A controller plays a crucial role in managing and regulating a system's performance, ensuring accuracy and stability in various applications such as electronics, finance, and project management. Understanding the functions and types of controllers can help you optimize efficiency and maintain control over complex processes. Discover more about how controllers impact your operations throughout the rest of the article.

Table of Comparison

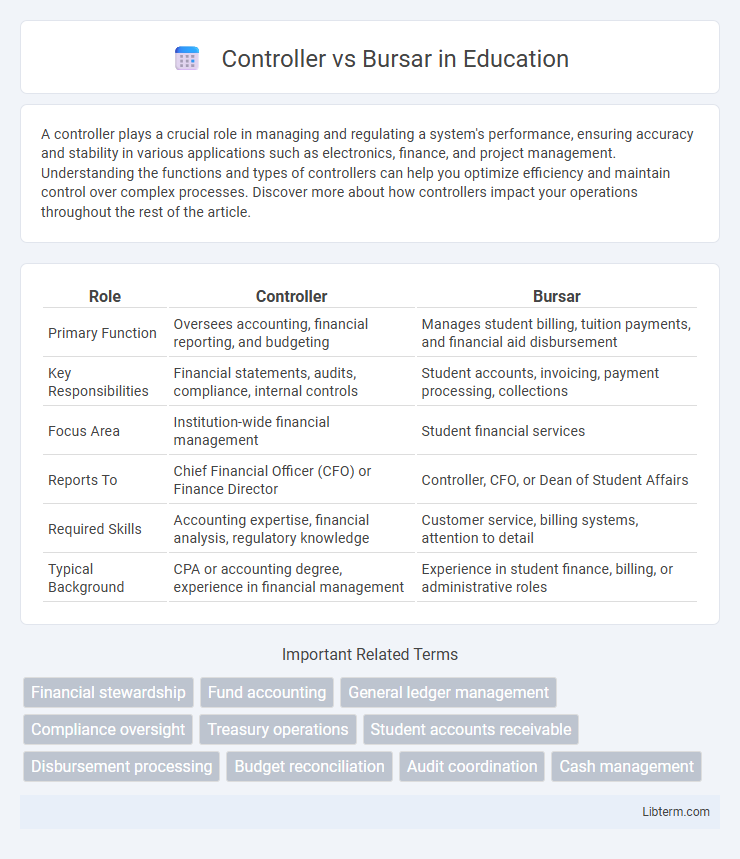

| Role | Controller | Bursar |

|---|---|---|

| Primary Function | Oversees accounting, financial reporting, and budgeting | Manages student billing, tuition payments, and financial aid disbursement |

| Key Responsibilities | Financial statements, audits, compliance, internal controls | Student accounts, invoicing, payment processing, collections |

| Focus Area | Institution-wide financial management | Student financial services |

| Reports To | Chief Financial Officer (CFO) or Finance Director | Controller, CFO, or Dean of Student Affairs |

| Required Skills | Accounting expertise, financial analysis, regulatory knowledge | Customer service, billing systems, attention to detail |

| Typical Background | CPA or accounting degree, experience in financial management | Experience in student finance, billing, or administrative roles |

Controller vs Bursar: Core Roles Defined

The Controller manages an organization's accounting, financial reporting, and internal controls, ensuring accurate financial data and compliance with regulations. The Bursar oversees student billing, tuition payments, and financial aid distribution in educational institutions, focusing on cash flow related to student accounts. While Controllers handle overall financial strategy and reporting, Bursars concentrate on operational finance involving student accounts and receivables.

Key Responsibilities of a Controller

The Controller oversees financial reporting, budgeting, and internal controls, ensuring accurate financial statements and regulatory compliance within an organization. They manage accounting operations, including ledger reconciliation, financial audits, and cost analysis, to support strategic decision-making. Unlike the Bursar, who handles student billing and tuition payments, the Controller focuses on the broader financial management and integrity of the institution's finances.

Main Duties of a Bursar

The main duties of a Bursar include managing student accounts, overseeing tuition payments, and handling billing processes within educational institutions. A Bursar is responsible for maintaining accurate financial records related to student fees, issuing invoices, collecting payments, and coordinating with financial aid offices to apply scholarships or grants. In contrast to a Controller, who manages overall financial reporting and budgeting, the Bursar focuses specifically on cash flow and accounts receivable related to student financial transactions.

Educational Background and Qualifications

Controllers typically hold a bachelor's degree in accounting, finance, or business administration, often supplemented by certifications such as CPA (Certified Public Accountant) or CMA (Certified Management Accountant). Bursars usually possess a degree in finance, accounting, or education management, emphasizing skills in cash management and student accounts. Both roles benefit from strong knowledge of financial regulations, but controllers require deeper expertise in financial reporting and auditing standards.

Skills Needed: Controller vs Bursar

Controllers require advanced financial analysis, strategic planning, and regulatory compliance skills to oversee accounting operations and financial reporting. Bursars need strong customer service abilities, cash handling expertise, and proficiency in billing systems to manage student accounts and tuition payments efficiently. Both roles demand attention to detail, organizational skills, and familiarity with financial software, but controllers emphasize corporate finance while bursars focus on educational institution billing.

Organizational Hierarchy and Reporting Lines

The Controller typically oversees the accounting department, managing financial reporting, budgeting, and internal controls, while reporting to the Chief Financial Officer (CFO). The Bursar manages student billing and tuition collections within the finance division, often reporting to the Controller or directly to the CFO depending on the institution's size. Organizational hierarchy places the Controller higher in the finance function with broader financial oversight, whereas the Bursar has a more specialized role in receivables and student financial services.

Financial Management: Overlapping Functions

The Controller manages financial reporting, budgeting, and internal controls, ensuring accurate financial statements and compliance. The Bursar handles cash management, billing, student accounts, and tuition fee collection, focusing on operational financial transactions. Both roles overlap in maintaining financial data integrity and supporting fiscal policies, but the Controller emphasizes financial strategy while the Bursar centers on daily cash flow and student account management.

Work Environments: Corporate vs Academic

Controllers typically work in corporate environments, managing financial reporting, budgeting, and internal controls to ensure regulatory compliance and optimize business operations. Bursars operate primarily within academic institutions, handling student billing, tuition collection, and financial aid disbursement to support university financial processes. The corporate setting demands expertise in corporate finance standards and stakeholder reporting, while academic bursars focus on educational fiscal management and student account administration.

Career Paths and Advancement Opportunities

A Controller typically advances through roles in accounting and financial management, leading to senior executive positions such as Chief Financial Officer (CFO) or VP of Finance within large organizations. Bursars often follow career paths rooted in higher education finance administration, progressing to roles like Director of Student Financial Services or Vice President of Finance at universities. Career advancement for Controllers emphasizes corporate financial strategy and compliance expertise, while Bursars focus on institutional budgeting, tuition management, and student financial policy development.

Choosing the Right Role: Controller or Bursar

Choosing between a Controller and a Bursar depends on the organization's financial needs and focus; Controllers oversee comprehensive financial reporting, budgeting, and compliance, while Bursars manage student billing, tuition payments, and campus financial transactions. Institutions prioritizing detailed financial strategy and regulatory adherence often benefit from a Controller's expertise, whereas schools concentrating on student account management and day-to-day cash handling find the Bursar role essential. Understanding the distinctions in responsibilities ensures alignment with institutional goals and efficient financial operations.

Controller Infographic

libterm.com

libterm.com