A beneficiary is an individual or entity designated to receive assets, benefits, or property from a will, trust, insurance policy, or retirement plan. Understanding how beneficiaries work is crucial for ensuring your estate is distributed according to your wishes and avoiding disputes. Discover more about how naming the right beneficiary can protect Your interests by reading the rest of this article.

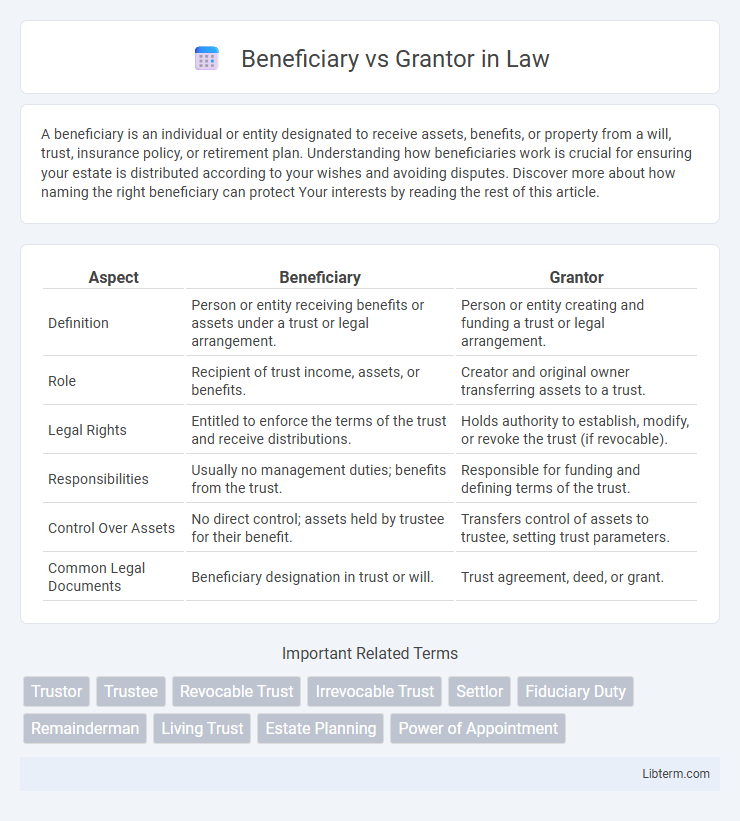

Table of Comparison

| Aspect | Beneficiary | Grantor |

|---|---|---|

| Definition | Person or entity receiving benefits or assets under a trust or legal arrangement. | Person or entity creating and funding a trust or legal arrangement. |

| Role | Recipient of trust income, assets, or benefits. | Creator and original owner transferring assets to a trust. |

| Legal Rights | Entitled to enforce the terms of the trust and receive distributions. | Holds authority to establish, modify, or revoke the trust (if revocable). |

| Responsibilities | Usually no management duties; benefits from the trust. | Responsible for funding and defining terms of the trust. |

| Control Over Assets | No direct control; assets held by trustee for their benefit. | Transfers control of assets to trustee, setting trust parameters. |

| Common Legal Documents | Beneficiary designation in trust or will. | Trust agreement, deed, or grant. |

Understanding the Roles: Beneficiary vs Grantor

The grantor is the individual or entity who creates a trust or grant, transferring assets and defining the terms for asset management. The beneficiary is the person or entity designated to receive benefits or income from the trust or grant according to the grantor's instructions. Understanding the distinction between grantor and beneficiary roles is essential for managing estate planning, trust administration, and legal rights over the transferred assets.

Key Definitions: Who is a Beneficiary? Who is a Grantor?

A beneficiary is an individual or entity designated to receive benefits or assets from a trust, will, or insurance policy, often playing a passive role in the legal arrangement. A grantor, also known as the settlor or trustor, is the person who creates a trust or transfers assets, actively establishing the terms and conditions of the trust's distribution. Understanding the distinct roles of beneficiary and grantor is essential in estate planning, trust management, and legal documentation.

Legal Responsibilities of the Grantor

The grantor holds significant legal responsibilities, including the duty to create, fund, and properly manage the trust according to its terms and applicable laws. Unlike the beneficiary, who primarily has rights to receive benefits, the grantor must ensure the trust's assets are accurately transferred and that fiduciary duties are upheld to protect the trust's integrity. Failure to fulfill these responsibilities can lead to legal disputes and potential liability for breaches of trust.

Rights and Interests of the Beneficiary

The beneficiary holds equitable rights to trust assets, including the right to receive distributions and enforce the terms of the trust against the grantor or trustee. Unlike the grantor, who creates and funds the trust, the beneficiary's interest is protected by fiduciary duties owed by the trustee. This ensures the beneficiary's interests are prioritized and safeguarded under trust law.

Differences in Trust Formation

The grantor is the individual who creates and funds the trust, establishing its terms and conditions, while the beneficiary is the person or entity designated to receive benefits from the trust assets. In trust formation, the grantor has control over the trust's purpose and management, whereas the beneficiary has no control but holds equitable interests or rights to distributions. These roles define legal responsibilities and rights, impacting estate planning, asset protection, and fiduciary duties within the trust framework.

Tax Implications for Grantors and Beneficiaries

Grantors transferring assets into trusts can face gift tax consequences depending on the value and nature of the trust, with irrevocable trusts often removing assets from the taxable estate, thereby reducing estate taxes. Beneficiaries generally do not incur income tax upon receiving distributions unless the trust generates taxable income that must be reported on their individual tax returns. Proper structuring of trusts is critical to optimize tax benefits, as grantors remain liable for income tax on grantor trusts, while beneficiaries may bear income tax burdens in non-grantor trusts.

Common Misconceptions About Grantors and Beneficiaries

Grantors and beneficiaries are often confused, but their roles are distinct: a grantor transfers assets or property into a trust or legal arrangement, while a beneficiary receives benefits from it. Common misconceptions include the belief that grantors lose control immediately, when in some trusts, they can retain significant authority during their lifetime. Another frequent error is assuming beneficiaries have no rights until the grantor's death, whereas some beneficiaries may have entitlements or access depending on the terms of the trust.

Impact on Estate Planning Strategies

The distinction between beneficiary and grantor plays a crucial role in shaping estate planning strategies by determining asset control and distribution timing. Grantors retain authority over assets and can modify trusts, influencing tax implications and succession plans. Beneficiaries receive benefits from the trust, affecting inheritance structures and potential creditor protections within estate plans.

When a Person Can Be Both Grantor and Beneficiary

A person can be both grantor and beneficiary in a trust when they create the trust (grantor) and retain certain benefits or interests in the trust property (beneficiary). This dual role commonly occurs in revocable living trusts, where the grantor maintains control and access to trust assets during their lifetime. The arrangement allows for flexibility in estate planning while ensuring the individual's financial needs are met.

Choosing the Right Structure for Your Estate Goals

Selecting between a beneficiary and a grantor depends on your estate goals and the control you wish to maintain over your assets. A grantor retains control and decision-making authority during their lifetime, while a beneficiary is the recipient of assets after the grantor's death, prioritizing transfer efficiency and tax considerations. Understanding the implications of each role helps optimize estate planning outcomes, ensuring alignment with your financial and legacy objectives.

Beneficiary Infographic

libterm.com

libterm.com