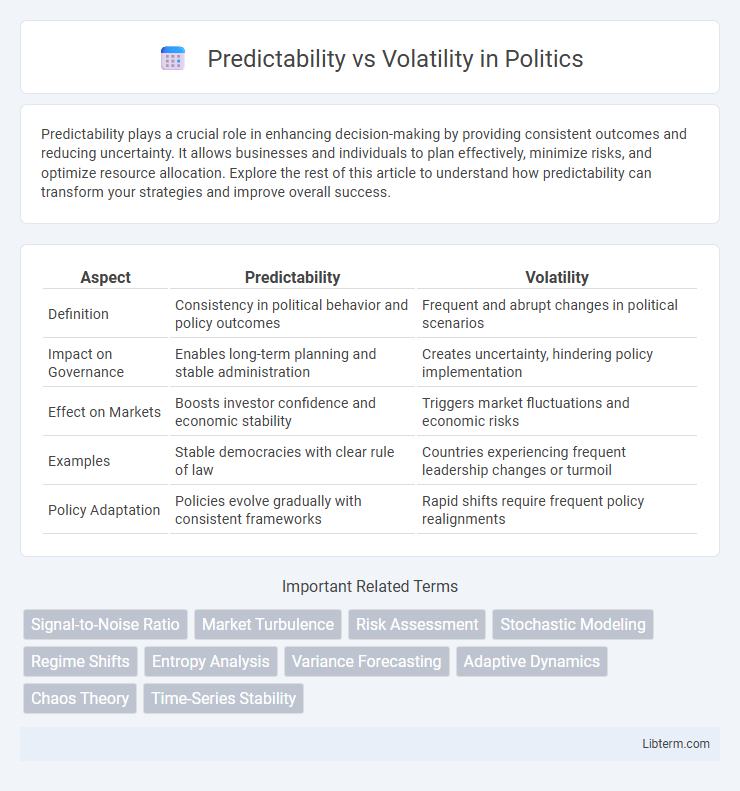

Predictability plays a crucial role in enhancing decision-making by providing consistent outcomes and reducing uncertainty. It allows businesses and individuals to plan effectively, minimize risks, and optimize resource allocation. Explore the rest of this article to understand how predictability can transform your strategies and improve overall success.

Table of Comparison

| Aspect | Predictability | Volatility |

|---|---|---|

| Definition | Consistency in political behavior and policy outcomes | Frequent and abrupt changes in political scenarios |

| Impact on Governance | Enables long-term planning and stable administration | Creates uncertainty, hindering policy implementation |

| Effect on Markets | Boosts investor confidence and economic stability | Triggers market fluctuations and economic risks |

| Examples | Stable democracies with clear rule of law | Countries experiencing frequent leadership changes or turmoil |

| Policy Adaptation | Policies evolve gradually with consistent frameworks | Rapid shifts require frequent policy realignments |

Understanding Predictability and Volatility

Predictability refers to the ability to forecast future events or outcomes based on consistent patterns and reliable data, often measured through statistical models and historical trends. Volatility indicates the degree of variation or uncertainty in data or market conditions, characterized by rapid and unpredictable changes that can significantly affect risk assessment. Understanding the balance between predictability and volatility is crucial for effective decision-making in finance, economics, and risk management.

Key Differences Between Predictability and Volatility

Predictability refers to the ability to forecast future events or outcomes based on consistent patterns or stable data, whereas volatility describes the degree of variation or unpredictability in a system, often characterized by rapid and significant changes. Predictable environments allow for risk assessment and strategic planning, while volatile conditions demand adaptability and real-time responses due to their inherent uncertainty. Key differences include stability versus fluctuation, the reliability of outcomes, and the impact on decision-making processes in financial markets, business operations, or natural phenomena.

The Role of Predictability in Decision-Making

Predictability plays a crucial role in decision-making by reducing uncertainty and enabling more accurate forecasting of outcomes. When environments exhibit high predictability, decision-makers can rely on consistent patterns and data trends, facilitating strategic planning and risk management. In contrast, reduced volatility allows for more confident allocation of resources, improving long-term performance and stability.

Volatility: Opportunity or Threat?

Volatility, characterized by rapid and unpredictable market fluctuations, presents both opportunity and threat for investors and businesses. High volatility can lead to significant gains through strategic investments and agile decision-making, but it also increases the risk of substantial losses and market instability. Effective risk management and adaptive strategies are essential to harness volatility's potential while mitigating its inherent dangers.

Factors Influencing Predictability in Markets

Market predictability is shaped by factors such as economic indicators, geopolitical stability, and corporate earnings reports, which provide data points for forecasting trends. Investor sentiment and market liquidity also play crucial roles, as they influence price movements and the ability to execute trades without significant impact. Technological advancements in data analytics and algorithmic trading enhance predictability by processing vast datasets and identifying patterns in volatile environments.

Causes of Volatility in Various Sectors

Market volatility arises from sudden changes in economic indicators, geopolitical events, and shifts in consumer sentiment, impacting sectors unevenly. Technology companies experience volatility due to rapid innovation cycles and regulatory changes, while energy markets are affected by fluctuations in supply, weather conditions, and geopolitical tensions. Financial sectors face volatility from interest rate adjustments, credit risks, and unexpected policy decisions by central banks.

Managing Risk: Strategies for Navigating Volatility

Managing risk in volatile markets requires adaptive strategies such as diversification, hedging, and dynamic asset allocation to mitigate potential losses. Emphasizing predictive analytics and real-time data monitoring enhances the ability to anticipate market shifts and adjust portfolios accordingly. Implementing stop-loss orders and stress-testing scenarios further strengthens risk management by containing downside exposure during unpredictable fluctuations.

Benefits and Drawbacks of Predictability

Predictability in markets offers clear benefits such as reduced risk, stable investment environments, and improved decision-making through consistent patterns and reliable forecasts. However, it may lead to complacency, limiting innovation and adaptability as businesses become overly reliant on established trends and resist change. Maintaining a balance between predictability and adaptability ensures resilience in dynamic economic conditions while leveraging stability for strategic growth.

Impacts of Volatility on Long-Term Planning

Volatility introduces significant uncertainty into financial markets and economic conditions, complicating long-term planning for businesses and investors. Fluctuating market variables like interest rates, commodity prices, and exchange rates can disrupt forecasts, making it difficult to allocate resources efficiently over extended time horizons. Organizations must adopt flexible strategies and incorporate risk management tools to mitigate the adverse effects of volatility on strategic decision-making and capital investments.

Achieving Balance: Embracing Both Predictability and Volatility

Achieving balance between predictability and volatility involves integrating stable processes with adaptive strategies to enhance resilience and innovation. Embracing predictable workflows ensures efficiency and consistency, while allowing room for volatility fosters flexibility and rapid response to market changes. Organizations that skillfully combine these elements optimize performance by mitigating risks without sacrificing agility.

Predictability Infographic

libterm.com

libterm.com