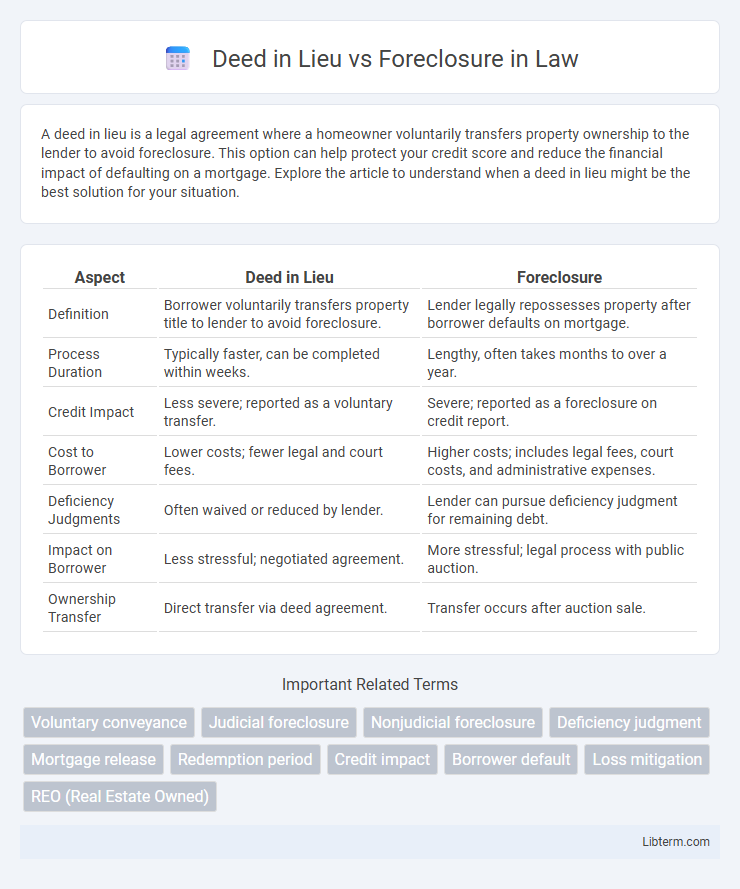

A deed in lieu is a legal agreement where a homeowner voluntarily transfers property ownership to the lender to avoid foreclosure. This option can help protect your credit score and reduce the financial impact of defaulting on a mortgage. Explore the article to understand when a deed in lieu might be the best solution for your situation.

Table of Comparison

| Aspect | Deed in Lieu | Foreclosure |

|---|---|---|

| Definition | Borrower voluntarily transfers property title to lender to avoid foreclosure. | Lender legally repossesses property after borrower defaults on mortgage. |

| Process Duration | Typically faster, can be completed within weeks. | Lengthy, often takes months to over a year. |

| Credit Impact | Less severe; reported as a voluntary transfer. | Severe; reported as a foreclosure on credit report. |

| Cost to Borrower | Lower costs; fewer legal and court fees. | Higher costs; includes legal fees, court costs, and administrative expenses. |

| Deficiency Judgments | Often waived or reduced by lender. | Lender can pursue deficiency judgment for remaining debt. |

| Impact on Borrower | Less stressful; negotiated agreement. | More stressful; legal process with public auction. |

| Ownership Transfer | Direct transfer via deed agreement. | Transfer occurs after auction sale. |

Understanding Deed in Lieu vs Foreclosure

Deed in Lieu of Foreclosure involves a borrower voluntarily transferring property ownership to the lender to avoid foreclosure, often preserving credit score better than foreclosure. Foreclosure is a legal process where the lender seizes and sells the property due to loan default, typically resulting in greater credit damage and longer financial recovery. Understanding these options helps homeowners mitigate losses and decide on the best strategy during financial hardship.

Key Differences Between Deed in Lieu and Foreclosure

A deed in lieu of foreclosure allows a homeowner to voluntarily transfer property ownership to the lender to avoid foreclosure, often resulting in less damage to credit scores compared to foreclosure. Foreclosure is a legal process where the lender forcibly sells the property due to borrower default, typically leading to more severe credit consequences and a longer timeline. Deed in lieu offers a quicker resolution with reduced costs and liens, whereas foreclosure may involve lengthy court proceedings and higher financial penalties.

Eligibility Requirements for Deed in Lieu

Eligibility for a deed in lieu of foreclosure typically requires the borrower to prove financial hardship and inability to continue mortgage payments, with the property being the borrower's primary residence. The lender often demands clear title to the property, meaning no junior liens exist, ensuring a smooth transfer of ownership. Borrowers must also demonstrate willingness to cooperate with the lender throughout the process, as some lenders require formal application and documentation before approving a deed in lieu agreement.

The Foreclosure Process Explained

The foreclosure process begins when a borrower defaults on mortgage payments, prompting the lender to initiate legal action to recover the owed amount by selling the property. This process involves several steps, including a foreclosure notice, public auction, and potential eviction, which can severely impact the borrower's credit score and financial future. In contrast, a deed in lieu of foreclosure allows the borrower to voluntarily transfer ownership of the property to the lender, avoiding the lengthy and costly foreclosure process.

Pros and Cons of Deed in Lieu

Deed in lieu of foreclosure allows homeowners to transfer property ownership to the lender, avoiding the lengthy foreclosure process and minimizing credit damage. Pros include faster resolution, reduced legal fees, and often a more favorable impact on credit compared to foreclosure. Cons involve the potential loss of deficiency judgments, the requirement for lender approval, and possible tax implications from forgiven debt.

Advantages and Disadvantages of Foreclosure

Foreclosure allows lenders to recover the owed mortgage amount by selling the property, often resulting in a faster resolution compared to lengthy loan modifications or negotiations. However, foreclosure can severely damage the borrower's credit score for up to seven years and lead to the total loss of home equity. The process is also costly and time-consuming for both parties, involving legal fees and a public auction that may not fully cover the outstanding loan balance.

Impact on Credit Score: Deed in Lieu vs Foreclosure

A deed in lieu of foreclosure generally results in a less severe impact on credit scores compared to foreclosure, often reducing the credit damage by several points. While both options remain on credit reports for up to seven years, a foreclosure can lower credit scores by 200 points or more, whereas a deed in lieu typically causes a smaller drop, sometimes around 100 to 150 points. Choosing a deed in lieu may improve the likelihood of faster credit recovery and qualify the borrower for future loans sooner than a foreclosure.

Financial Consequences for Homeowners

A Deed in Lieu of Foreclosure allows homeowners to avoid the lengthy foreclosure process by voluntarily transferring property ownership to the lender, often resulting in less severe credit score damage compared to foreclosure. Foreclosure remains on a credit report for up to seven years, significantly lowering credit scores and hindering future loan approvals, whereas a Deed in Lieu may have a shorter impact and improve chances for mortgage approval sooner. Homeowners should consider potential tax implications and deficiency judgments, which vary by state and loan type, influencing the overall financial consequences of each option.

Effect on Future Home Buying Ability

A deed in lieu of foreclosure typically has a less severe impact on future home buying ability compared to a foreclosure, as it demonstrates a proactive approach to resolving mortgage default. Lenders may view a deed in lieu more favorably, often resulting in shorter waiting periods--usually 2 to 4 years--before qualifying for a new mortgage. Foreclosure generally results in longer waiting times, typically 5 to 7 years, and may lead to higher interest rates and stricter lending criteria for future home purchases.

How to Decide: Deed in Lieu or Foreclosure?

Choosing between a deed in lieu and foreclosure depends on factors such as credit impact, timeline, and lender cooperation. A deed in lieu typically results in less severe credit damage and a faster resolution, benefiting homeowners who want to avoid lengthy foreclosure procedures. Consulting with the lender about eligibility and negotiating terms will help determine the best option for minimizing financial and emotional costs.

Deed in Lieu Infographic

libterm.com

libterm.com