Community property laws determine how assets and debts acquired during marriage are divided between spouses, ensuring equitable ownership. These rules vary by state, affecting property rights in cases of divorce, death, or separation. Explore the full article to understand how community property impacts Your financial security and legal responsibilities.

Table of Comparison

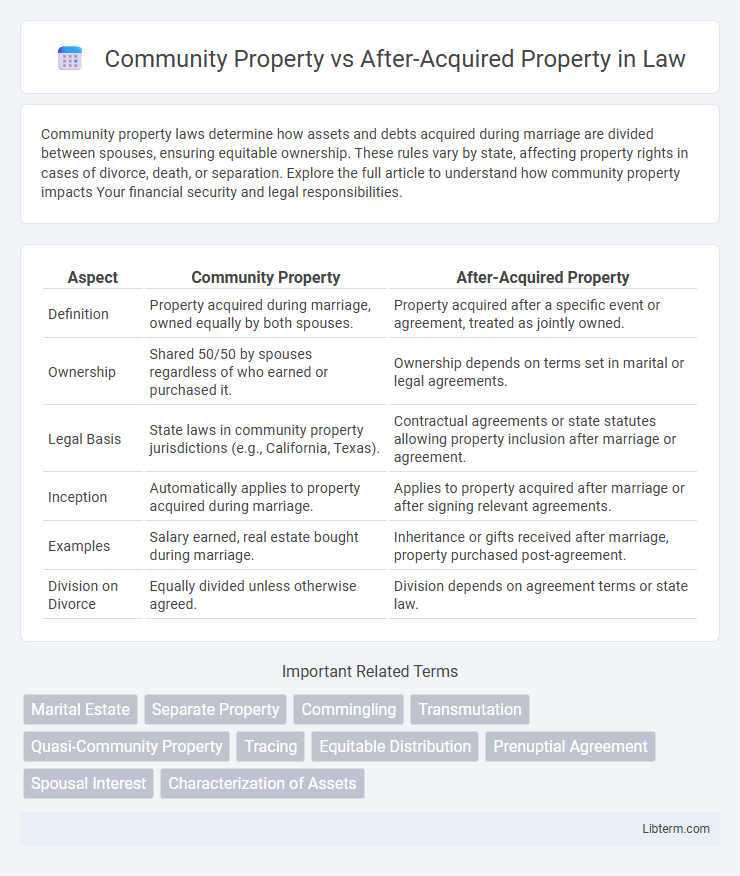

| Aspect | Community Property | After-Acquired Property |

|---|---|---|

| Definition | Property acquired during marriage, owned equally by both spouses. | Property acquired after a specific event or agreement, treated as jointly owned. |

| Ownership | Shared 50/50 by spouses regardless of who earned or purchased it. | Ownership depends on terms set in marital or legal agreements. |

| Legal Basis | State laws in community property jurisdictions (e.g., California, Texas). | Contractual agreements or state statutes allowing property inclusion after marriage or agreement. |

| Inception | Automatically applies to property acquired during marriage. | Applies to property acquired after marriage or after signing relevant agreements. |

| Examples | Salary earned, real estate bought during marriage. | Inheritance or gifts received after marriage, property purchased post-agreement. |

| Division on Divorce | Equally divided unless otherwise agreed. | Division depends on agreement terms or state law. |

Understanding Community Property

Community property refers to assets and debts acquired during a marriage, considered jointly owned by both spouses regardless of whose name is on the title. Understanding community property is essential for equitable division during divorce or death, as it ensures both parties have equal rights to property accumulated throughout the marriage. This concept contrasts with after-acquired property, which pertains to assets obtained after a specific event, such as separation or divorce.

Defining After-Acquired Property

After-acquired property refers to assets obtained by either spouse during the marriage that were not owned before the marriage began. This type of property is typically classified as community property under community property law, meaning both spouses have equal ownership rights. Understanding the legal distinction between community property and after-acquired property is critical for asset division in divorce proceedings or estate planning.

Legal Framework for Property Classification

Community property encompasses assets acquired during a marriage, governed by state statutes such as California Family Code Sections 760-761, which presume equal ownership between spouses. After-acquired property refers to assets obtained post-separation or divorce, typically subject to equitable distribution rules outlined in jurisdiction-specific family law codes. Legal frameworks distinguish classification criteria based on acquisition timing, source of funds, and intent, ensuring precise delineation of property rights in divorce proceedings.

Key Differences Between Community and After-Acquired Property

Community property consists of assets and debts acquired during marriage, jointly owned by both spouses regardless of who earned or purchased them. After-acquired property refers to assets obtained after certain legal actions such as separation or divorce, potentially remaining separate depending on jurisdiction and timing. The key difference lies in the timing of acquisition and the legal status of ownership, where community property is automatically shared, while after-acquired property may be excluded from division based on specific legal provisions.

Impact on Marriage and Divorce Settlements

Community property includes assets and debts acquired during the marriage, typically shared equally between spouses, directly influencing divorce settlements by requiring an equitable division. After-acquired property refers to assets obtained after legal separation or divorce filing, often treated as separate property and excluded from marital division. Understanding these distinctions is crucial for managing financial expectations and legal rights during marriage dissolution proceedings.

Inheritance Implications

Community property includes assets acquired during marriage, equally owned by both spouses, affecting inheritance by typically passing to the surviving spouse unless specified otherwise. After-acquired property refers to assets obtained after separation or divorce, which generally do not form part of community property and thus may be inherited solely by the acquiring spouse or heirs. Understanding these distinctions is crucial in estate planning to ensure proper distribution of assets under state-specific community property laws.

State Laws Governing Property Types

State laws vary significantly in defining community property and after-acquired property, impacting spouses' ownership rights during marriage. Community property states, such as California and Texas, generally consider assets obtained during marriage as jointly owned, while after-acquired property rules determine how assets acquired after marriage or separation are classified. Understanding the specific statutes in states like Washington, Arizona, and Louisiana is crucial for accurately delineating ownership and division of property upon divorce or death.

Protecting Your Assets: Tips and Strategies

To protect your assets effectively, it is crucial to understand the distinction between community property and after-acquired property, as community property typically includes assets obtained during marriage, while after-acquired property refers to items acquired after separation or divorce. Implementing asset protection strategies such as prenuptial agreements, clear documentation of income sources, and separating accounts can safeguard property rights and prevent disputes. Consulting with a family law attorney knowledgeable in state-specific community property laws ensures that your assets are accurately classified and adequately protected.

Common Misconceptions Explained

Community property typically includes assets acquired during marriage, while after-acquired property refers to assets obtained after separation or divorce. A common misconception is that all property acquired after marriage automatically becomes community property, but this excludes items like gifts or inheritances that remain separate. Understanding the distinction clarifies how courts treat assets during division, emphasizing the timing and source of acquisition.

Frequently Asked Questions About Property Ownership

Community property includes assets and debts acquired during marriage, while after-acquired property refers to assets obtained after separation or divorce. Common questions involve how each type of property is divided upon dissolution, the impact of state laws, and whether after-acquired property can remain separate. Understanding differences in community property states versus non-community property states is crucial for accurate property ownership and division.

Community Property Infographic

libterm.com

libterm.com