Understanding the basics of financial literacy empowers you to make informed decisions about budgeting, saving, investing, and managing debt effectively. Mastering essential concepts such as compound interest, credit scores, and retirement planning can significantly improve your long-term financial stability. Discover how enhancing your financial knowledge can transform your money management by reading the rest of this article.

Table of Comparison

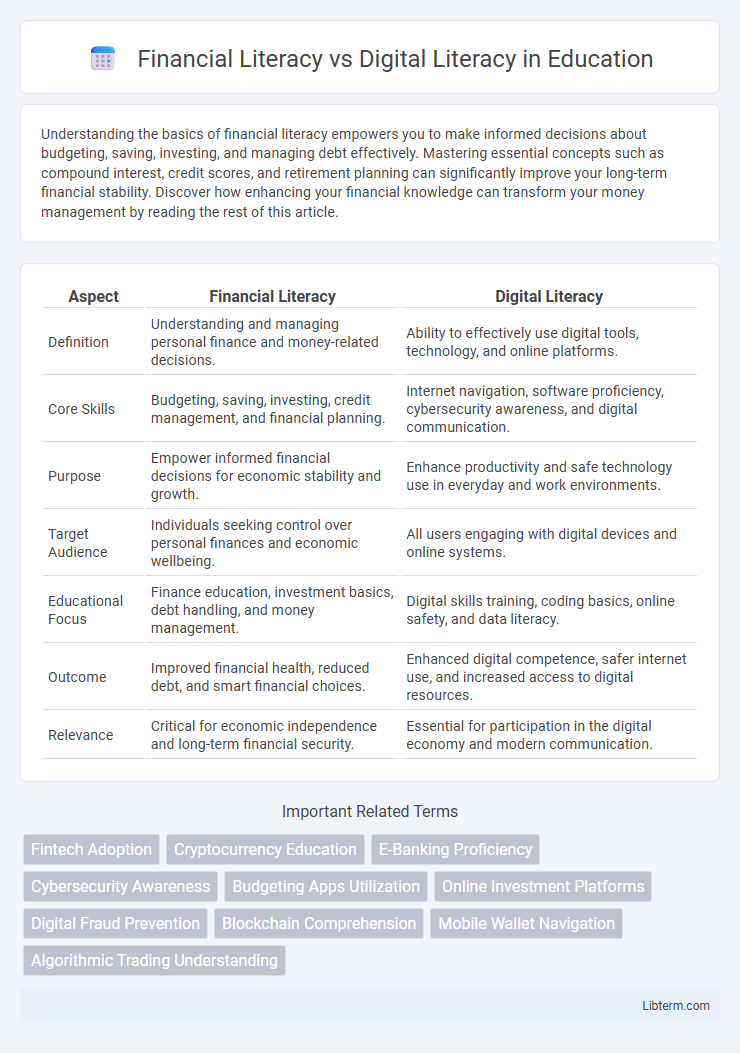

| Aspect | Financial Literacy | Digital Literacy |

|---|---|---|

| Definition | Understanding and managing personal finance and money-related decisions. | Ability to effectively use digital tools, technology, and online platforms. |

| Core Skills | Budgeting, saving, investing, credit management, and financial planning. | Internet navigation, software proficiency, cybersecurity awareness, and digital communication. |

| Purpose | Empower informed financial decisions for economic stability and growth. | Enhance productivity and safe technology use in everyday and work environments. |

| Target Audience | Individuals seeking control over personal finances and economic wellbeing. | All users engaging with digital devices and online systems. |

| Educational Focus | Finance education, investment basics, debt handling, and money management. | Digital skills training, coding basics, online safety, and data literacy. |

| Outcome | Improved financial health, reduced debt, and smart financial choices. | Enhanced digital competence, safer internet use, and increased access to digital resources. |

| Relevance | Critical for economic independence and long-term financial security. | Essential for participation in the digital economy and modern communication. |

Understanding Financial Literacy: Key Concepts and Importance

Financial literacy encompasses essential knowledge in budgeting, saving, investing, and managing debt to ensure financial well-being and informed decision-making. Understanding concepts such as compound interest, credit scores, and risk diversification is crucial for navigating personal finance effectively. Mastery of financial literacy empowers individuals to plan for future goals, avoid debt traps, and make strategic money choices.

Defining Digital Literacy in the Modern World

Digital literacy in the modern world encompasses the ability to efficiently navigate, evaluate, and create information using digital technologies, including computers, smartphones, and the internet. It involves understanding online safety, digital communication tools, and data privacy, enabling individuals to participate effectively in a digitally-driven society. Mastery of digital literacy enhances access to information and services, promoting informed decision-making in various aspects of life, from education to employment.

Core Differences Between Financial and Digital Literacy

Financial literacy involves understanding and managing personal finances, including budgeting, investing, and credit management, whereas digital literacy focuses on the ability to use digital technologies and navigate online environments effectively. Core differences include the skill sets required: financial literacy emphasizes numerical and economic knowledge, while digital literacy centers on technical skills and digital communication. Mastery of financial literacy enhances money management and financial decision-making, whereas digital literacy ensures competent use of digital tools and online security awareness.

Overlapping Skills: Where Finance Meets Technology

Financial literacy and digital literacy intersect through skills such as data analysis, critical thinking, and problem-solving, enabling individuals to manage finances effectively using technological tools. Proficiency in digital platforms like online banking, budgeting apps, and investment software enhances one's ability to make informed financial decisions. Understanding cybersecurity and digital privacy further protects financial assets in an increasingly digital economy.

Why Both Literacies Matter in Today’s Economy

Financial literacy enables individuals to manage money, investments, and debt, essential for navigating today's complex economic environment. Digital literacy provides the skills to access online banking, digital payment systems, and financial planning tools, increasing efficiency and security in financial transactions. Together, these literacies empower people to make informed economic decisions and participate fully in the increasingly digital global economy.

Challenges in Acquiring Financial vs Digital Literacy

Acquiring financial literacy is challenged by complex economic terminology and the rapidly changing financial products that require continuous learning. Digital literacy faces obstacles such as unequal access to technology and the fast evolution of digital tools, which can outpace users' ability to adapt. Both literacies demand consistent education efforts, but financial literacy requires understanding abstract concepts while digital literacy emphasizes practical skills with devices and software.

Building Financial and Digital Skills: Effective Strategies

Building financial and digital skills requires targeted strategies such as interactive workshops, real-world applications, and continuous self-assessment. Integrating practical tools like budgeting apps and online learning platforms enhances both financial literacy and digital fluency. Emphasizing critical thinking and problem-solving fosters adaptable competencies essential for navigating both economic and technological challenges.

The Role of Education in Promoting Both Literacies

Education plays a pivotal role in fostering both financial literacy and digital literacy by integrating tailored curricula that address budgeting, investing, cybersecurity, and digital tools usage. Schools and community programs enhance critical thinking and decision-making skills necessary to navigate complex financial products and digital environments safely and effectively. Emphasizing experiential learning and real-world applications increases students' competence and confidence in managing money and technology in today's interconnected economy.

Real-World Applications: Navigating Everyday Life

Financial literacy empowers individuals to manage budgeting, saving, and investing effectively, ensuring long-term economic stability. Digital literacy enables seamless navigation of online banking, digital payment systems, and cybersecurity measures to protect personal information. Combining both skills is essential for making informed financial decisions in today's technology-driven marketplace.

Future Trends: The Convergence of Financial and Digital Literacy

Future trends indicate a significant convergence between financial literacy and digital literacy, driven by the increasing digitization of financial services. The rise of fintech innovations such as blockchain, mobile banking, and digital wallets necessitates a hybrid skill set combining financial knowledge with digital competencies. This integration empowers individuals to navigate complex financial ecosystems securely and make informed decisions in an evolving digital economy.

Financial Literacy Infographic

libterm.com

libterm.com