Claim Handling Expense refers to the costs incurred by insurance companies in processing and managing claims, including investigation, adjustment, legal fees, and administrative expenses. Efficient management of these expenses is crucial to maintaining profitability and customer satisfaction in the insurance sector. Explore the full article to understand how controlling claim handling expenses can benefit your insurance experience.

Table of Comparison

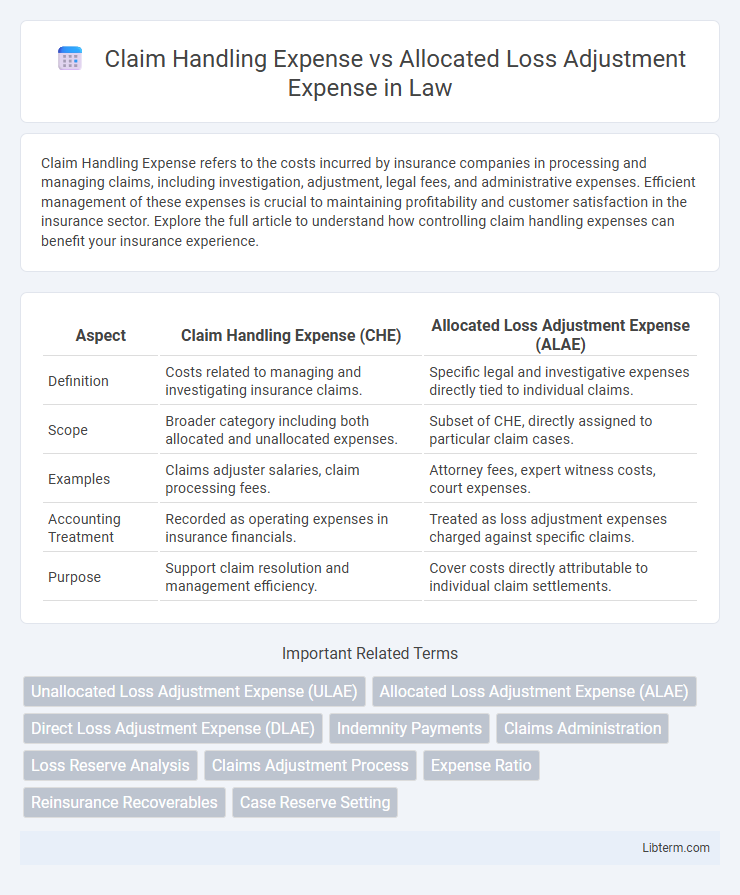

| Aspect | Claim Handling Expense (CHE) | Allocated Loss Adjustment Expense (ALAE) |

|---|---|---|

| Definition | Costs related to managing and investigating insurance claims. | Specific legal and investigative expenses directly tied to individual claims. |

| Scope | Broader category including both allocated and unallocated expenses. | Subset of CHE, directly assigned to particular claim cases. |

| Examples | Claims adjuster salaries, claim processing fees. | Attorney fees, expert witness costs, court expenses. |

| Accounting Treatment | Recorded as operating expenses in insurance financials. | Treated as loss adjustment expenses charged against specific claims. |

| Purpose | Support claim resolution and management efficiency. | Cover costs directly attributable to individual claim settlements. |

Introduction to Claim Handling Expense

Claim Handling Expense (CHE) encompasses all costs directly associated with managing and settling insurance claims, including adjuster fees, investigation costs, and administrative expenses. Allocated Loss Adjustment Expense (ALAE) is a subset of CHE, specifically identified and charged to individual claims for legal and investigative services. CHE is critical for insurers to accurately estimate total claim costs and maintain appropriate reserves.

Understanding Allocated Loss Adjustment Expense (ALAE)

Allocated Loss Adjustment Expense (ALAE) refers to the specific costs directly associated with the investigation and defense of individual insurance claims, such as legal fees and expert witness expenses. Unlike general claim handling expenses that cover broader administrative costs, ALAE is precisely attributed to each claim, enabling more accurate financial tracking and reserve setting by insurers. Proper understanding of ALAE is crucial for insurers to manage claim settlements efficiently and optimize loss adjustment processes.

Key Differences Between CHE and ALAE

Claim Handling Expense (CHE) primarily covers costs related to the administrative functions involved in managing claims, including personnel salaries and office expenses. Allocated Loss Adjustment Expense (ALAE) refers specifically to expenses directly tied to the investigation, defense, and settlement of individual claims, such as legal fees and expert witness costs. The key difference lies in CHE encompassing general administrative costs while ALAE targets claim-specific legal and adjustment costs.

Components of Claim Handling Expenses

Claim Handling Expenses encompass the total costs incurred during the processing and settlement of insurance claims, which include Allocated Loss Adjustment Expenses (ALAE) and Unallocated Loss Adjustment Expenses (ULAE). ALAE represent specific costs directly attributable to individual claims, such as legal fees, expert witness charges, and investigation expenses. ULAE consist of overhead costs not tied to any single claim but necessary for the overall claims administration, including salaries of claims adjusters and office expenses.

Components of Allocated Loss Adjustment Expenses

Allocated Loss Adjustment Expense (ALAE) includes costs directly associated with investigating, adjusting, and defending specific claims, such as attorney fees, expert witness fees, and court costs. Claim Handling Expense generally encompasses a broader range of expenses related to the overall claims process, but ALAE specifically targets allocated costs that can be identified with individual claims. Understanding the distinction and components of ALAE is crucial for accurate claims reserving and expense management in insurance companies.

Impact on Insurance Profitability

Claim Handling Expense (CHE) and Allocated Loss Adjustment Expense (ALAE) directly affect insurance profitability by influencing the cost structure related to settling claims. Efficient management of CHE, encompassing both direct and overhead costs, can reduce total claims expenses, thereby improving underwriting margins. Precise allocation and control of ALAE, which includes legal fees and expert witness costs, help insurers maintain accurate loss reserves and enhance overall financial performance.

Accounting Treatment of CHE and ALAE

Claim Handling Expense (CHE) and Allocated Loss Adjustment Expense (ALAE) are both recognized as components of loss adjustment expenses but differ in accounting treatment. CHE generally includes overhead and support costs indirectly related to claims and is often expensed as incurred, whereas ALAE relates to expenses directly attributable to specific claims, such as legal fees and investigation costs, and is capitalized and matched against the associated claim liabilities. Proper distinction and classification ensure accurate financial reporting and compliance with insurance accounting standards like GAAP and IFRS.

CHE vs ALAE: Real-World Examples

Claim Handling Expense (CHE) typically includes costs directly related to investigating and settling claims, such as adjusters' salaries and claim office expenses, whereas Allocated Loss Adjustment Expense (ALAE) covers specific expenses directly assignable to individual claims, such as legal fees and expert witness costs. In real-world insurance operations, a complex liability claim might generate high ALAE due to extensive litigation support, while routine auto claims primarily incur CHE with minimal ALAE. Effective differentiation between CHE and ALAE ensures accurate loss reserving and pricing strategies, reflecting the distinct cost drivers experienced in property and casualty insurance portfolios.

Strategies to Optimize Claims Expenses

Effective strategies to optimize claim handling expenses and allocated loss adjustment expenses (ALAE) include implementing advanced data analytics to identify fraudulent claims early and streamline investigation processes. Leveraging automation technologies and standardized workflows reduces manual processing time, improves accuracy, and lowers administrative costs associated with claims management. Establishing clear communication channels and proactive customer engagement mitigates claim inflation and accelerates resolution, directly impacting overall loss adjustment expense efficiency.

Conclusion: Importance in Insurance Operations

Claim Handling Expense (CHE) and Allocated Loss Adjustment Expense (ALAE) are critical components in insurance operations, directly impacting profitability and reserve adequacy. Effective management of CHE, which covers general claim processing costs, alongside precise tracking of ALAE, which includes expenses specifically linked to individual claims such as legal fees, ensures accurate financial reporting and operational efficiency. Prioritizing both expense categories enables insurers to optimize claims settlement processes, control costs, and maintain regulatory compliance, ultimately supporting a sustainable underwriting cycle.

Claim Handling Expense Infographic

libterm.com

libterm.com