Aides play a crucial role in supporting professionals across various fields, enhancing efficiency and ensuring smooth operations. They assist with tasks ranging from administrative duties to specialized support, making them indispensable team members. Discover how aides can transform your workflow and the benefits they bring by reading the rest of the article.

Table of Comparison

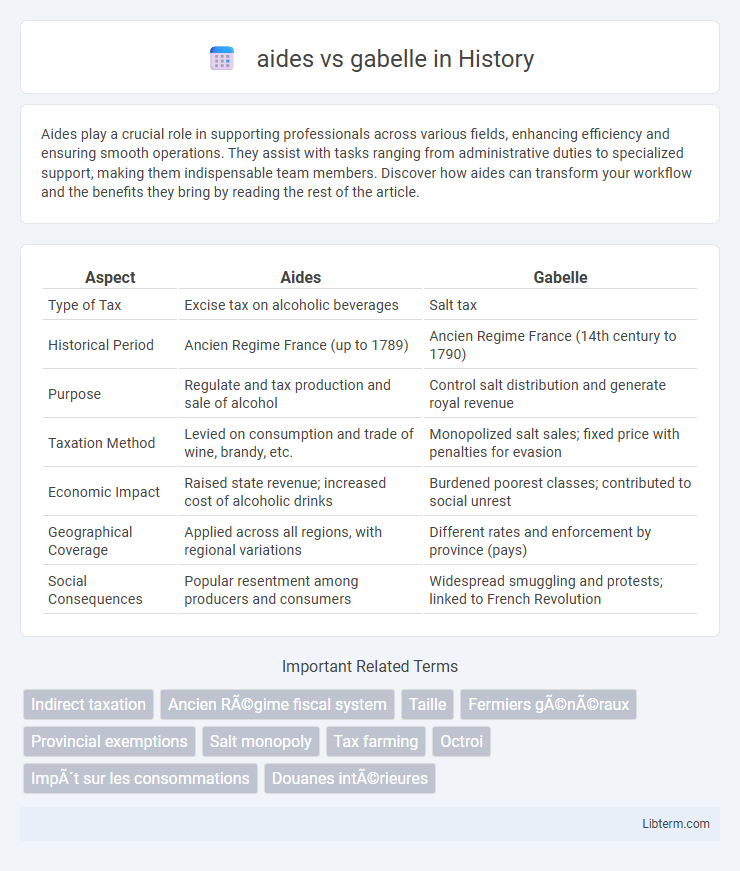

| Aspect | Aides | Gabelle |

|---|---|---|

| Type of Tax | Excise tax on alcoholic beverages | Salt tax |

| Historical Period | Ancien Regime France (up to 1789) | Ancien Regime France (14th century to 1790) |

| Purpose | Regulate and tax production and sale of alcohol | Control salt distribution and generate royal revenue |

| Taxation Method | Levied on consumption and trade of wine, brandy, etc. | Monopolized salt sales; fixed price with penalties for evasion |

| Economic Impact | Raised state revenue; increased cost of alcoholic drinks | Burdened poorest classes; contributed to social unrest |

| Geographical Coverage | Applied across all regions, with regional variations | Different rates and enforcement by province (pays) |

| Social Consequences | Popular resentment among producers and consumers | Widespread smuggling and protests; linked to French Revolution |

Introduction to Aides and Gabelle

Aides and Gabelle were two significant types of taxes in pre-revolutionary France, crucial for royal revenue. Aides were indirect taxes on the sale of commodities such as wine and tobacco, collected locally but controlled by the crown. The Gabelle was a highly unpopular salt tax, enforced strictly and varying regionally, symbolizing the fiscal inequalities that fueled public discontent leading to the French Revolution.

Historical Background of Aides

Aides were indirect taxes levied on goods and consumption in pre-revolutionary France, originating in the 14th century to fund royal expenditures, particularly military campaigns. These taxes were collected at various stages of production and distribution, including on wine, tobacco, and salt, forming a significant portion of the Ancien Regime's revenue system. The fiscal burden imposed by aides contributed to widespread public discontent, fueling opposition to the gabelle, another infamous salt tax, and broader tax reforms.

The Origin and Purpose of the Gabelle

The gabelle originated in medieval France as a mandatory salt tax imposed by the monarchy to fund royal expenses, becoming one of the most hated and unevenly enforced taxes before the French Revolution. Its purpose was to control salt distribution and generate significant revenue for the state, contrasting with aides, which were broader indirect taxes on goods and services. The gabelle's heavy burden on commoners, especially in salt-poor regions, fueled widespread resentment and economic hardship, highlighting its role in pre-revolutionary fiscal policy.

Aides: Types and Collection Methods

Aides were indirect taxes imposed on goods such as wine, beer, and tobacco in pre-revolutionary France, collected primarily at production or entry points like wineries and breweries. These taxes were administered through a network of tax farmers who purchased the right to collect revenue, ensuring efficient and widespread tax gathering. Different types of aides included the grande and petite aides, varying in rates and targeted products, reflecting the complexity of the fiscal system under the Ancien Regime.

Gabelle: Implementation and Regional Variations

The Gabelle was a tax on salt imposed in France, implemented in the 14th century and varying significantly across regions, with some provinces exempt and others subjected to high rates, reflecting economic and political disparities. Its enforcement created smuggling and widespread resentment, influencing social unrest leading to the French Revolution. Unlike the aides, which targeted consumer goods broadly, the Gabelle's regional disparities underscored deep fiscal inequalities entrenched within the ancien regime.

Economic Impact of Aides and Gabelle

Aides and Gabelle were key tax systems in pre-revolutionary France that significantly influenced the country's economy by placing a heavy fiscal burden on consumers and traders. The Aides, levied on goods like wine and tobacco, restricted economic growth by increasing production costs and reducing trade competitiveness, while the Gabelle, a tax on salt, disproportionately affected lower-income populations by inflating essential living expenses. These taxes contributed to widespread economic inequality and social unrest, weakening overall market efficiency and provoking resistance that destabilized the Ancien Regime's financial structure.

Social and Political Reactions

The Aides and Gabelle taxes in pre-revolutionary France triggered widespread social unrest and political dissent due to their perceived inequality and oppressive enforcement. The Gabelle, a salt tax disproportionately burdening rural populations, fueled peasant revolts and intensified resentment toward the monarchy, while the Aides, a customs duty on goods, exacerbated tensions among urban merchants and the bourgeoisie. These fiscal grievances contributed significantly to the eruption of revolutionary movements, highlighting the deep social divisions and the failure of the Ancien Regime to address economic injustices.

Role in Pre-Revolutionary France

The aides were indirect taxes on consumer goods, crucial for funding the monarchy's expenses but deeply unpopular among the Third Estate. The gabelle was a highly resented salt tax, symbolizing royal oppression and economic inequality in pre-Revolutionary France. Both taxes contributed significantly to social unrest and the eventual outbreak of the French Revolution.

Abolition and Legacy of the Taxes

The abolition of aides and gabelle in France marked the end of these oppressive fiscal systems, with the gabelle, a salt tax, being particularly resented and repealed during the French Revolution in 1790. This tax legacy influenced modern tax reforms by highlighting the dangers of unequal taxation and the need for more equitable fiscal policies. The removal of these taxes paved the way for a more centralized and fair taxation system in post-revolutionary France, shaping the country's economic structure.

Aides vs Gabelle: Key Differences and Final Comparison

Aides were indirect taxes imposed on goods like tobacco and alcohol, primarily to fund state expenditures, whereas the Gabelle was a specific salt tax with a fixed monopoly and significant regional disparities across France. The Gabelle was notorious for its heavy burden on lower classes and its role in fomenting social unrest, contrasting with Aides, which were broader consumption taxes affecting various commodities. The final comparison highlights Aides as general consumption levies supporting fiscal needs, while the Gabelle exemplified a single, oppressive tax deeply embedded in pre-Revolutionary France's economic and social fabric.

aides Infographic

libterm.com

libterm.com