Direct action empowers individuals and groups to create immediate social or political change without relying on intermediaries or formal institutions. This approach can take many forms, including protests, strikes, sit-ins, and civil disobedience, aiming to challenge unjust systems directly. Discover how direct action can amplify Your impact and transform movements by reading the full article.

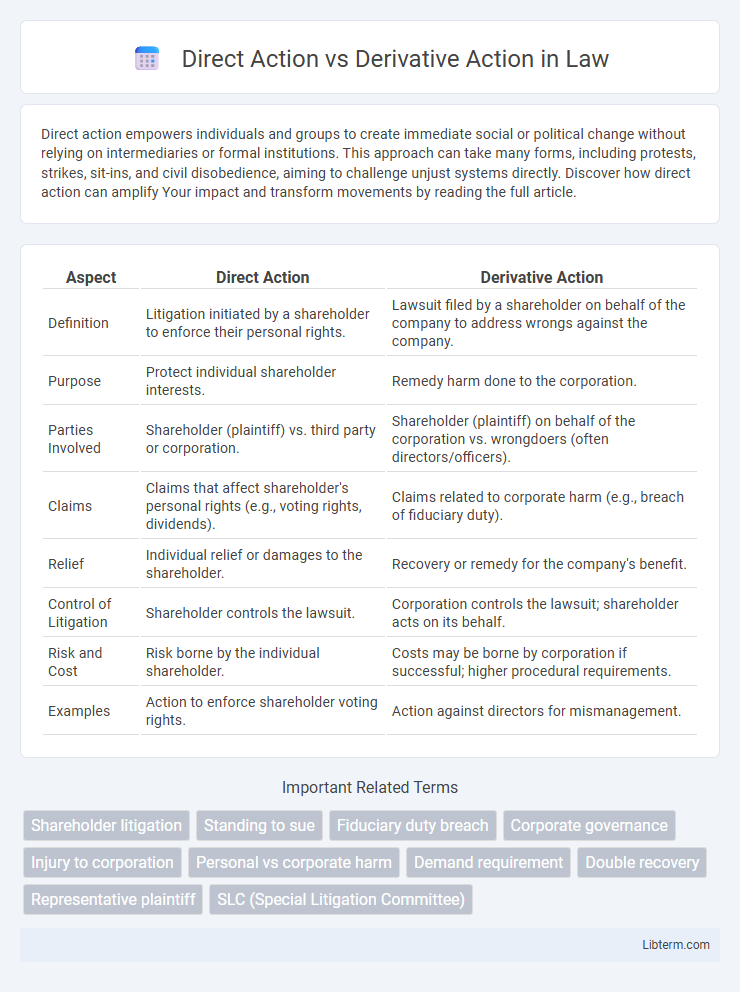

Table of Comparison

| Aspect | Direct Action | Derivative Action |

|---|---|---|

| Definition | Litigation initiated by a shareholder to enforce their personal rights. | Lawsuit filed by a shareholder on behalf of the company to address wrongs against the company. |

| Purpose | Protect individual shareholder interests. | Remedy harm done to the corporation. |

| Parties Involved | Shareholder (plaintiff) vs. third party or corporation. | Shareholder (plaintiff) on behalf of the corporation vs. wrongdoers (often directors/officers). |

| Claims | Claims that affect shareholder's personal rights (e.g., voting rights, dividends). | Claims related to corporate harm (e.g., breach of fiduciary duty). |

| Relief | Individual relief or damages to the shareholder. | Recovery or remedy for the company's benefit. |

| Control of Litigation | Shareholder controls the lawsuit. | Corporation controls the lawsuit; shareholder acts on its behalf. |

| Risk and Cost | Risk borne by the individual shareholder. | Costs may be borne by corporation if successful; higher procedural requirements. |

| Examples | Action to enforce shareholder voting rights. | Action against directors for mismanagement. |

Introduction to Direct and Derivative Actions

Direct actions allow shareholders to sue a corporation for harms directly affecting their individual rights, such as breach of contract or violations of shareholder agreements. Derivative actions enable shareholders to initiate lawsuits on behalf of the corporation against third parties, typically for corporate wrongs like fraud or mismanagement that harm the company as a whole. Understanding the distinction between direct and derivative actions is vital for effectively addressing the nature of the injury and the proper plaintiff in corporate litigation.

Defining Direct Action in Corporate Law

Direct action in corporate law is a legal remedy that allows shareholders to sue a corporation or its officers directly for harm caused to their individual rights or interests. This action contrasts with derivative suits, which are brought on behalf of the corporation by shareholders to address wrongs against the corporation itself. Direct actions typically involve claims such as breach of contract or denial of shareholder voting rights, where the injury is personal to the shareholder rather than to the corporation.

Understanding Derivative Action

Derivative action allows shareholders to initiate a lawsuit on behalf of the corporation against third parties, typically insiders like directors or officers, for harm caused to the company. This legal mechanism is crucial when management fails to address wrongdoing, ensuring accountability and protecting corporate interests. Shareholders must meet procedural requirements, such as making a demand on the board or demonstrating futility, to proceed with a derivative claim.

Key Differences Between Direct and Derivative Actions

Direct actions are lawsuits filed by shareholders to protect their own rights or address personal grievances, while derivative actions are brought on behalf of the corporation to address wrongs done to the company by its directors or officers. In direct actions, the shareholder seeks individual relief, whereas derivative actions require the shareholder to demonstrate that the corporation has been harmed and that the wrongdoers are typically insiders. The burden of proof and procedural requirements differ significantly, with derivative actions often necessitating a demand on the board before filing, which is not required in direct actions.

Legal Standing and Who Can Sue

Direct actions are lawsuits filed by shareholders to address violations of their personal rights, granting individual legal standing to sue for harms directly affecting them. Derivative actions involve shareholders suing on behalf of the corporation when the company's rights are infringed, requiring the plaintiff to demonstrate that the corporation failed to take action. Legal standing in derivative cases hinges on meeting demand requirements and showing ownership of shares at the time of the alleged wrongdoing.

Typical Scenarios for Direct Actions

Typical scenarios for direct actions include shareholders suing a corporation directly for violations of their personal rights, such as breaches of contract, dividend disputes, or infringement of voting rights. These actions arise when the harm affects the plaintiff individually rather than the corporation as a whole. Direct actions commonly occur in situations involving denied shareholder access to information, improper refusal to register shares, or suppression of minority shareholder rights.

Common Cases for Derivative Actions

Derivative actions commonly arise in shareholder disputes involving breach of fiduciary duty, corporate mismanagement, or fraud by executives or board members. These cases enable shareholders to initiate lawsuits on behalf of the corporation when the board fails to act against wrongdoers. Typical examples include claims for self-dealing, misappropriation of corporate assets, or violation of corporate governance standards.

Benefits and Drawbacks of Each Action

Direct actions allow shareholders to sue for personal rights violations, offering greater control and faster resolution but exposing individuals to higher legal costs and risks. Derivative actions enable shareholders to sue on behalf of the corporation for wrongs against the company, providing collective redress and potential recovery for all shareholders yet often involving complex procedures and limited personal benefit. Both actions balance the pursuit of justice with practical considerations of cost, control, and scope of impact.

Judicial Considerations and Outcomes

Judicial considerations in direct action prioritize the individual shareholder's right to enforce a personal claim, focusing on the validity and harm specific to the shareholder, while derivative action requires courts to assess whether the claim benefits the corporation and if the shareholder has met procedural prerequisites like demand futility. Outcomes in direct actions typically result in remedies awarded to the individual plaintiff, whereas derivative actions produce remedies benefiting the corporation, impacting overall corporate governance and shareholder rights. Courts scrutinize standing and causation more stringently in derivative suits to prevent frivolous litigation and ensure corporate interests are protected.

Selecting the Appropriate Legal Remedy

Selecting the appropriate legal remedy between direct action and derivative action depends on who holds the right to sue and the nature of the harm. Direct action is suitable when shareholders seek to enforce their own rights, often involving personal losses or violations affecting them individually. Derivative action is appropriate when shareholders sue on behalf of the corporation to address wrongs done to the company typically due to management misconduct or breaches of fiduciary duty.

Direct Action Infographic

libterm.com

libterm.com