Guaranteed money provides financial security by ensuring a fixed income regardless of market fluctuations or business performance. This concept is crucial for individuals seeking stability in retirement planning or steady cash flow in investments. Explore the article to understand how guaranteed money can safeguard your financial future and optimize your wealth strategy.

Table of Comparison

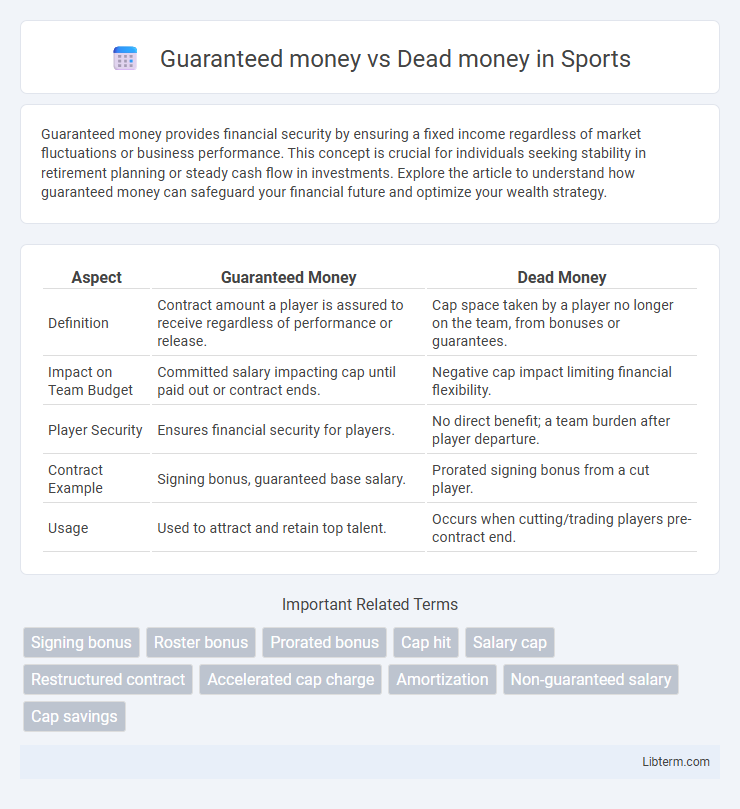

| Aspect | Guaranteed Money | Dead Money |

|---|---|---|

| Definition | Contract amount a player is assured to receive regardless of performance or release. | Cap space taken by a player no longer on the team, from bonuses or guarantees. |

| Impact on Team Budget | Committed salary impacting cap until paid out or contract ends. | Negative cap impact limiting financial flexibility. |

| Player Security | Ensures financial security for players. | No direct benefit; a team burden after player departure. |

| Contract Example | Signing bonus, guaranteed base salary. | Prorated signing bonus from a cut player. |

| Usage | Used to attract and retain top talent. | Occurs when cutting/trading players pre-contract end. |

Understanding Guaranteed Money in Contracts

Guaranteed money in contracts refers to the portion of a player's salary that is assured regardless of injury, release, or performance, providing financial security and stability. Dead money represents the salary cap space taken up by guaranteed money on players no longer on the team, impacting a franchise's ability to sign new talent. Understanding the distinction between guaranteed and dead money is crucial for teams to effectively manage salary caps and roster building strategies.

Defining Dead Money in Sports Finance

Dead money in sports finance refers to the salary cap space occupied by a player who is no longer on a team's active roster, typically due to release or trade. It results from guaranteed money that remains owed despite the player's departure, reducing a team's available budget for acquiring new talent. Understanding dead money is crucial for managing salary caps and maintaining financial flexibility in professional sports leagues.

Key Differences Between Guaranteed and Dead Money

Guaranteed money refers to the portion of a player's contract that is fully assured to be paid regardless of injury, release, or performance, providing financial security for the athlete. Dead money represents the salary cap space occupied by a player no longer on the team, often resulting from bonuses or guaranteed amounts that accelerate upon release or trade. Key differences include guaranteed money being an active financial commitment to a current roster player, while dead money is a cap charge tied to past contract decisions impacting future team flexibility.

How Guaranteed Money Affects Player Security

Guaranteed money ensures a player receives a predetermined contract amount regardless of performance or injury, providing financial stability and security throughout the contract term. This guaranteed portion reduces uncertainty and risk, allowing players to focus on their development and on-field performance without concern for sudden income loss. Teams offering higher guaranteed money often attract elite talent who prioritize long-term financial protection over potentially higher but non-guaranteed earnings.

The Impact of Dead Money on Team Salary Caps

Dead money refers to the salary cap space taken up by a player who is no longer on the team's roster, often resulting from guaranteed money in a contract. This dead money limits a team's financial flexibility by reducing available cap space for signing new players or extending current ones. Managing dead money effectively is crucial for optimizing salary cap health and maintaining competitive roster construction in professional sports leagues.

Negotiation Strategies: Prioritizing Guaranteed Money

Negotiation strategies for NFL contracts emphasize securing guaranteed money over dead money to maximize financial stability and reduce long-term risk for players. Guaranteed money provides assured salary regardless of future injury or release, while dead money represents cap space consumed by previously guaranteed payments to departed players, impacting team flexibility. Prioritizing guaranteed money in contract talks empowers players with security and leverage, ensuring more predictable income amid the volatile nature of professional football careers.

Dead Money: Risks and Consequences for Teams

Dead money refers to cap space occupied by players who are no longer on a team's roster but still count against the salary cap due to guaranteed contracts or bonuses. This financial burden restricts a team's flexibility to sign free agents or retain key players, significantly impacting roster construction and long-term competitiveness. Teams facing large dead money charges often struggle to allocate resources efficiently, which can hinder their ability to improve talent and sustain success.

Real-World Examples: Guaranteed vs Dead Money

Guaranteed money in NFL contracts refers to the portion of a player's salary that is fully secured, regardless of injury or release, exemplified by Patrick Mahomes' $45 million guaranteed in his 10-year extension with the Kansas City Chiefs. Dead money represents salary cap space taken up by a player no longer on the roster, such as Le'Veon Bell's $23 million dead money hit for the New York Jets after his release. Teams like the Dallas Cowboys have strategically minimized dead money by structuring contracts with lower guarantees, allowing more flexibility for roster moves.

Managing Cap Hits: Mitigating Dead Money

Managing cap hits effectively involves distinguishing between guaranteed money and dead money to optimize a team's salary cap flexibility. Guaranteed money counts against the cap whether a player is on the roster or not, whereas dead money results from releasing or trading players before their contracts expire, still imposing a cap hit without on-field contributions. Strategic contract structuring and timely roster decisions can mitigate dead money, preserving cap space for impactful signings and long-term team building.

Future Trends in Contract Structures

Guaranteed money in NFL contracts ensures players receive a set amount regardless of release or injury, while dead money refers to salary cap charges for players no longer on the roster. Future trends in contract structures indicate an increase in creative guaranteed money segmentation, such as injury and performance guarantees, to balance risk between teams and players. Teams are also expected to leverage dead money strategically through roster design, often using offset language and void years to manage cap implications.

Guaranteed money Infographic

libterm.com

libterm.com