Tallage was a medieval form of taxation imposed by a lord on his serfs or tenants, often arbitrarily set and lacking fixed rates. This levy played a crucial role in feudal economies, impacting local communities and the distribution of wealth. Explore the article to understand how tallage influenced historical taxation systems and its legacy in modern fiscal policies.

Table of Comparison

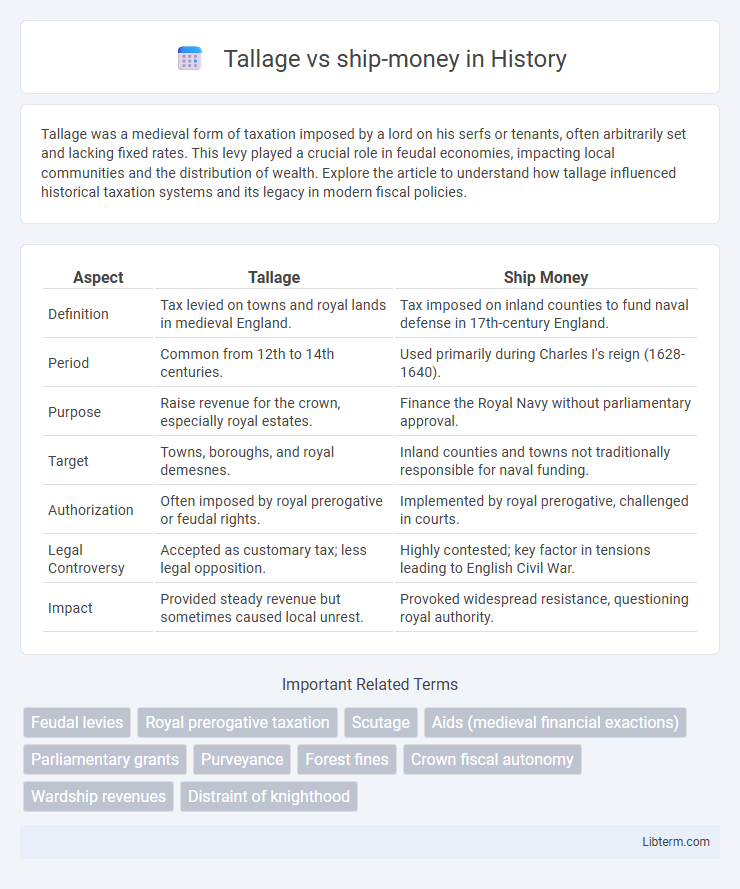

| Aspect | Tallage | Ship Money |

|---|---|---|

| Definition | Tax levied on towns and royal lands in medieval England. | Tax imposed on inland counties to fund naval defense in 17th-century England. |

| Period | Common from 12th to 14th centuries. | Used primarily during Charles I's reign (1628-1640). |

| Purpose | Raise revenue for the crown, especially royal estates. | Finance the Royal Navy without parliamentary approval. |

| Target | Towns, boroughs, and royal demesnes. | Inland counties and towns not traditionally responsible for naval funding. |

| Authorization | Often imposed by royal prerogative or feudal rights. | Implemented by royal prerogative, challenged in courts. |

| Legal Controversy | Accepted as customary tax; less legal opposition. | Highly contested; key factor in tensions leading to English Civil War. |

| Impact | Provided steady revenue but sometimes caused local unrest. | Provoked widespread resistance, questioning royal authority. |

Introduction to Tallage and Ship-Money

Tallage was a medieval English tax imposed primarily on towns and royal demesne lands, used by monarchs to raise revenue without parliamentary consent. Ship-money originated in the 17th century as a levy on coastal counties to fund naval defense, later controversially extended inland by Charles I, sparking legal disputes over royal taxation authority. Both tallage and ship-money exemplify prerogative taxes that challenged the limits of monarchical power in English history.

Historical Context of Medieval English Taxation

Tallage was a form of medieval English taxation primarily imposed on towns and royal demesne lands, reflecting the king's feudal prerogative to levy funds without Parliamentary consent. Ship money emerged later in the 17th century as a non-parliamentary tax traditionally levied on coastal counties to fund naval defense, controversially extended inland by Charles I, sparking constitutional disputes. Both taxes highlight the tension between royal authority and the evolving demand for Parliamentary approval in English fiscal policies.

Definition and Origins of Tallage

Tallage was a medieval English tax imposed by the king on towns, villages, and royal lands, often arbitrarily assessed without parliamentary consent, originating from the feudal system's need to fund royal expenses. Ship-money, emerging in the 17th century, was a levy historically demanded from coastal ports to finance naval defense but controversially extended inland by Charles I without parliamentary approval. The dispute between tallage and ship-money highlights the evolution of royal taxation authority and the conflict over lawful taxation powers in pre-Civil War England.

Definition and Origins of Ship-Money

Ship-money was a medieval English tax levied by the crown on coastal towns to fund naval defense, originally imposed during times of war or emergency. Unlike tallage, which was a general tax imposed by the king on towns and royal lands, ship-money specifically targeted maritime counties for the purpose of maintaining naval readiness. Its origins trace back to the 13th century but became notably controversial during King Charles I's reign in the 17th century when it was extended to inland counties without parliamentary consent.

Key Differences Between Tallage and Ship-Money

Tallage was a medieval land tax imposed on towns and royal demesnes, primarily affecting the peasantry and urban merchants, whereas Ship-Money was a levy originally meant to fund naval defense, charged on coastal counties but controversially extended inland during the 17th century. Unlike Tallage, which was a fixed and recurring tax demanded by the Crown, Ship-Money became notable for its arbitrary assessment and collection without parliamentary consent, sparking significant legal opposition, including John Hampden's famous refusal. The fundamental difference lies in Tallage's basis as a territorial and administrative tax versus Ship-Money's origin as a specific naval levy misapplied to raise general revenue.

Legal Basis and Authority for Each Tax

Tallage was a medieval feudal tax imposed by the king or lord on towns and royal demesne lands, grounded in customary law and royal prerogative, often lacking statutory authorization but justified through feudal rights. Ship-money originated as a levy on coastal towns for naval defense, derived from ancient maritime obligations codified over time, later extended by royal decree without parliamentary consent during Charles I's reign, sparking significant legal controversy. The core legal distinction lies in tallage's feudal customary basis versus ship-money's asserted crown prerogative expanding into direct taxation without parliamentary approval.

Impact on Different Social Classes

Tallage primarily burdened urban merchants and peasants by targeting movable property and commercial goods, deepening economic hardship among the middle and lower classes. Ship-money's extension to inland counties expanded fiscal demands to the gentry and rural landowners, provoking widespread resistance and political unrest. The diverging impacts of these levies intensified class tensions, undermining the traditional social order in 17th-century England.

Notable Controversies and Resistance

Tallage and ship-money incited significant controversies due to their imposition without Parliamentary consent, challenging constitutional norms in 14th and 17th century England. Tallage, a tax levied mainly on towns and boroughs by the monarchy, sparked widespread resistance from merchants and urban communities who viewed it as an arbitrary royal demand. Ship-money, extended under King Charles I to coastal and inland counties, provoked legal challenges led by figures like John Hampden, who argued it violated traditional taxation rights, fueling broader opposition that culminated in the English Civil War.

Legacy and Long-term Effects on English Tax Policy

The Tallage vs Ship-Money conflict fundamentally shaped English taxation by challenging royal prerogative and promoting parliamentary consent for levies, setting a precedent for the principle of no taxation without representation. This dispute influenced the development of constitutional law and contributed to the emergence of statutory taxation, diminishing the monarchy's unilateral tax authority. Its legacy persists in modern English tax policy, where parliamentary approval remains essential for legitimate taxation.

Conclusion: Tallage vs Ship-Money in English History

Tallage and ship-money both served as royal taxes in medieval and early modern England but differed significantly in application and historical impact. Tallage was a feudal levy primarily on towns and royal domains, while ship-money was a controversial prerogative tax imposed on coastal counties without parliamentary consent. The resistance to ship-money, notably in the 1630s, marked a crucial shift contributing to the conflict between Charles I and Parliament, setting the stage for the English Civil War, unlike tallage which declined earlier with the rise of parliamentary taxation.

Tallage Infographic

libterm.com

libterm.com