Rent prices fluctuate based on location, market demand, and property features, impacting your housing budget significantly. Understanding rental agreements and tenant rights ensures you secure a fair and legally sound contract. Explore the rest of the article to navigate the rental market confidently and make informed decisions.

Table of Comparison

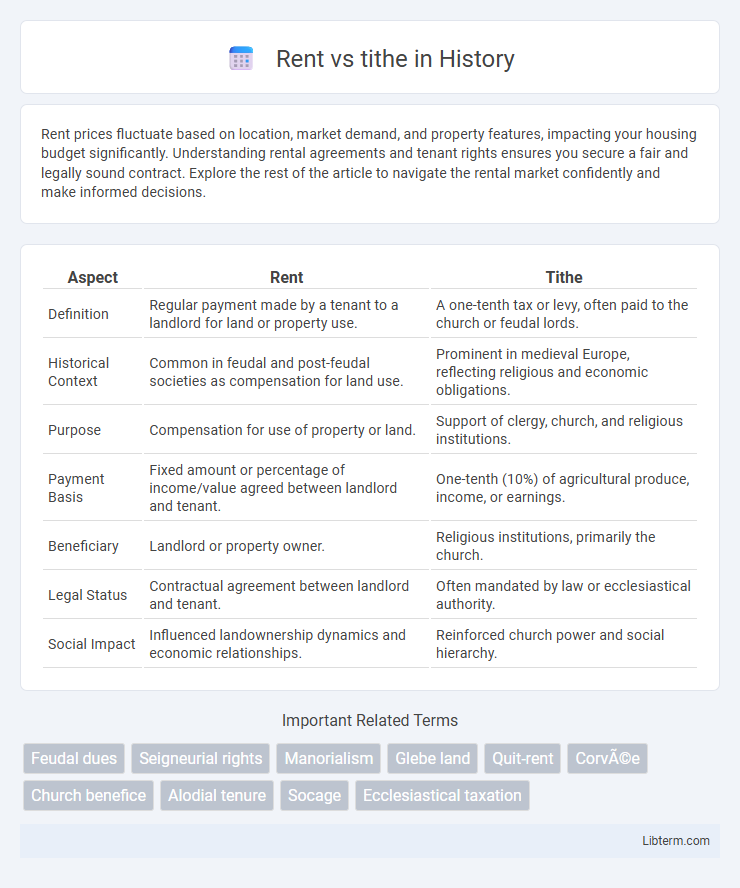

| Aspect | Rent | Tithe |

|---|---|---|

| Definition | Regular payment made by a tenant to a landlord for land or property use. | A one-tenth tax or levy, often paid to the church or feudal lords. |

| Historical Context | Common in feudal and post-feudal societies as compensation for land use. | Prominent in medieval Europe, reflecting religious and economic obligations. |

| Purpose | Compensation for use of property or land. | Support of clergy, church, and religious institutions. |

| Payment Basis | Fixed amount or percentage of income/value agreed between landlord and tenant. | One-tenth (10%) of agricultural produce, income, or earnings. |

| Beneficiary | Landlord or property owner. | Religious institutions, primarily the church. |

| Legal Status | Contractual agreement between landlord and tenant. | Often mandated by law or ecclesiastical authority. |

| Social Impact | Influenced landownership dynamics and economic relationships. | Reinforced church power and social hierarchy. |

Understanding the Concepts: Rent vs Tithe

Rent refers to a payment made by a tenant to a landlord for the use of property or land, typically agreed upon in a lease contract. Tithe is a historical or religious contribution, usually amounting to one-tenth of an individual's income or agricultural produce, given to support religious institutions or clergy. Understanding the difference between rent and tithe is essential, as rent is a secular transaction based on property use, while tithe represents a charitable or religious obligation tied to income or yield.

Historical Context of Rent and Tithing

Rent and tithing have distinct historical contexts rooted in different societal structures: rent originated as a payment for the use of land or property, evolving from feudal systems where tenants paid lords for agricultural or residential use, while tithing emerged as a religious obligation requiring individuals to give a tenth of their income or produce to support clergy and religious institutions. Rent reflects economic transactions within secular or legal frameworks, particularly prominent in medieval Europe's manorial system, whereas tithing is embedded in religious traditions, especially within Christian and Jewish communities, formalizing spiritual obedience and community support. These practices shaped social hierarchies and resource distribution, influencing economic and religious landscapes from ancient times through the early modern period.

Financial Implications: Rent Compared to Tithe

Rent payments typically represent a fixed expense based on property value or market rates, often amounting to a predictable monthly outflow impacting personal or business cash flow. Tithes, commonly calculated as a percentage (usually 10%) of income, vary with earnings and function as a variable financial obligation tied to religious or community support. While rent diminishes disposable income with no direct return, tithes often provide intangible benefits through community engagement and spiritual fulfillment, influencing financial decisions differently.

Legal Perspectives on Paying Rent and Tithes

Legal perspectives on paying rent and tithes differ significantly, with rent governed primarily by property and contract law, ensuring tenants' and landlords' rights in leasing agreements. Tithes, historically rooted in religious obligations, have limited or no enforceability in modern secular legal systems, often classified as voluntary donations rather than mandated payments. Courts typically enforce rent payments under civil law, while tithes remain outside statutory obligations, reflecting distinct legal frameworks for each.

Religious Significance of Tithing

Tithing holds profound religious significance as a sacred practice in many faith traditions, symbolizing obedience, gratitude, and trust in divine provision. Unlike rent, which is a secular financial obligation for the use of property, tithing represents a voluntary giving of a portion of one's income, often one-tenth, to support religious institutions and community welfare. This act reinforces spiritual discipline and cultivates a mindset of stewardship and generosity aligned with religious teachings.

Socioeconomic Impact of Rent Payments

Rent payments often represent a significant portion of household expenses, reducing disposable income and limiting savings potential, which exacerbates economic inequality. In contrast, tithes are typically a fixed percentage of income directed towards religious or community support, with different socioeconomic implications primarily influencing social cohesion rather than direct economic burden. High rent costs contribute to housing insecurity and limit upward mobility, while tithes generally foster community investment without directly impacting essential living costs.

Comparing Long-Term Benefits: Rent vs Tithe

Rent provides predictable, fixed housing costs that can simplify personal budgeting over time, while tithing promotes consistent charitable giving, fostering community support and spiritual growth. Long-term benefits of rent include property stability without ownership burdens, whereas tithing's advantages lie in building generosity habits and enhancing social networks. Evaluating both, rent secures residence needs while tithing cultivates long-lasting moral and communal value.

Modern Trends in Housing and Tithing

Modern trends in housing reveal a significant shift towards renting, driven by urbanization, affordability challenges, and changing lifestyle preferences among millennials and Gen Z. Concurrently, tithing practices have evolved with digital payment platforms facilitating easier, more consistent donations despite varying religious adherence. This intersection highlights how technology shapes financial commitments in both housing and religious giving, reflecting broader socioeconomic transformations.

Ethical Considerations in Rent and Tithing Practices

Rent practices often raise ethical concerns regarding affordability, tenant rights, and fair market value, impacting social equity and community stability. Ethical tithing emphasizes voluntary giving aligned with personal beliefs and communal support, fostering trust and spiritual integrity without coercion. Balancing rent ethics with responsible tithing encourages financial justice and social responsibility within economic and religious frameworks.

Navigating Personal Choices: Rent or Tithe

Choosing between paying rent and tithing involves balancing financial responsibility with spiritual or ethical commitments. Rent ensures stable housing security, an essential financial priority, while tithing supports religious organizations and community welfare, fostering personal values and generosity. Evaluating monthly income, essential expenses, and individual beliefs helps navigate this decision, promoting financial health and moral fulfillment.

Rent Infographic

libterm.com

libterm.com