The duty of loyalty requires directors and officers to act in the best interests of the corporation, avoiding conflicts of interest and self-dealing. Breaching this duty can lead to legal consequences and damage to your company's reputation. Explore the rest of the article to understand how to uphold loyalty and protect your business.

Table of Comparison

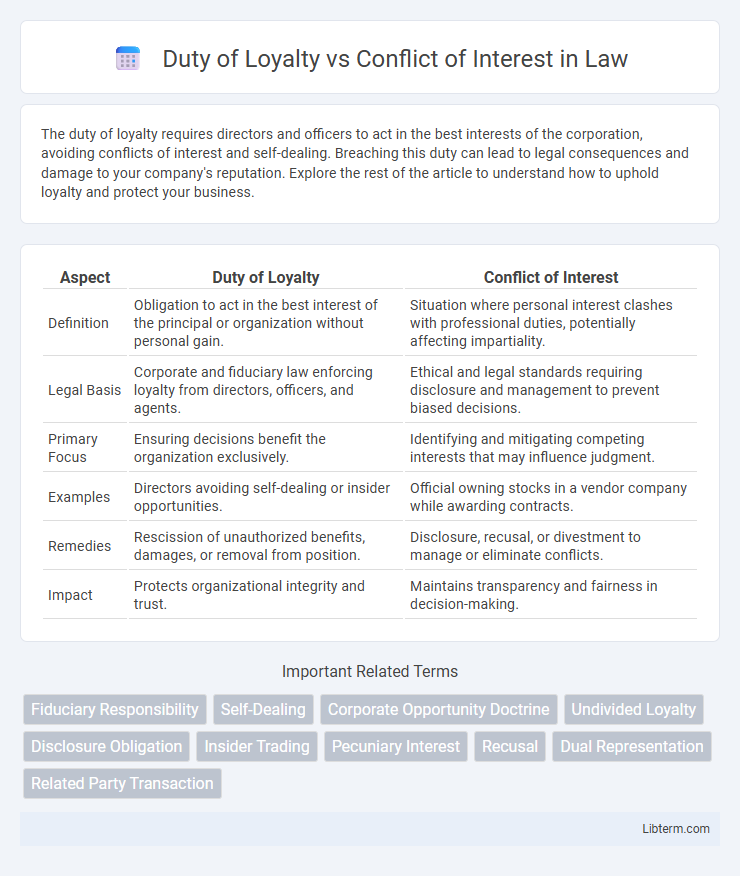

| Aspect | Duty of Loyalty | Conflict of Interest |

|---|---|---|

| Definition | Obligation to act in the best interest of the principal or organization without personal gain. | Situation where personal interest clashes with professional duties, potentially affecting impartiality. |

| Legal Basis | Corporate and fiduciary law enforcing loyalty from directors, officers, and agents. | Ethical and legal standards requiring disclosure and management to prevent biased decisions. |

| Primary Focus | Ensuring decisions benefit the organization exclusively. | Identifying and mitigating competing interests that may influence judgment. |

| Examples | Directors avoiding self-dealing or insider opportunities. | Official owning stocks in a vendor company while awarding contracts. |

| Remedies | Rescission of unauthorized benefits, damages, or removal from position. | Disclosure, recusal, or divestment to manage or eliminate conflicts. |

| Impact | Protects organizational integrity and trust. | Maintains transparency and fairness in decision-making. |

Understanding the Duty of Loyalty

The duty of loyalty requires directors and officers to act in the best interests of the corporation, avoiding personal gain at the company's expense. This fiduciary responsibility ensures decisions prioritize corporate benefits over individual interests, maintaining trust and integrity within management. Understanding and upholding this duty prevent conflicts of interest from compromising corporate governance and stakeholder value.

Defining Conflict of Interest

A conflict of interest arises when an individual's personal interests potentially interfere with their duty of loyalty to an organization or client, compromising impartial decision-making. This situation occurs when the individual's conflicting interests might undermine their ability to act in the best interests of the entity they serve. Clear identification and management of conflicts of interest are essential to uphold fiduciary responsibilities and maintain ethical standards in professional relationships.

Key Differences Between Duty of Loyalty and Conflict of Interest

The duty of loyalty requires directors and officers to act in the best interests of the corporation, avoiding self-dealing and prioritizing corporate benefits over personal gain. Conflict of interest arises when a person's personal interests potentially interfere with their ability to act impartially on behalf of the corporation. Key differences include that duty of loyalty is a fiduciary obligation mandating faithful service, whereas conflict of interest is a situation that may compromise this duty but can sometimes be managed or waived through full disclosure and approval.

Legal Foundations of Duty of Loyalty

The legal foundations of the duty of loyalty are rooted in fiduciary law, requiring directors and officers to act in the best interests of the corporation rather than personal gain. This duty prohibits self-dealing and mandates full disclosure of conflicts of interest to prevent breaches that could harm the corporation. Courts enforce this duty through strict scrutiny of related-party transactions and impose remedies when loyalty obligations are compromised.

Common Examples of Conflicts of Interest

Common examples of conflicts of interest include situations where a corporate director has a financial stake in a competing company, potentially compromising their duty of loyalty to shareholders. Another frequent scenario involves employees using insider information for personal gain, violating their obligation to act in the best interests of their employer. Conflicts also arise when consultants recommend services benefiting their own business interests rather than those of the client.

How Duty of Loyalty Prevents Conflicts

The duty of loyalty requires directors and officers to prioritize the interests of the corporation above personal gains, effectively preventing conflicts of interest by ensuring decisions benefit the company rather than individual parties. By mandating full disclosure and prohibiting self-dealing transactions without proper authorization, the duty of loyalty creates a legal framework that deters actions compromising corporate integrity. This fiduciary obligation serves as a proactive mechanism to identify and address potential conflicts before they harm the organization.

Consequences of Breaching Duty of Loyalty

Breaching the duty of loyalty can result in significant legal consequences, including civil litigation, financial damages, and removal from managerial positions. Conflicts of interest that undermine fiduciary responsibilities may lead to reputational harm and loss of trust among stakeholders. Courts often impose strict remedies such as disgorgement of profits gained through self-dealing and injunctions to prevent further violations.

Recognizing and Disclosing Conflicts of Interest

Recognizing and disclosing conflicts of interest is essential to uphold the duty of loyalty, which requires fiduciaries to act in the best interests of their principals without personal bias or gain. Effective identification involves evaluating relationships, transactions, or personal interests that could compromise impartial decision-making or create divided loyalty. Transparent disclosure ensures that all parties are informed of potential conflicts, enabling corrective measures and maintaining trust in fiduciary responsibilities.

Best Practices for Maintaining Loyalty in Organizations

Maintaining a strong duty of loyalty involves clear policies that require full disclosure of any potential conflicts of interest by employees and board members to prevent divided allegiances. Regular training sessions and transparent reporting mechanisms reinforce commitment, ensuring that organizational decisions prioritize collective goals over personal gain. Implementing an independent oversight committee can effectively monitor compliance and address violations swiftly, safeguarding the integrity of the organization.

Case Studies: Real-World Loyalty and Conflict Scenarios

Case studies reveal that the duty of loyalty requires executives to prioritize their organization's interests over personal gain, as seen in the landmark Disney shareholder derivative litigation where breaches resulted in financial penalties. Conflicts of interest often emerge in scenarios where board members hold competing roles, exemplified by the Enron scandal where divided loyalties contributed to corporate fraud. These real-world examples highlight the critical need for transparent governance policies to enforce loyalty and effectively manage conflicts of interest.

Duty of Loyalty Infographic

libterm.com

libterm.com