Program-based budgeting allocates financial resources according to specific programs and their objectives, enhancing transparency and accountability in public sector financial management. This approach helps you prioritize funding based on measurable outcomes, improving efficiency and ensuring that resources directly support strategic goals. Explore the rest of the article to discover how program-based budgeting can transform your organization's financial planning.

Table of Comparison

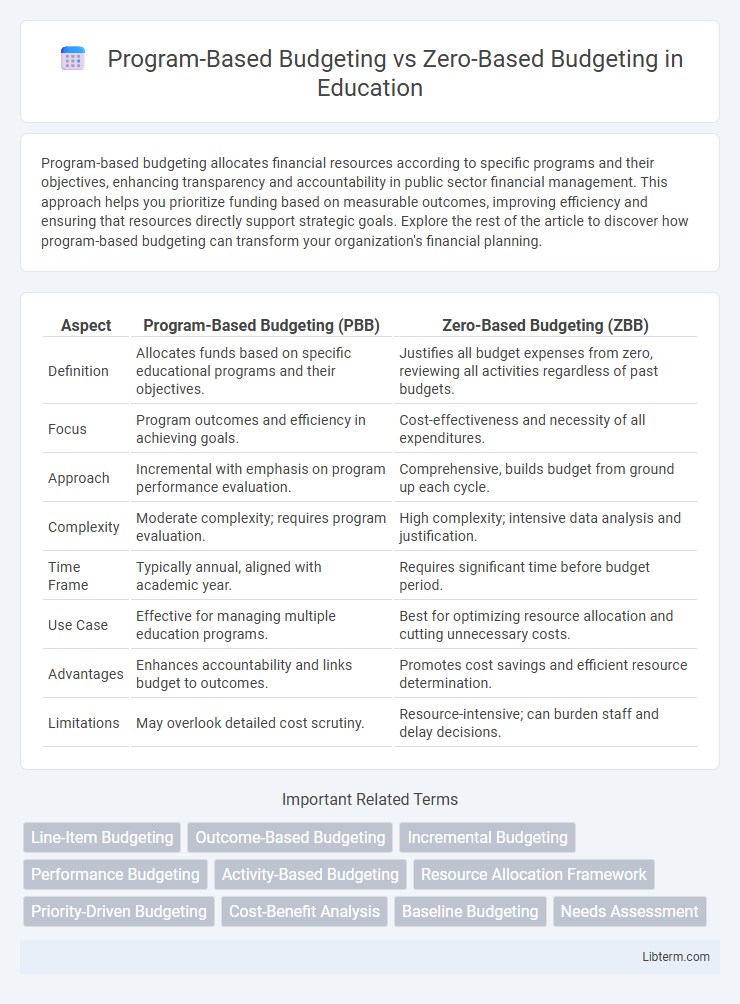

| Aspect | Program-Based Budgeting (PBB) | Zero-Based Budgeting (ZBB) |

|---|---|---|

| Definition | Allocates funds based on specific educational programs and their objectives. | Justifies all budget expenses from zero, reviewing all activities regardless of past budgets. |

| Focus | Program outcomes and efficiency in achieving goals. | Cost-effectiveness and necessity of all expenditures. |

| Approach | Incremental with emphasis on program performance evaluation. | Comprehensive, builds budget from ground up each cycle. |

| Complexity | Moderate complexity; requires program evaluation. | High complexity; intensive data analysis and justification. |

| Time Frame | Typically annual, aligned with academic year. | Requires significant time before budget period. |

| Use Case | Effective for managing multiple education programs. | Best for optimizing resource allocation and cutting unnecessary costs. |

| Advantages | Enhances accountability and links budget to outcomes. | Promotes cost savings and efficient resource determination. |

| Limitations | May overlook detailed cost scrutiny. | Resource-intensive; can burden staff and delay decisions. |

Introduction to Program-Based Budgeting and Zero-Based Budgeting

Program-Based Budgeting allocates resources based on specific programs and their objectives, emphasizing outcomes and performance metrics to ensure efficient use of funds. Zero-Based Budgeting requires each budget cycle to start from zero, compelling departments to justify every expense, promoting cost-effectiveness and eliminating unnecessary expenditures. Both approaches aim to optimize financial planning but differ in methodology and focus, with Program-Based Budgeting prioritizing program goals and Zero-Based Budgeting emphasizing expense justification.

Key Principles of Program-Based Budgeting

Program-Based Budgeting organizes expenditures around specific programs, emphasizing clear objectives, measurable outcomes, and resource allocation aligned with program goals. It requires defining distinct programs, establishing performance indicators, and linking budgets directly to program outputs and results. This approach enhances transparency, accountability, and strategic planning by prioritizing funding based on program effectiveness and impact.

Core Concepts of Zero-Based Budgeting

Zero-Based Budgeting (ZBB) requires every expense to be justified from scratch for each new budgeting period, unlike Program-Based Budgeting which allocates funds based on predefined programs and past expenditures. Core concepts of ZBB include building the budget from a zero base, focusing on cost-benefit analysis, and prioritizing resources based on current needs and objectives rather than historical spending. This method enhances financial discipline and resource allocation by eliminating unnecessary costs and ensuring alignment with organizational goals.

Budget Preparation Process: Program-Based vs Zero-Based

Program-Based Budgeting (PBB) structures the budget preparation process around specific programs, linking resources directly to predefined objectives and performance metrics for enhanced transparency and accountability. Zero-Based Budgeting (ZBB) requires each budget cycle to start from a "zero base," necessitating justifications for all expenditures, thereby promoting comprehensive cost analysis and prioritization. While PBB aligns funding with strategic outcomes, ZBB enforces rigorous scrutiny of every budget item, optimizing resource allocation through detailed evaluation.

Allocation of Resources in Both Budgeting Approaches

Program-Based Budgeting allocates resources by linking funds directly to specific programs or projects, emphasizing performance outcomes and measurable objectives to ensure efficient use of budgetary allocations. Zero-Based Budgeting requires each department to justify all expenses from scratch, prioritizing resource allocation based on current needs and strategic goals rather than historical spending, leading to more flexible and potentially optimized budget distribution. Both approaches enhance fiscal discipline but differ in their resource allocation focus: Program-Based Budgeting revolves around program performance, while Zero-Based Budgeting centers on comprehensive justification and need-based funding.

Advantages of Program-Based Budgeting

Program-Based Budgeting (PBB) enhances transparency and accountability by linking expenditures directly to specific programs and outcomes, facilitating performance measurement and resource allocation efficiency. PBB supports strategic planning by aligning budget decisions with organizational goals, enabling better prioritization compared to traditional budgeting methods like Zero-Based Budgeting (ZBB). Unlike ZBB, PBB reduces complexity and time consumption by building on existing program structures rather than requiring a complete budget reset, making it more practical for continuous financial management.

Benefits of Zero-Based Budgeting

Zero-Based Budgeting (ZBB) enhances financial efficiency by requiring all expenses to be justified from zero each period, ensuring resource allocation aligns directly with organizational goals. This method improves cost control and transparency by eliminating redundant or outdated expenditures, fostering a more strategic and flexible budgeting process. Compared to Program-Based Budgeting, ZBB drives accountability and prioritizes funding for high-impact activities, resulting in optimized budget utilization and stronger financial discipline.

Common Challenges and Limitations

Program-Based Budgeting often faces challenges such as difficulty in accurately defining program objectives and measuring outcomes, leading to inefficiencies in resource allocation. Zero-Based Budgeting struggles with the intensive labor and time required to justify all expenses from scratch, which can overwhelm organizations and delay financial planning. Both methods encounter limitations in adapting to dynamic business environments where rapid changes demand flexible budgeting approaches.

Real-World Applications and Case Studies

Program-Based Budgeting (PBB) enables organizations like governments and nonprofits to allocate resources by linking funds to specific programs, enhancing transparency and accountability as seen in the U.S. Department of Health and Human Services. Zero-Based Budgeting (ZBB) requires justifying all expenses from zero each cycle, driving cost efficiency demonstrated by the State of Georgia's government restructuring, which achieved significant savings. Comparative case studies reveal PBB is effective for aligning budgets with strategic goals while ZBB excels in cost control during financial constraints.

Choosing the Best Budgeting Method for Your Organization

Program-Based Budgeting allocates resources according to specific programs, ensuring alignment with strategic goals and enhancing accountability through clear performance metrics. Zero-Based Budgeting requires each expense to be justified from scratch, promoting cost efficiency and preventing budgetary inflation in organizations with variable or uncertain expenditures. Organizations with stable operations may benefit from Program-Based Budgeting for its strategic focus, while those facing fluctuating priorities might prefer Zero-Based Budgeting for rigorous cost control.

Program-Based Budgeting Infographic

libterm.com

libterm.com