and volatility is crucial for managing risk and achieving optimal performance in dynamic environments.

The Role of Order in System Stability

Order in complex systems acts as a stabilizing force by organizing interactions and reducing randomness, which helps maintain consistent behavior over time. Structured order limits extreme fluctuations, thus minimizing volatility and enhancing the predictability of outcomes. The balance between order and disorder is crucial; too much order can lead to rigidity, while sufficient order ensures resilience and system stability.

The Nature and Impact of Volatility

Volatility in financial markets reflects the degree of price fluctuations over a given period, directly impacting order execution and market stability. High volatility increases the risk of slippage and order imbalances, leading to unpredictable market behavior and wider bid-ask spreads. Understanding volatility's nature allows traders to optimize order strategies, enhancing execution efficiency and risk management.

Historical Perspectives: Order vs Volatility

Historical perspectives on order versus volatility reveal cyclical patterns in market behavior where periods of structured stability alternate with phases of high uncertainty and rapid change. Economic data from the 20th century illustrates how regulatory frameworks and technological advancements contributed to extended durations of market order before crises triggered spikes in volatility. Analysis of past financial crises, such as the Great Depression and the 2008 financial meltdown, highlights the dynamic tension between systemic order and disruptive volatility shaping economic evolution.

Balancing Order and Volatility in Modern Systems

Balancing order and volatility in modern systems requires integrating adaptive frameworks that maintain structured processes while accommodating rapid changes and uncertainties. Leveraging real-time data analytics and machine learning algorithms helps dynamically adjust system parameters, promoting stability without sacrificing flexibility. Emphasizing modular design and decentralized control enhances resilience, enabling systems to respond effectively to fluctuating conditions without losing operational coherence.

Effects of Volatility on Organizational Structure

Volatility in the market compels organizations to adopt flexible and adaptive structures to withstand unpredictable changes. High volatility often leads to decentralized decision-making, enabling quicker responses and increased innovation within teams. Conversely, low volatility environments allow for more rigid hierarchies that emphasize efficiency and standardized processes.

Tools and Strategies to Manage Volatility

Effective tools to manage volatility include algorithmic trading platforms that execute pre-defined strategies based on market fluctuations, reducing emotional decision-making. Risk management strategies such as stop-loss orders, limit orders, and diversification help limit exposure during periods of high volatility. Employing volatility filters and using options strategies like straddles and strangles provide traders with mechanisms to profit or hedge against unpredictable price swings.

Innovations Arising from Volatility

Volatility drives innovations by creating dynamic market conditions that force businesses to adapt rapidly and develop disruptive technologies, enhancing competitive advantage. Emerging industries such as fintech and renewable energy capitalize on volatility by introducing agile solutions like blockchain and smart grids, which optimize efficiency amid uncertainty. These innovations promote resilience and foster long-term growth despite fluctuating economic landscapes.

Risks and Rewards: Navigating Order and Volatility

Order provides structure that minimizes risks by creating predictable environments, whereas volatility introduces uncertainty that can amplify both risks and rewards. Managing the balance between these forces requires strategic decision-making to capitalize on opportunities while mitigating potential losses. Effective navigation involves assessing market or operational conditions to optimize outcomes amid fluctuating dynamics.

Future Trends: Shifting Dynamics Between Order and Volatility

Future trends indicate a growing interplay between order and volatility as market dynamics evolve with technological advancements and global economic shifts. Algorithm-driven trading and real-time data analysis enhance market order, yet increasing geopolitical tensions and rapid information dissemination fuel volatility spikes. Balancing these forces requires adaptive risk management strategies and regulatory frameworks that accommodate both stability and sudden market fluctuations.

Order Infographic

libterm.com

libterm.com