Cooperative ownership allows individuals to collectively own and manage property or a business, sharing both responsibilities and benefits. This model fosters a sense of community and democratic decision-making, often leading to more equitable and sustainable outcomes. Discover how cooperative ownership can empower your financial and social goals by reading the full article.

Table of Comparison

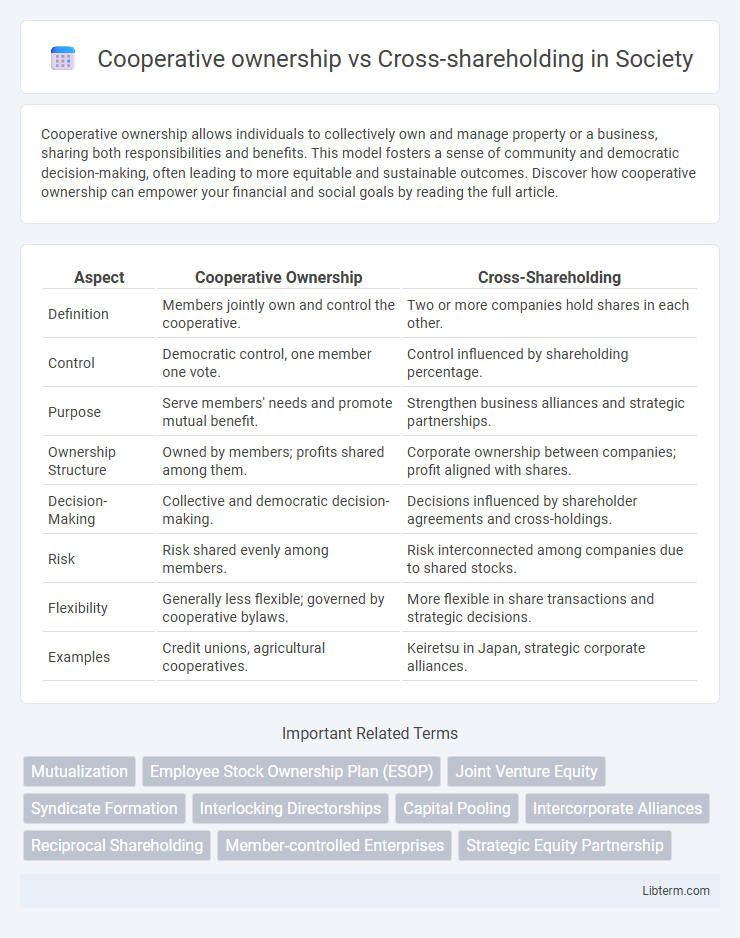

| Aspect | Cooperative Ownership | Cross-Shareholding |

|---|---|---|

| Definition | Members jointly own and control the cooperative. | Two or more companies hold shares in each other. |

| Control | Democratic control, one member one vote. | Control influenced by shareholding percentage. |

| Purpose | Serve members' needs and promote mutual benefit. | Strengthen business alliances and strategic partnerships. |

| Ownership Structure | Owned by members; profits shared among them. | Corporate ownership between companies; profit aligned with shares. |

| Decision-Making | Collective and democratic decision-making. | Decisions influenced by shareholder agreements and cross-holdings. |

| Risk | Risk shared evenly among members. | Risk interconnected among companies due to shared stocks. |

| Flexibility | Generally less flexible; governed by cooperative bylaws. | More flexible in share transactions and strategic decisions. |

| Examples | Credit unions, agricultural cooperatives. | Keiretsu in Japan, strategic corporate alliances. |

Introduction to Cooperative Ownership and Cross-Shareholding

Cooperative ownership involves members collectively owning and managing a business, emphasizing democratic control and shared benefits among participants, often found in sectors like agriculture and retail. Cross-shareholding occurs when companies hold shares in each other to strengthen business alliances and deter hostile takeovers, commonly seen in corporate networks, especially in Japan and South Korea. Understanding these ownership structures highlights differences in governance, strategic alliances, and stakeholder priorities within various economic systems.

Definitions and Key Concepts

Cooperative ownership refers to a business model where members collectively own and control the enterprise, sharing profits and decision-making authority based on democratic principles. Cross-shareholding involves two or more companies holding shares in each other, creating interlocking ownership structures that can enhance strategic alliances and stabilize control. Both concepts revolve around shared ownership but differ in focus: cooperatives prioritize member participation and mutual benefit, while cross-shareholding emphasizes corporate collaboration and investment.

Historical Background of Both Models

Cooperative ownership traces its roots to the early 19th century, emerging from the Rochdale Pioneers' 1844 principles that emphasized democratic member control and shared economic benefits, shaping a model centered on community and mutual aid. Cross-shareholding originated in the early 20th century, particularly in Japan and Europe, as a strategic alliance mechanism where companies exchanged equity stakes to solidify business relationships and protect against hostile takeovers. Both models have evolved to reflect distinct economic philosophies: cooperatives prioritize member welfare and equitable governance, while cross-shareholding focuses on corporate stability and networked influence.

Structural Differences Between the Two Approaches

Cooperative ownership is characterized by member-owned and democratically controlled structures where each member typically has one vote, emphasizing collective decision-making and profit distribution among members. Cross-shareholding involves reciprocal equity investments between companies, creating complex inter-company relationships that often lead to mutual dependencies and influence over strategic decisions. Structural differences highlight that cooperatives prioritize equality and member benefits, while cross-shareholding focuses on corporate alliances and control through ownership stakes.

Benefits of Cooperative Ownership

Cooperative ownership enhances member control by granting equal voting rights regardless of share size, promoting democratic decision-making within the organization. It encourages profit distribution based on member participation rather than capital investment, aligning financial benefits with actual contribution or use of services. This model fosters community engagement and long-term sustainability by prioritizing member needs and collective welfare over short-term shareholder profits.

Advantages of Cross-Shareholding

Cross-shareholding enhances corporate stability by creating long-term partnerships among companies, reducing the risk of hostile takeovers and market volatility. It fosters strategic collaborations that improve resource sharing, innovation, and competitive advantage across industries. This structure also facilitates mutual financial support, reinforcing resilience during economic fluctuations and promoting sustained growth.

Challenges and Criticisms of Cooperative Ownership

Cooperative ownership faces challenges such as limited access to capital and difficulties in scaling operations compared to traditional corporate models. Decision-making processes can be slower due to the democratic structure, potentially hindering swift strategic actions. Critics also argue that cooperative ownership may struggle with accountability and professional management, leading to inefficiencies and reduced competitiveness in dynamic markets.

Drawbacks of Cross-Shareholding Structures

Cross-shareholding structures can create complex interdependencies that obscure true corporate performance and reduce transparency in financial reporting. These arrangements often lead to reduced market discipline, as companies owning shares in each other may avoid hostile takeovers and limit shareholder activism. Such structures can also entrench management, hamper mergers and acquisitions, and result in inefficient capital allocation.

Real-World Examples and Case Studies

Cooperative ownership is prominently featured in the Mondragon Corporation in Spain, where worker-owned cooperatives demonstrate democratic decision-making and profit sharing, fostering local economic resilience. Cross-shareholding is exemplified by Japanese keiretsu, such as the Toyota Group, where interlocking shareholdings create stable alliances, facilitate long-term planning, and reduce hostile takeovers. Studies comparing these models reveal that cooperative ownership prioritizes member welfare and community benefits, while cross-shareholding emphasizes strategic corporate alliances and financial stability.

Conclusion: Choosing the Right Ownership Model

Cooperative ownership fosters democratic decision-making and aligns member interests through shared control and profit distribution. Cross-shareholding creates strategic alliances between companies, promoting stability and mutual investment but may complicate governance and reduce transparency. Selecting the right ownership model depends on prioritizing either member-driven objectives in cooperatives or inter-company collaboration and financial integration in cross-shareholding structures.

Cooperative ownership Infographic

libterm.com

libterm.com