Middle class typically refers to a socioeconomic group characterized by moderate income, education, and occupational status, often providing a comfortable standard of living but without significant wealth. This group plays a crucial role in economic stability and social mobility, influencing consumer trends and public policies. Discover how understanding the middle class can impact your perspective on economic opportunities in the rest of the article.

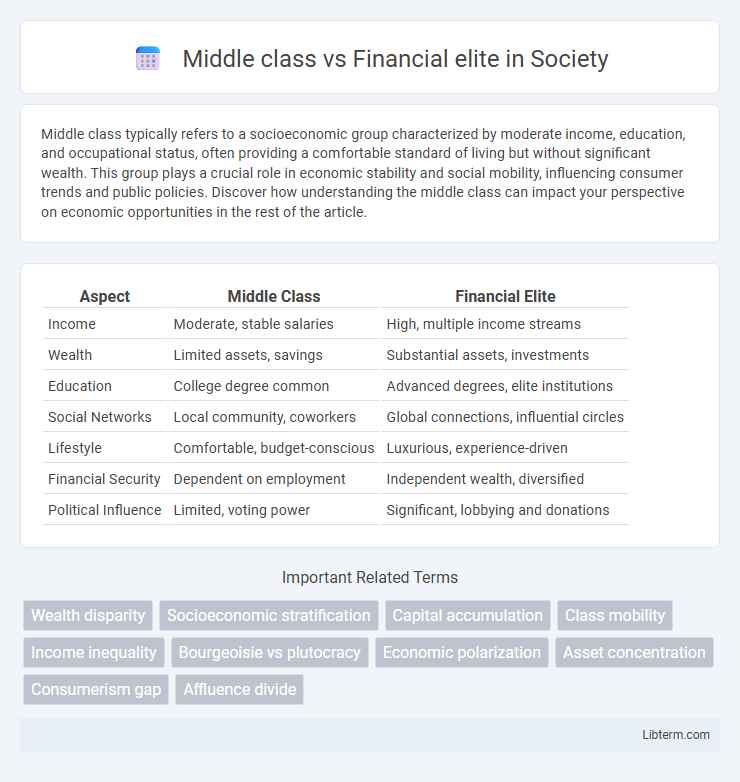

Table of Comparison

| Aspect | Middle Class | Financial Elite |

|---|---|---|

| Income | Moderate, stable salaries | High, multiple income streams |

| Wealth | Limited assets, savings | Substantial assets, investments |

| Education | College degree common | Advanced degrees, elite institutions |

| Social Networks | Local community, coworkers | Global connections, influential circles |

| Lifestyle | Comfortable, budget-conscious | Luxurious, experience-driven |

| Financial Security | Dependent on employment | Independent wealth, diversified |

| Political Influence | Limited, voting power | Significant, lobbying and donations |

Defining the Middle Class and Financial Elite

The middle class typically includes individuals and households with moderate income levels, stable employment, and access to essential services such as education and healthcare, representing a broad economic group crucial for consumer-driven economies. The financial elite, by contrast, comprises individuals or families possessing substantial wealth, significant investment portfolios, and influential financial power, often controlling large assets and corporate equity. Defining these groups involves assessing income ranges, asset ownership, financial influence, and lifestyle indicators that distinguish economic stability from concentrated wealth and power.

Historical Evolution of Economic Classes

The historical evolution of economic classes reveals a shift from rigid feudal hierarchies to more fluid distinctions between the middle class and financial elite, shaped by industrialization and the rise of capitalist economies. While the middle class emerged through professions, commerce, and education during the 18th and 19th centuries, the financial elite consolidated power through ownership of capital, investment banking, and global financial markets. The difference in wealth accumulation, access to capital, and political influence underscores the ongoing economic stratification between these classes in modern societies.

Income Gaps: Statistics and Trends

Income gaps between the middle class and the financial elite have widened significantly, with the top 1% capturing nearly 20% of total income in many developed countries. The middle class often sees stagnant wage growth, averaging around 1-2% annually, compared to the financial elite whose incomes grow exponentially through investments and capital gains. Recent studies show that wealth concentration in the financial elite sector accelerates economic inequality, reducing middle-class purchasing power and social mobility.

Social Mobility: Barriers and Opportunities

Social mobility between the middle class and financial elite is significantly influenced by access to quality education, networking opportunities, and capital investment, which remain major barriers for middle-class individuals. Wealth concentration within the financial elite limits upward mobility by perpetuating advantages through inheritance, exclusive social circles, and preferential financial instruments. Policies promoting equal education, affordable capital access, and dismantling systemic biases are critical to enhancing opportunities for middle-class advancement into elite financial strata.

Lifestyle Differences: Consumption and Habits

The middle class typically prioritizes practical consumption, focusing on budgeting for essential goods, family needs, and occasional leisure activities, whereas the financial elite engage in luxury spending, investing in high-end real estate, designer brands, and exclusive experiences. Consumption habits of the financial elite often emphasize status and long-term wealth preservation through assets like art and private equity, contrasting with the middle class's emphasis on consumer goods and services that enhance day-to-day living. Lifestyle differences also reflect varying access to bespoke services, private education, and international travel, reinforcing divergent consumption patterns and social behaviors between the two groups.

Wealth Accumulation: Assets and Investments

The financial elite accumulate wealth primarily through diversified investments, including stocks, real estate, private equity, and hedge funds, which offer higher returns and tax advantages compared to traditional savings. Middle-class wealth accumulation relies more on income savings, homeownership, and retirement accounts, often lacking access to exclusive investment opportunities. The disparity in asset portfolios significantly contributes to the wealth gap, as financial elites continually leverage capital gains and passive income streams to grow their net worth exponentially.

Education and Career Disparities

The financial elite often access prestigious educational institutions, benefiting from elite networks and advanced resources that propel them into high-paying, influential careers. Middle class individuals typically attend public or less selective institutions, encountering limited networking opportunities and slower career progression. This educational divide reinforces significant disparities in wealth accumulation, job security, and social capital between the two groups.

Political Influence and Representation

The financial elite wield disproportionate political influence through substantial campaign contributions, lobbying, and access to policymakers, shaping legislation that often prioritizes their economic interests. In contrast, the middle class experiences limited political representation due to fewer resources and less direct access to decision-makers, resulting in policies that may inadequately address their needs. This disparity in political power reinforces systemic inequalities, affecting democratic accountability and public policy responsiveness.

Impact on Society and Economy

The middle class drives consumer demand and economic stability through widespread spending and tax contributions, while the financial elite influence markets and policy decisions via concentrated wealth and investments. Economic disparities between these groups can exacerbate social inequality, limiting upward mobility and access to education or healthcare. Balancing the interests of both classes is crucial for sustainable economic growth and social cohesion.

Bridging the Divide: Solutions and Future Prospects

Bridging the divide between the middle class and financial elite requires targeted policies such as progressive taxation, affordable education, and accessible investment opportunities to promote economic mobility and wealth distribution. Expanding financial literacy programs and supporting small business growth empower middle-class individuals to build assets and create sustainable income streams. Innovations in technology and inclusive economic reforms offer promising future prospects for narrowing the wealth gap and fostering a more equitable society.

Middle class Infographic

libterm.com

libterm.com