A trustee's sale occurs when a property is sold to satisfy a defaulted loan secured by a deed of trust, typically conducted through a public auction. This process allows lenders to recover the outstanding mortgage balance without going through a judicial foreclosure. Discover how understanding a trustee's sale can help protect your investment and make informed decisions in the real estate market by reading the rest of this article.

Table of Comparison

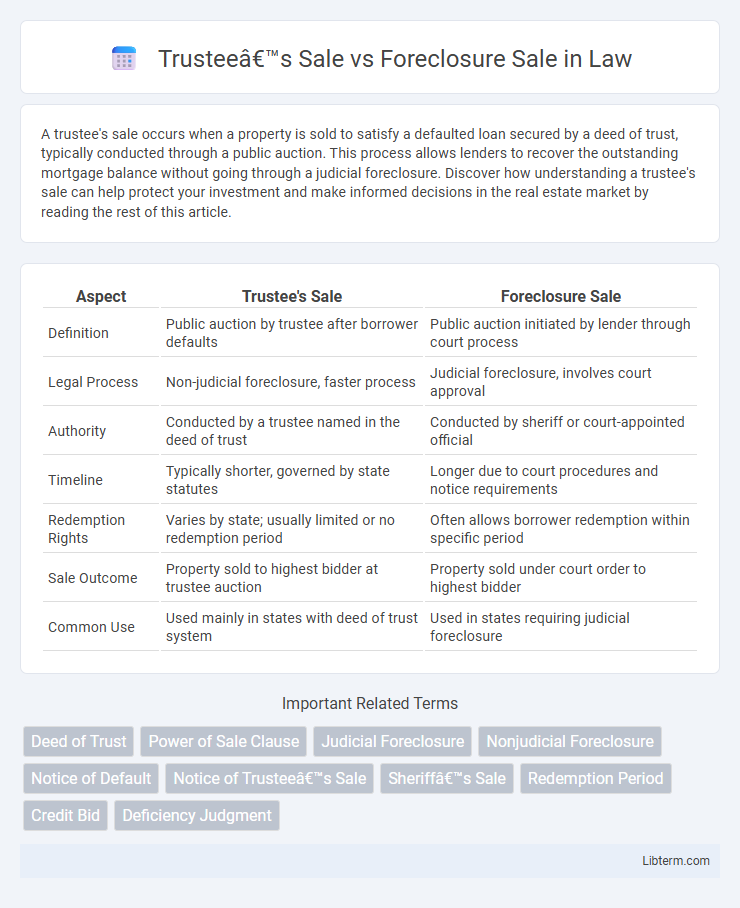

| Aspect | Trustee's Sale | Foreclosure Sale |

|---|---|---|

| Definition | Public auction by trustee after borrower defaults | Public auction initiated by lender through court process |

| Legal Process | Non-judicial foreclosure, faster process | Judicial foreclosure, involves court approval |

| Authority | Conducted by a trustee named in the deed of trust | Conducted by sheriff or court-appointed official |

| Timeline | Typically shorter, governed by state statutes | Longer due to court procedures and notice requirements |

| Redemption Rights | Varies by state; usually limited or no redemption period | Often allows borrower redemption within specific period |

| Sale Outcome | Property sold to highest bidder at trustee auction | Property sold under court order to highest bidder |

| Common Use | Used mainly in states with deed of trust system | Used in states requiring judicial foreclosure |

Understanding Trustee’s Sale: An Overview

A Trustee's Sale is a public auction conducted by a trustee when a borrower defaults on a deed of trust, aiming to recover the loan balance by selling the secured property. It differs from a foreclosure sale, which is typically a court-supervised process, whereas trustee's sales are usually non-judicial, faster, and governed by the terms of the deed of trust and state laws. Understanding the mechanics of a trustee's sale, including notice requirements, bidding procedures, and redemption rights, is critical for both borrowers and investors in real estate transactions.

What Is a Foreclosure Sale?

A foreclosure sale is a public auction where a lender sells a property to recover the outstanding mortgage balance after a homeowner defaults on loan payments. Unlike a trustee's sale, which is conducted by a third-party trustee under a deed of trust, a foreclosure sale typically involves the court overseeing the process in a judicial foreclosure. The outcome of a foreclosure sale transfers ownership to the highest bidder, often resulting in the borrower losing equity and property rights.

Legal Differences Between Trustee’s Sale and Foreclosure Sale

A Trustee's Sale occurs under a deed of trust, where the trustee sells the property after the borrower defaults, bypassing court involvement. A Foreclosure Sale is part of a judicial foreclosure process, requiring a court order to authorize the sale of the property. The key legal difference lies in the non-judicial nature of Trustee's Sales versus the court-supervised procedure of Foreclosure Sales.

The Process of a Trustee’s Sale Explained

A Trustee's Sale is a public auction of a property conducted by a trustee after the borrower defaults on a loan secured by a deed of trust, where the trustee initiates the sale to recover the owed debt without court involvement. The process begins with a Notice of Default, followed by a Notice of Trustee's Sale, which is publicly recorded and published, allowing the borrower time to cure the default. On the sale date, the property is auctioned to the highest bidder, transferring ownership immediately without judicial foreclosure proceedings.

Step-by-Step Guide to Foreclosure Sales

A Trustee's Sale occurs when a property is sold at auction by a trustee after the borrower defaults on a deed of trust, while a Foreclosure Sale is the broader process resulting from a mortgage default. The step-by-step guide to foreclosure sales typically includes default notification, public notice of sale, auction scheduling, and property transfer to the highest bidder. Key steps ensure legal compliance, such as filing a Notice of Default, issuing a Notice of Trustee's Sale, and conducting the auction on the courthouse steps or designated location.

Key Participants: Who’s Involved in Each Sale Type?

A Trustee's Sale primarily involves the borrower, the trustee, and the lender or beneficiary, where the trustee acts as a neutral third party managing the sale process under a deed of trust. In contrast, a Foreclosure Sale includes the borrower, the lender, and the court or trustee handling the judicial foreclosure, which requires court approval before the sale. Key participants in Trustee's Sales operate outside the court system, while Foreclosure Sales depend on judicial oversight and legal procedures.

Timeline Comparison: Trustee’s Sale vs Foreclosure Sale

A Trustee's Sale typically follows a non-judicial foreclosure process, occurring after the borrower defaults and the lender issues a Notice of Default, usually taking about 90 to 180 days before the sale. Foreclosure Sale in judicial states involves a court-supervised process that can extend from several months to over a year, starting with the lender filing a lawsuit and ending with a court-ordered sale. The Trustee's Sale timeline is generally faster due to fewer legal steps, while Foreclosure Sale varies significantly based on court schedules and state laws.

Impact on Homeowners: Rights and Consequences

Trustee's Sale typically allows homeowners a redemption period and more control over the sale process, often preserving some equity and providing opportunities to cure defaults before the sale. Foreclosure Sale usually results in immediate loss of property rights with limited homeowner recourse, leading to significant credit score damage and potential deficiency judgments. Understanding these differences is crucial for homeowners to navigate recovery options and mitigate long-term financial impacts.

Buying Property at Trustee’s Sale vs Foreclosure Sale

Buying property at a Trustee's Sale typically offers a faster and more transparent transaction compared to a Foreclosure Sale, as it occurs directly through the foreclosure trustee after a loan default. Trustee's Sales often allow buyers to purchase properties with cleared liens, reducing post-sale legal complications, while Foreclosure Sales can involve more prolonged court proceedings and potential title issues. Investors seeking discounted properties often prefer Trustee's Sales for the relative certainty and streamlined process in acquiring real estate.

Which Sale Is More Common in Different States?

Trustee's sales are more common in states like California and Washington, where non-judicial foreclosure processes predominate, allowing lenders to sell properties without court involvement. Foreclosure sales occur more frequently in judicial foreclosure states such as Florida and New York, where the sale must be approved by a court after a lawsuit. The prevalence of each sale type depends largely on state laws governing the foreclosure process, impacting the timeline and procedures for lenders and borrowers.

Trustee’s Sale Infographic

libterm.com

libterm.com