Khums is a mandatory Islamic tax requiring Muslims to pay one-fifth of certain kinds of earnings to support religious and charitable causes. It plays a significant role in promoting social justice and aiding the community, particularly within Shia Islam. Explore the rest of the article to understand how Khums impacts your financial responsibilities and spiritual obligations.

Table of Comparison

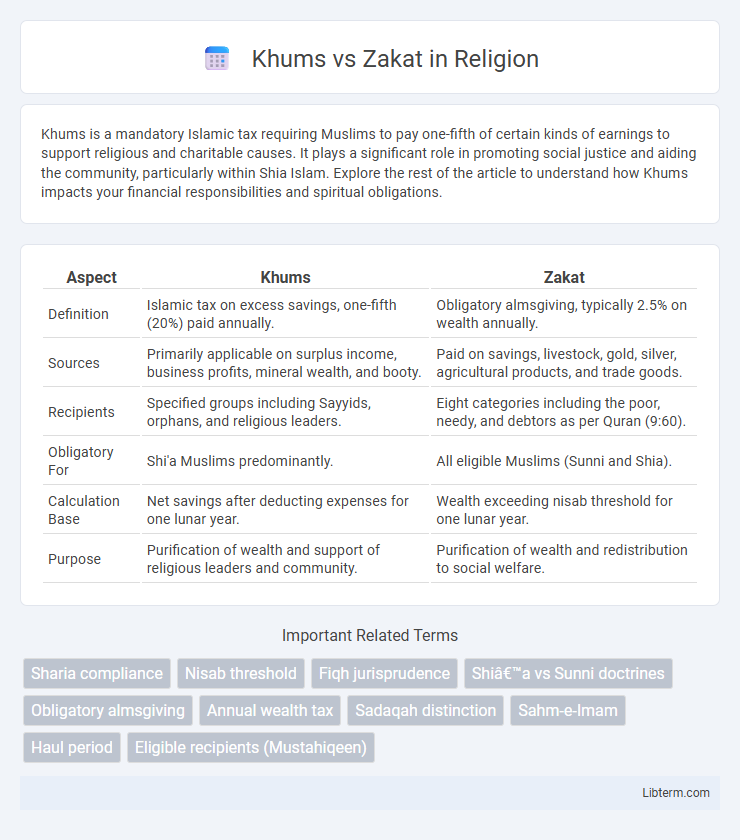

| Aspect | Khums | Zakat |

|---|---|---|

| Definition | Islamic tax on excess savings, one-fifth (20%) paid annually. | Obligatory almsgiving, typically 2.5% on wealth annually. |

| Sources | Primarily applicable on surplus income, business profits, mineral wealth, and booty. | Paid on savings, livestock, gold, silver, agricultural products, and trade goods. |

| Recipients | Specified groups including Sayyids, orphans, and religious leaders. | Eight categories including the poor, needy, and debtors as per Quran (9:60). |

| Obligatory For | Shi'a Muslims predominantly. | All eligible Muslims (Sunni and Shia). |

| Calculation Base | Net savings after deducting expenses for one lunar year. | Wealth exceeding nisab threshold for one lunar year. |

| Purpose | Purification of wealth and support of religious leaders and community. | Purification of wealth and redistribution to social welfare. |

Understanding Khums and Zakat: Key Definitions

Khums is a 20% Islamic tax on surplus income and certain finds, specifically mandated in Shia Islam, distinct from Zakat, which is a 2.5% obligatory almsgiving on accumulated wealth for all eligible Muslims. Zakat serves as a foundational pillar in Sunni Islam, purifying wealth by supporting designated categories such as the poor, orphans, and travelers, while Khums primarily funds religious and community needs, including scholars and descendants of Prophet Muhammad. Understanding these key definitions highlights their unique roles in Islamic finance and social welfare systems.

Historical Origins of Khums and Zakat

Khums originated during the era of Prophet Muhammad as a tax on war spoils, specifically institutionalized in Islamic governance to support the Prophet's family and community welfare. Zakat, one of the Five Pillars of Islam, traces back to pre-Islamic practices formalized in the Quran, serving as a mandatory almsgiving system to purify wealth and assist the poor. Both Khums and Zakat have evolved with distinct religious and socio-economic roles within Islamic jurisprudence, reflecting their foundational purposes in historical contexts.

Scriptural Basis in Islam: Verses and Hadiths

Khums and Zakat both hold significant places in Islamic financial obligations, with distinct scriptural foundations. Khums is explicitly mentioned in the Quran in Surah Al-Anfal (8:41), instructing believers to give one-fifth of their war booty or surplus wealth, emphasizing its spiritual and communal role. Zakat is firmly rooted in numerous Quranic verses such as Surah Al-Baqarah (2:110) and reinforced by Hadiths from Sahih Bukhari and Sahih Muslim, mandating Muslims to purify their wealth by giving a prescribed portion to eligible recipients annually.

Obligation and Eligibility Criteria

Khums is an Islamic tax amounting to 20% on certain types of income, obligatory primarily for Shia Muslims who have surplus wealth beyond their basic needs after expenses. Zakat, a fundamental pillar of Islam, requires eligible Muslims to pay 2.5% of their accumulated wealth annually, provided their wealth exceeds the Nisab threshold, which is equivalent to the value of 87.48 grams of gold. While Zakat applies broadly across various assets and intended for social welfare, Khums targets specific earnings and has distinct distribution rules, reflecting differences in religious jurisprudence and community obligations.

Calculation Methods: Khums vs Zakat

Khums is calculated as 20% of a Muslim's surplus savings after deducting yearly expenses, business costs, and personal needs, primarily applied to profits from trade, mining, and certain types of wealth. Zakat is computed as 2.5% of a Muslim's accumulated wealth, including savings, gold, silver, and agricultural produce, once it exceeds the nisab threshold over a lunar year. Both calculations require precise asset valuation but differ in scope, percentage, and applicable wealth categories within Islamic finance.

Beneficiaries: Who Receives Khums and Zakat?

Khums is primarily distributed to the Prophet's descendants (Sayyids), religious scholars (ulama), and the poor within the Shia Islamic community, while Zakat is allocated to eight specific categories mentioned in the Quran, including the poor, the needy, those in debt, and those fighting in the cause of Allah. Khums beneficiaries are distinctly tied to religious authority and community leadership, reflecting its spiritual and socio-political functions. Zakat's broader recipient base targets financial aid and social welfare to reduce economic disparities across the Muslim ummah.

Frequency and Timing of Payment

Khums is paid once annually on surplus income or savings after fulfilling living expenses, typically at the end of the financial year, whereas Zakat requires payment annually based on the lunar calendar after owning the nisab (minimum threshold) for one lunar year. Zakat is often due on specific assets such as cash, agricultural produce, and livestock, with timing strictly observed to maintain its ritual purity. Khums, primarily significant in Shia Islam, is settled once yearly, reflecting a one-time purification of wealth, while Zakat's annual cycle encourages continuous social responsibility and wealth redistribution.

Spiritual and Social Objectives

Khums and Zakat are Islamic financial obligations with distinct spiritual and social objectives; Khums, primarily observed in Shia Islam, emphasizes purification of wealth and support for religious leaders and needy communities, fostering spiritual growth and communal solidarity. Zakat, one of the Five Pillars of Islam, mandates wealth redistribution to the poor and vulnerable, promoting social justice and economic equity within the Muslim ummah. Both practices aim to purify wealth and strengthen societal bonds through charity and moral responsibility.

Differences Between Sunni and Shia Practices

Khums is a 20% tax on surplus income observed primarily by Shia Muslims, while Zakat, typically 2.5%, is a mandatory almsgiving practiced by Sunni Muslims on wealth and savings. Shia Muslims allocate Khums into two portions: one for religious leaders and one for the needy, whereas Sunnis distribute Zakat among specific categories like the poor, debtors, and travelers. The fundamental difference lies in the religious authority and specific algebraic calculations that govern Khums in Shia jurisprudence compared to the broader Zakat guidelines in Sunni law.

Contemporary Applications and Challenges

Khums and Zakat, foundational Islamic fiscal pillars, differ in contemporary applications where Zakat primarily targets poverty alleviation through fixed asset thresholds, while Khums addresses surplus income and specific categories such as business profits. Modern financial complexities challenge the calculation and collection of Khums, especially with diverse income sources and digital economies, requiring updated methodologies compatible with Shariah compliance. Zakat faces challenges in ensuring transparency and efficient distribution within global Muslim communities, necessitating robust institutional frameworks to maximize its socio-economic impact.

Khums Infographic

libterm.com

libterm.com