The official sector plays a vital role in economic stability by managing public finances, regulating monetary policy, and overseeing financial institutions. It influences interest rates, inflation, and currency value to ensure sustainable growth and market confidence. Explore the rest of the article to understand how your financial decisions can be impacted by official sector policies.

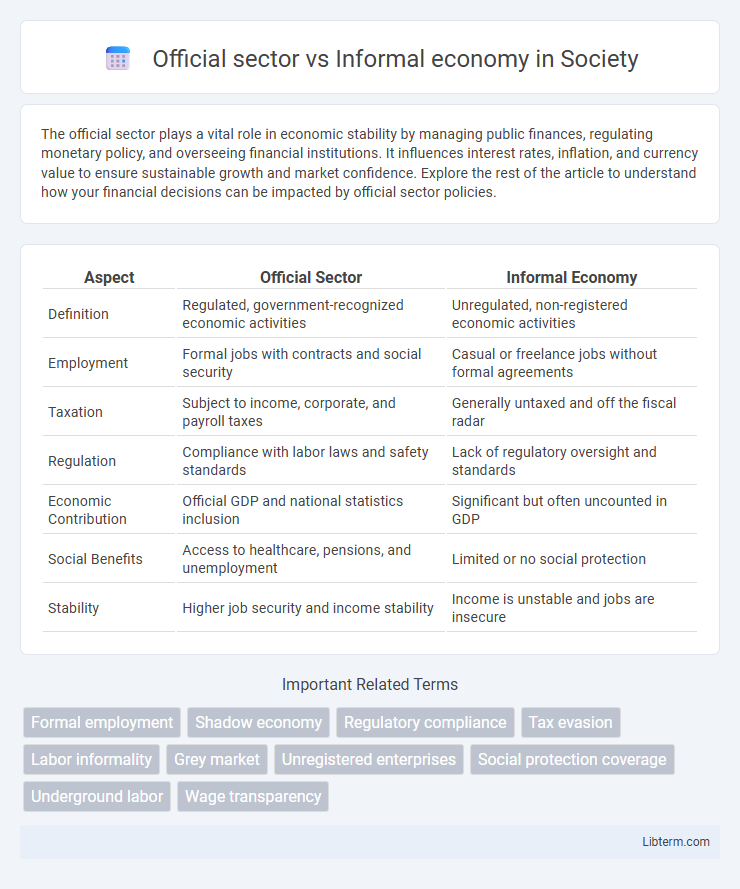

Table of Comparison

| Aspect | Official Sector | Informal Economy |

|---|---|---|

| Definition | Regulated, government-recognized economic activities | Unregulated, non-registered economic activities |

| Employment | Formal jobs with contracts and social security | Casual or freelance jobs without formal agreements |

| Taxation | Subject to income, corporate, and payroll taxes | Generally untaxed and off the fiscal radar |

| Regulation | Compliance with labor laws and safety standards | Lack of regulatory oversight and standards |

| Economic Contribution | Official GDP and national statistics inclusion | Significant but often uncounted in GDP |

| Social Benefits | Access to healthcare, pensions, and unemployment | Limited or no social protection |

| Stability | Higher job security and income stability | Income is unstable and jobs are insecure |

Defining the Official Sector and Informal Economy

The official sector encompasses all economic activities regulated by government policies, including formal employment, tax collection, and adherence to labor laws. In contrast, the informal economy consists of unregistered, unregulated activities that operate outside official oversight, often involving small-scale trade, self-employment, and undeclared labor. Understanding the distinction between these sectors is essential for accurate economic analysis, policy formulation, and addressing issues such as tax evasion and labor rights.

Key Characteristics of Each Sector

The official sector operates under government regulation, maintains formal contracts, and contributes to tax revenues, while the informal economy lacks formal recognition, often involves unregistered businesses, and evades taxation. Workers in the official sector typically enjoy labor rights, social security, and stable incomes, whereas informal sector participants face job insecurity, absence of legal protections, and inconsistent earnings. The official sector's data is systematically recorded in national accounts, contrasting with the informal economy's reliance on estimates due to its unregulated nature.

Size and Contribution to National GDP

The official sector, characterized by regulated and tax-compliant businesses, typically accounts for a substantial portion of national GDP, often ranging from 60% to 90% in developed countries. The informal economy, including unregistered and untaxed activities, can represent 10% to over 40% of GDP, especially in developing nations where it provides significant employment and income. Accurate measurement of the informal economy's size remains challenging due to its unregulated nature, yet its economic contribution substantially impacts overall economic activity and labor markets.

Employment Patterns and Labor Dynamics

Employment patterns in the official sector are typically characterized by formal contracts, regulated wages, social security benefits, and adherence to labor laws, ensuring job stability and worker protections. In contrast, the informal economy features irregular employment, lack of legal contracts, minimal or no social benefits, and often involves self-employment or small-scale entrepreneurial activities prone to income volatility. Labor dynamics in the informal sector exhibit higher flexibility and adaptability but are marked by vulnerability, limited access to formal financial services, and significant contributions to overall employment, particularly in developing economies.

Regulatory Frameworks and Compliance

Regulatory frameworks in the official sector enforce strict compliance with labor laws, taxation, and safety standards, ensuring transparency and legal protection for businesses and workers. In contrast, the informal economy operates largely outside formal regulations, lacking official oversight, which leads to challenges in tax collection, labor rights enforcement, and access to social security benefits. Strengthening regulatory mechanisms and creating inclusive policies are essential to bridge the gap between the official sector and the informal economy, promoting formalization and economic stability.

Taxation and Revenue Implications

The official sector generates tax revenue through formal channels, enabling governments to fund public services and infrastructure with reliable data on income and economic activity. The informal economy, characterized by unregistered businesses and cash transactions, often escapes taxation, leading to significant revenue losses and challenges in policy enforcement. Addressing this gap requires targeted tax reforms and incentives to encourage formalization, improving overall fiscal capacity and economic transparency.

Social Protections and Workers’ Rights

The official sector provides formal social protections such as unemployment insurance, health benefits, and regulated working hours, ensuring legal enforcement of workers' rights. In contrast, the informal economy often lacks access to these social safety nets, leaving workers vulnerable to exploitation, job insecurity, and absence of legal labor rights. Strengthening labor regulations and expanding social protection coverage can help bridge disparities between formal and informal employment sectors.

Innovation and Productivity Differences

The official sector exhibits higher innovation and productivity levels due to structured regulations, access to formal financing, and intellectual property protections that incentivize research and development. In contrast, the informal economy often faces resource constraints, limited access to technology, and lack of formal training, leading to lower productivity and slower innovation rates. Empirical studies show that firms in the official sector invest significantly more in technological upgrades and workforce skills, driving sustainable economic growth.

Challenges and Opportunities for Integration

The official sector benefits from regulated frameworks, stable taxation, and access to social protections, but often struggles to fully incorporate informal economy participants due to bureaucratic barriers and compliance costs. Informal economy workers face challenges including lack of legal recognition, limited access to credit, and vulnerability to exploitation, yet they provide significant economic contributions through innovation and flexible labor markets. Opportunities for integration lie in simplifying registration processes, improving access to financial services, and creating tailored social protection schemes that encourage transition into the formal economy while preserving the informal sector's adaptability.

Policy Approaches for Bridging the Sectors

Policy approaches for bridging the official sector and informal economy prioritize regulatory simplification to enhance business formalization and tax compliance. Governments implement inclusive social protection schemes and accessible financial services to integrate informal workers while preserving their livelihoods. Targeted capacity-building programs and digitalization initiatives foster formal sector entry, promoting economic growth and labor rights protection.

Official sector Infographic

libterm.com

libterm.com