Interlocking directorates occur when members of a company's board serve on the boards of other companies, creating a network of interconnected firms. This practice can influence corporate governance, competition, and decision-making processes across industries. Explore the rest of the article to understand how interlocking directorates impact your business environment.

Table of Comparison

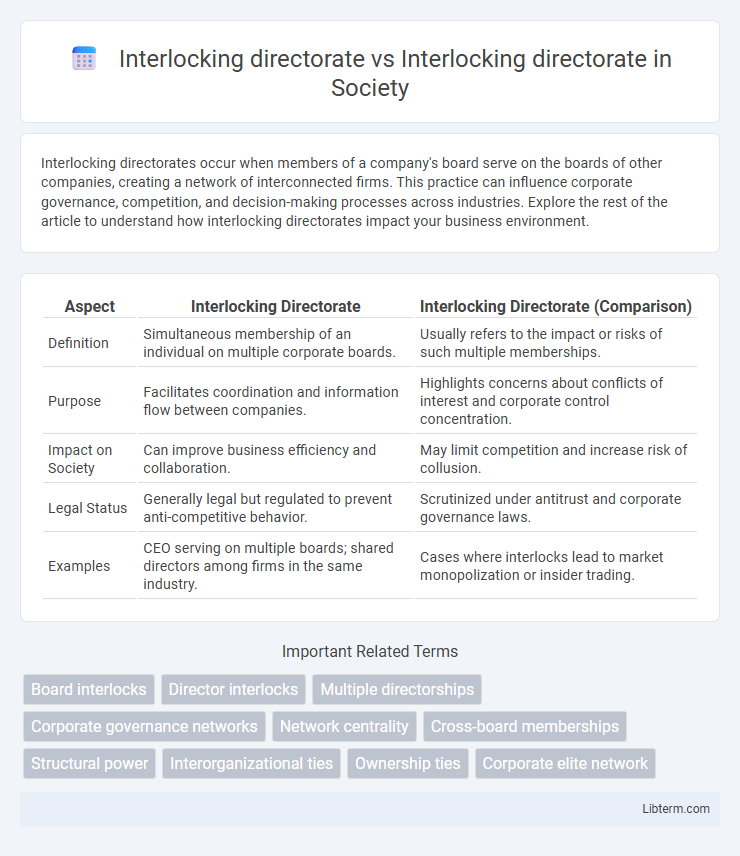

| Aspect | Interlocking Directorate | Interlocking Directorate (Comparison) |

|---|---|---|

| Definition | Simultaneous membership of an individual on multiple corporate boards. | Usually refers to the impact or risks of such multiple memberships. |

| Purpose | Facilitates coordination and information flow between companies. | Highlights concerns about conflicts of interest and corporate control concentration. |

| Impact on Society | Can improve business efficiency and collaboration. | May limit competition and increase risk of collusion. |

| Legal Status | Generally legal but regulated to prevent anti-competitive behavior. | Scrutinized under antitrust and corporate governance laws. |

| Examples | CEO serving on multiple boards; shared directors among firms in the same industry. | Cases where interlocks lead to market monopolization or insider trading. |

Understanding Interlocking Directorate

Understanding interlocking directorate involves analyzing how overlapping board memberships link multiple corporations, influencing decision-making and corporate control. Interlocking directorates can create networks that facilitate information flow and strategic alliances but also raise concerns about reduced competition and conflicts of interest. Examining these connections helps identify potential impacts on market dynamics and corporate governance practices.

Historical Context of Interlocking Directorates

Interlocking directorates have historically played a pivotal role in shaping corporate governance by linking the boards of multiple companies through shared directors, often facilitating coordination and control within industries. The practice gained prominence in the late 19th and early 20th centuries during the rise of large industrial conglomerates in the United States, where influential business leaders used interlocks to consolidate power and influence market competition. Regulatory responses, such as the Clayton Antitrust Act of 1914, sought to curb potential anti-competitive effects by addressing the concentration of corporate control arising from interlocking directorates.

Mechanisms Behind Interlocking Directorates

Interlocking directorates occur when a member of a company's board of directors also serves on the board of another company, creating a network of overlapping board memberships. The primary mechanisms behind interlocking directorates include information sharing, coordinated strategies, and enhanced control over market competition, which can facilitate collusion or reduce competitive pressures. These interconnected boards influence corporate governance by aligning interests and enabling resource exchange among firms within similar industries or geographic areas.

Types of Interlocking Directorates

Interlocking directorates occur when members of a company's board of directors also serve on another company's board, creating a network of overlapping leadership. Types of interlocking directorates include direct interlocks, where the same individual sits on two boards, and indirect interlocks, involving intermediaries connecting multiple boards through shared directors. These interlocks can shape corporate governance, influence strategic decisions, and affect competitive behavior across industries.

Key Benefits of Interlocking Directorates

Interlocking directorates enable firms to share strategic information, fostering collaboration and reducing competition risks across board members. They facilitate resource sharing and improve corporate governance by aligning interests among interconnected companies. This structure also enhances trust and coordination, leading to more effective decision-making and market influence.

Major Risks and Drawbacks

Interlocking directorates pose significant risks including conflicts of interest, reduced board independence, and compromised corporate governance, which can lead to anticompetitive practices and diminished shareholder value. These structures may facilitate collusion among companies, negatively impacting market competition and innovation. Overlapping directorships also increase the risk of groupthink and reduce accountability, undermining effective decision-making within organizations.

Legal and Regulatory Perspectives

Interlocking directorates, where board members serve on multiple companies simultaneously, raise significant legal and regulatory issues related to antitrust laws and corporate governance to prevent conflicts of interest and reduce anti-competitive behavior. Regulatory frameworks such as the Clayton Act in the United States restrict interlocking directorates among competing firms to maintain market competition and protect shareholder interests. Enforcement agencies closely monitor these overlaps to ensure compliance with securities regulations and promote transparency in boardroom decision-making.

Interlocking Directorates in Different Industries

Interlocking directorates occur when a member of a company's board of directors simultaneously serves on the board of another company, creating a network of directorial connections that can influence corporate strategy and competitive dynamics. In different industries, interlocking directorates often facilitate the exchange of industry-specific knowledge, promote strategic alliances, and align interests among firms in sectors such as technology, finance, and manufacturing. These cross-industry board memberships can lead to significant impact on market competition, regulatory outcomes, and corporate governance by enabling information flow and coordinating actions across diverse business environments.

Case Studies: Examples of Interlocking Directorates

Case studies of interlocking directorates reveal how shared board members create networks among corporations, influencing governance and competitive dynamics. For example, the historic Ford-Motor City interlock demonstrated how overlapping directors controlled vital automotive industry decisions, while the 2000s Nestle-Roche interlock illustrated cross-industry influence between food and pharmaceuticals. These examples highlight the strategic maneuvering and regulatory concerns arising from interlocking directorates in securing corporate power and market coordination.

The Future of Interlocking Directorates

Interlocking directorates, where board members serve on multiple company boards, pose ongoing challenges for corporate governance and competition regulation by potentially facilitating anti-competitive collusion and reducing board independence. The future of interlocking directorates is expected to see increased scrutiny through stricter regulatory frameworks and enhanced transparency mandates to mitigate conflicts of interest and promote market fairness. Technological advancements like AI-driven monitoring tools will further enable regulators and shareholders to analyze network effects and power dynamics within corporate boardrooms.

Interlocking directorate Infographic

libterm.com

libterm.com