Property tax is a crucial source of revenue for local governments, funding essential services such as schools, infrastructure, and public safety. Your property's assessed value directly impacts the amount you owe, making it important to understand the assessment process and applicable exemptions. Explore the rest of this article to learn how property taxes work and strategies to manage your tax burden effectively.

Table of Comparison

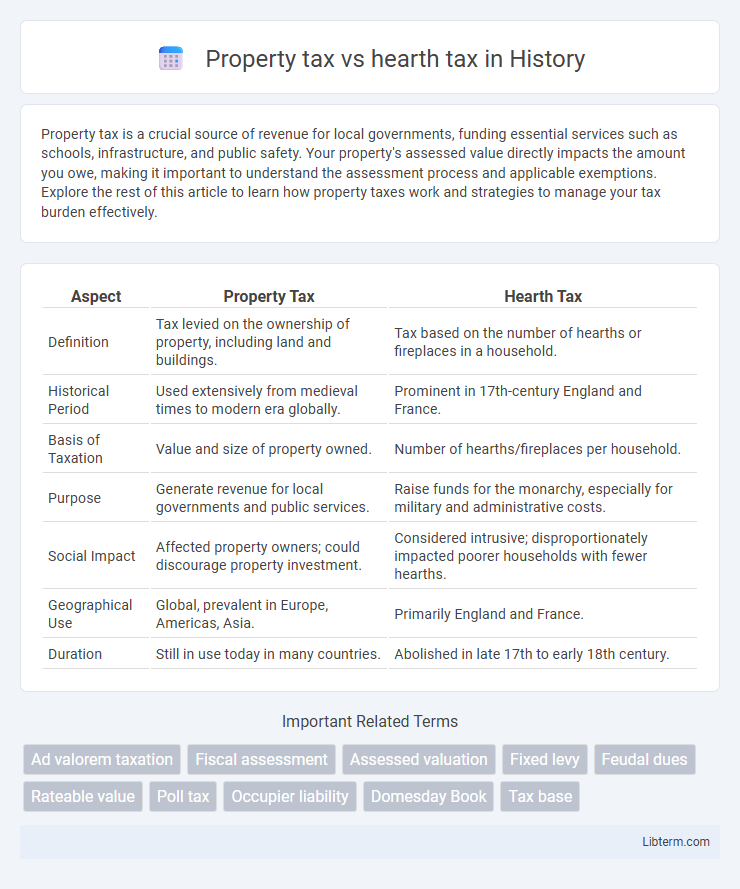

| Aspect | Property Tax | Hearth Tax |

|---|---|---|

| Definition | Tax levied on the ownership of property, including land and buildings. | Tax based on the number of hearths or fireplaces in a household. |

| Historical Period | Used extensively from medieval times to modern era globally. | Prominent in 17th-century England and France. |

| Basis of Taxation | Value and size of property owned. | Number of hearths/fireplaces per household. |

| Purpose | Generate revenue for local governments and public services. | Raise funds for the monarchy, especially for military and administrative costs. |

| Social Impact | Affected property owners; could discourage property investment. | Considered intrusive; disproportionately impacted poorer households with fewer hearths. |

| Geographical Use | Global, prevalent in Europe, Americas, Asia. | Primarily England and France. |

| Duration | Still in use today in many countries. | Abolished in late 17th to early 18th century. |

Understanding Property Tax and Hearth Tax

Property tax is a recurring local tax levied on real estate based on assessed property value, funding essential public services like schools, roads, and emergency services. Hearth tax, historically imposed in England from 1662 to 1689, was a window into household wealth by taxing the number of hearths or fireplaces in a home, reflecting the occupant's economic status. Understanding property tax involves recognizing its role in modern municipal finance, whereas hearth tax provides insight into historical taxation methods tied to domestic assets.

Historical Background of Both Taxes

Property tax originated in ancient civilizations such as Egypt and Rome, where land and property ownership were assessed to generate revenue for public expenditures. Hearth tax emerged in medieval England during the 14th century, specifically under the reign of Edward I, as a levy on households based on the number of hearths or fireplaces, serving as a proxy for wealth and household size. Both taxes reflect early fiscal efforts to capture wealth through tangible assets, with property tax focusing on land value and hearth tax targeting domestic living spaces.

Definition and Scope of Property Tax

Property tax is a government levy imposed on real estate assets based on assessed value, encompassing land and permanent structures used for residential, commercial, or industrial purposes. It funds local services such as schools, infrastructure, and emergency services, making it a primary revenue source for municipalities. In contrast, hearth tax was a historical levy targeting households based on the number of fireplaces or hearths, reflecting wealth rather than the property's value or size.

Definition and Scope of Hearth Tax

Hearth tax was a medieval property tax levied based on the number of hearths or fireplaces in a dwelling, serving as a proxy for household wealth and size. Unlike modern property tax, which assesses the value of land and buildings for fiscal purposes, hearth tax specifically targeted hearth counts to estimate a household's economic status. Its scope was limited to residential properties with hearths, primarily in England during the 17th century, reflecting social and economic conditions of that era.

Key Differences Between Property Tax and Hearth Tax

Property tax is a modern, recurring tax levied on the value of real estate by local governments to fund public services, whereas hearth tax was a historical levy imposed based on the number of hearths or fireplaces in a dwelling. Property tax rates are typically calculated as a percentage of assessed property value, while hearth tax focused on physical household features to estimate wealth. Unlike the indefinite nature of property tax, hearth tax was often temporary and specifically targeted for revenue during certain periods in history.

Economic Impact and Revenue Generation

Property tax provides a stable source of revenue for local governments due to its broad tax base and predictable collection, facilitating funding for public services and infrastructure. Hearth tax, historically levied based on the number of hearths or fireplaces in a dwelling, often imposed a regressive economic burden on lower-income households, limiting its effectiveness and resulting in social resistance. Compared to hearth tax, property tax exhibits greater economic efficiency and equity, supporting sustained revenue generation without disproportionately impacting vulnerable populations.

Social Implications and Public Response

Property tax often generates more consistent public support due to its predictable revenue stream and perceived fairness based on ownership value, while hearth tax historically faced widespread resistance for its invasive property assessments and disproportionate impact on lower-income households. Social implications of hearth tax included increased hardship for poor families who were taxed on the number of hearths in their homes, often seen as a regressive burden, leading to evasion tactics and public unrest. In contrast, property tax systems tend to promote more stable funding for local services but can still provoke debate over equity and affordability in high-value areas.

Calculation Methods for Each Tax

Property tax is calculated based on the assessed value of real estate, typically using a percentage rate determined by local government authorities applied annually to that valuation. Hearth tax was historically calculated by counting the number of hearths or fireplaces in a dwelling, with a fixed amount charged per hearth, reflecting household size and wealth. Property tax assessment involves periodic revaluation to reflect market changes, while hearth tax depended on physical inspection of properties to enumerate taxable hearths.

Evolution and Abolition of Hearth Tax

The Hearth Tax, introduced in 1662 in England, evolved as a property tax based on the number of hearths or fireplaces in a dwelling, symbolizing a direct approach to taxing domestic wealth. Over time, widespread evasion and administrative difficulties led to its decline, with the tax being formally abolished in 1689. The evolution of property tax shifted towards more generalized and less intrusive forms of taxation, laying the foundation for modern property tax systems that assess real estate value rather than specific household features.

Modern Relevance and Legacy of These Taxes

Property tax remains a crucial revenue source for local governments, funding essential public services like education, infrastructure, and emergency response, reflecting its ongoing modern relevance. Hearth tax, abolished centuries ago, offers historical insight into early taxation systems based on household assets, influencing contemporary tax policies and property valuation methods. The legacy of hearth tax underscores the evolution of property taxation from simple assessments to complex fiscal structures used today for equitable resource allocation.

Property tax Infographic

libterm.com

libterm.com