Capitation is a payment model where healthcare providers receive a fixed amount per patient for a specified period, regardless of how many services each patient uses. This approach encourages cost control and preventive care by shifting financial risk from payers to providers. Explore the rest of the article to understand how capitation can impact your healthcare decisions and provider relationships.

Table of Comparison

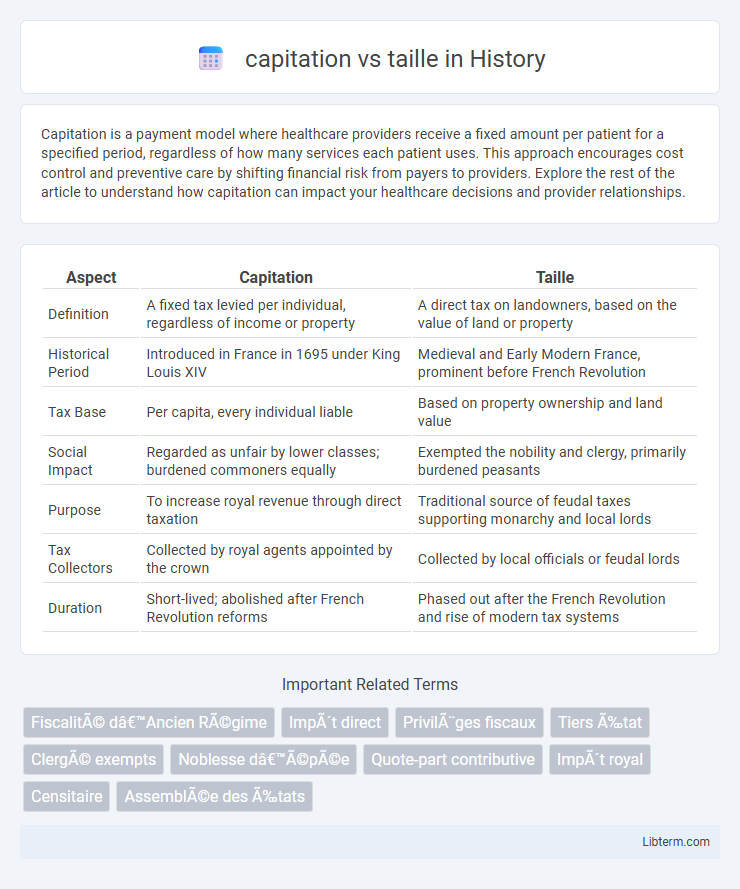

| Aspect | Capitation | Taille |

|---|---|---|

| Definition | A fixed tax levied per individual, regardless of income or property | A direct tax on landowners, based on the value of land or property |

| Historical Period | Introduced in France in 1695 under King Louis XIV | Medieval and Early Modern France, prominent before French Revolution |

| Tax Base | Per capita, every individual liable | Based on property ownership and land value |

| Social Impact | Regarded as unfair by lower classes; burdened commoners equally | Exempted the nobility and clergy, primarily burdened peasants |

| Purpose | To increase royal revenue through direct taxation | Traditional source of feudal taxes supporting monarchy and local lords |

| Tax Collectors | Collected by royal agents appointed by the crown | Collected by local officials or feudal lords |

| Duration | Short-lived; abolished after French Revolution reforms | Phased out after the French Revolution and rise of modern tax systems |

Understanding Capitation and Taille: Key Definitions

Capitation is a fixed payment model in healthcare where providers receive a set amount per patient regardless of services rendered, promoting cost control and preventive care. Taille refers to a historical French tax on personal income or property, representing a direct financial obligation to the state. Understanding these terms highlights the contrast between a modern healthcare payment system and an archaic fiscal levy, emphasizing capitation's role in managing healthcare costs and taille's significance in taxation history.

Historical Context: Capitation and Taille in France

Capitation and taille were two distinct forms of taxation in pre-revolutionary France, reflecting social and economic hierarchies during the Ancien Regime. Capitation, introduced in 1695 by Louis XIV, was a poll tax levied on individuals regardless of wealth, while taille was a land tax primarily imposed on the peasantry and non-noble classes. The unequal burden of these taxes fueled widespread resentment and contributed to the financial crises that precipitated the French Revolution.

Origins: How Capitation and Taille Emerged

Capitation originated in medieval England as a fixed tax levied per individual to fund local governance and military campaigns, reflecting the feudal system's need for straightforward revenue collection. The taille emerged in 14th-century France as a direct land tax imposed primarily on the peasantry to support royal expenses, notably during periods of war and centralization of power under the monarchy. Both systems illustrate early attempts by European states to establish consistent fiscal mechanisms based on population and land ownership.

Structure and Administration of Capitation

Capitation is a payment model where providers receive a fixed amount per patient regardless of services rendered, emphasizing pre-allocated budgeting and risk management. Its structure requires rigorous patient enrollment and stratification to ensure equitable fund distribution and optimize resource allocation. Administration of capitation involves continuous data monitoring, provider accountability, and adjustments based on population health metrics to control costs and maintain care quality.

Mechanisms and Features of Taille

Taille was a direct tax imposed on French non-noble households during the Ancien Regime, primarily assessed based on land ownership and social status, making it a significant source of royal revenue. Its mechanisms included fixed annual payments calculated through cadastral surveys, with exemptions for clergy and nobility, emphasizing its role in reinforcing social hierarchies. Unlike capitation, which taxed individuals per capita, taille focused on property and wealth, reflecting economic capacity over mere population count.

Eligibility and Exemptions: Who Paid Capitation vs Taille

Capitation taxes were levied primarily on individuals holding certain offices or professional statuses, requiring those eligible, such as clergy and nobles, to pay a fixed sum, while many commoners were exempt. In contrast, the taille targeted the peasantry and non-noble classes, specifically taxing landholders and inhabitants who did not possess noble exemptions. Exemptions in taille were significant for the upper estates, whereas capitation aimed at particular social categories, reflecting the distinct fiscal roles of these levies in pre-revolutionary France.

Social and Economic Impacts of Both Taxes

Capitation taxes impose a fixed amount per individual, often disproportionately affecting lower-income populations and potentially reducing disposable income, leading to decreased consumer spending and increased poverty rates. Taille, typically based on land ownership or income, can create economic distortions by discouraging investment and productivity among wealthier landowners, yet it generates significant revenue for public services which can be used for social welfare programs. Both taxes influence income distribution and economic behavior, where capitation tends to be regressive and taille more progressive, shaping social equality and economic growth in different ways.

Capitation vs Taille: Key Differences and Similarities

Capitation and taille are both forms of taxation historically used to raise revenue, with capitation being a fixed tax levied per individual regardless of income, while taille varied based on land ownership or wealth. Capitation ensured a uniform tax burden across a population, often applied to heads of households, whereas the taille was a direct tax on real property primarily imposed on the peasantry in pre-revolutionary France. Both systems reflect early fiscal structures but differ fundamentally in assessment criteria and social impact, shaping economic obligations and class tensions in their respective contexts.

Criticisms and Controversies Surrounding Both Taxes

Capitation taxes often face criticism for being regressive, disproportionately impacting lower-income populations by imposing a flat fee regardless of ability to pay. Taille, a historical French land tax, sparked controversy due to its exemption of the nobility and clergy, creating significant social inequality and fueling resentment among commoners. Both taxes highlight challenges in achieving equitable taxation, with debates centered on fairness, economic burden distribution, and social justice implications.

Legacy and Abolition: Enduring Effects on Tax Systems

Capitation, a fixed per-person tax, and taille, a land-based tax in pre-revolutionary France, both shaped fiscal legacies by influencing modern tax equity debates. The abolition of capitation and the taille during the French Revolution paved the way for more progressive income and property taxes, emphasizing fairness and reducing aristocratic privileges entrenched in ancien regime tax systems. Their enduring effects persist in contemporary tax structures by highlighting the shift from arbitrary levies to systematic, codified taxation reflective of socio-economic status.

capitation Infographic

libterm.com

libterm.com