Private insurance offers customized coverage options tailored to meet Your specific health, auto, or property needs, often providing faster claim processing and broader provider networks compared to public plans. It allows for greater flexibility in selecting services and can include benefits like lower deductibles or enhanced amenities. Explore the full article to discover how private insurance can safeguard Your assets and well-being effectively.

Table of Comparison

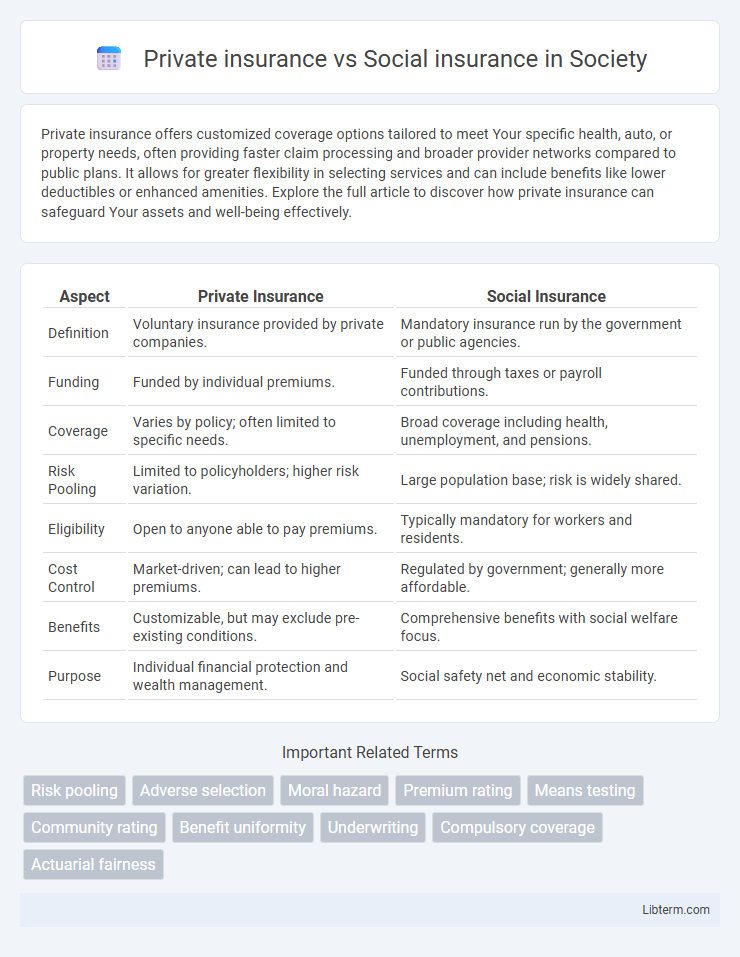

| Aspect | Private Insurance | Social Insurance |

|---|---|---|

| Definition | Voluntary insurance provided by private companies. | Mandatory insurance run by the government or public agencies. |

| Funding | Funded by individual premiums. | Funded through taxes or payroll contributions. |

| Coverage | Varies by policy; often limited to specific needs. | Broad coverage including health, unemployment, and pensions. |

| Risk Pooling | Limited to policyholders; higher risk variation. | Large population base; risk is widely shared. |

| Eligibility | Open to anyone able to pay premiums. | Typically mandatory for workers and residents. |

| Cost Control | Market-driven; can lead to higher premiums. | Regulated by government; generally more affordable. |

| Benefits | Customizable, but may exclude pre-existing conditions. | Comprehensive benefits with social welfare focus. |

| Purpose | Individual financial protection and wealth management. | Social safety net and economic stability. |

Overview of Private and Social Insurance

Private insurance involves coverage purchased from commercial insurers, offering personalized plans and flexible benefits tailored to individual needs, typically funded by premiums paid directly by policyholders. Social insurance is a government-managed program providing broad coverage through mandatory contributions, designed to protect populations against economic risks such as unemployment, disability, and retirement. Both systems play crucial roles in risk management, with private insurance emphasizing market-driven options and social insurance focusing on universal access and social safety nets.

Key Differences Between Private and Social Insurance

Private insurance involves individual or employer-purchased policies providing customized coverage, often with higher premiums and greater flexibility in benefits. Social insurance is government-mandated, financed through taxes or contributions, offering standardized protection targeted at social risks like unemployment, disability, or retirement. The key differences lie in funding sources, eligibility criteria, and the scope of coverage, with private insurance emphasizing personal choice and social insurance focusing on broad public welfare.

Coverage Scope: What Each Insurance Type Offers

Private insurance typically offers customizable coverage plans tailored to individual needs, including specialized healthcare, property protection, and life insurance options. Social insurance provides broad, mandatory coverage designed to ensure basic income security and access to essential services like healthcare, unemployment benefits, and pensions. While private insurance emphasizes flexibility and additional benefits, social insurance guarantees foundational protection for a wider population through government-managed programs.

Eligibility Criteria Explained

Private insurance eligibility depends on individual factors such as age, health status, income, and employment, often requiring medical underwriting and credit evaluations. Social insurance eligibility is typically based on predefined legal criteria including employment history, contributions to social funds, age, disability status, or specific life events like retirement or unemployment. Private insurance offers personalized coverage options, while social insurance ensures universal or categorical access tied to public welfare programs and legislative mandates.

Cost Comparison: Premiums, Deductibles, and Out-of-Pocket Expenses

Private insurance typically involves higher premiums and deductibles compared to social insurance, which often offers lower or income-based premiums and minimal deductibles. Out-of-pocket expenses in private plans can be substantial, including copayments and coinsurance, whereas social insurance programs generally cap these costs to protect beneficiaries from financial hardship. The cost structure differences significantly impact affordability and access, with social insurance providing more predictable and controlled expenses for individuals.

Accessibility and Enrollment Process

Private insurance often requires applicants to meet specific eligibility criteria and may involve extensive underwriting processes, limiting accessibility to individuals with pre-existing conditions or lower income levels. Social insurance programs provide broader accessibility through mandated enrollment and minimal eligibility barriers, often funded by government contributions to ensure coverage for large populations. Enrollment in social insurance is typically automatic or streamlined via payroll deductions, whereas private insurance demands active selection and can involve complex application procedures.

Quality of Service and Provider Choice

Private insurance typically offers higher quality of service with faster claims processing and personalized customer support, enhancing overall user experience. It provides greater provider choice, allowing policyholders to select from a wide network of healthcare professionals and facilities without restrictions. Social insurance often limits provider options but ensures standardized care quality and broad access, emphasizing equitable service delivery across the population.

Financial Sustainability and Risk Pooling

Private insurance relies on individual premiums and risk assessment, often leading to higher costs for high-risk individuals and potentially limiting broad risk pooling. Social insurance pools risks across entire populations, enhancing financial sustainability by distributing costs more evenly and maintaining stable funding through compulsory contributions. This system mitigates adverse selection and ensures long-term viability by spreading financial risks over a larger, diverse group.

Impact on Health Outcomes and Equity

Private insurance often leads to varied health outcomes due to disparities in coverage quality and access, with higher-income individuals benefiting from comprehensive plans while lower-income groups face coverage gaps. Social insurance aims to enhance equity by providing universal or broad-based coverage, reducing disparities in access to essential healthcare services and improving overall population health outcomes. Studies show countries with robust social insurance systems typically achieve better equity in health outcomes, minimizing socioeconomic health inequalities.

Choosing the Right Insurance for Your Needs

Choosing the right insurance requires evaluating coverage, cost, and flexibility between private and social insurance options. Private insurance offers customizable plans and faster claim processing but generally comes with higher premiums and out-of-pocket costs. Social insurance provides broader access and mandatory coverage for essential services, often funded through taxes, making it ideal for those seeking stability and comprehensive protection.

Private insurance Infographic

libterm.com

libterm.com