The taxing clause outlines the government's authority to impose and collect taxes within a jurisdiction, ensuring funding for public services and infrastructure. It defines the scope and limitations of taxation, safeguarding taxpayer rights while enabling effective revenue generation. Explore the rest of the article to understand how taxing clauses impact your financial obligations and legal protections.

Table of Comparison

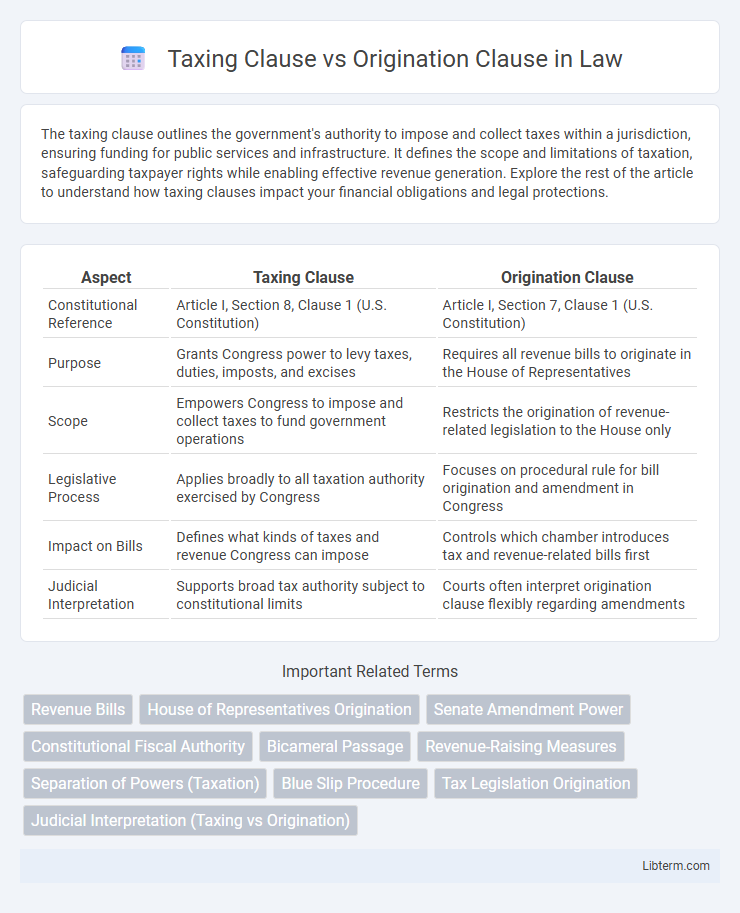

| Aspect | Taxing Clause | Origination Clause |

|---|---|---|

| Constitutional Reference | Article I, Section 8, Clause 1 (U.S. Constitution) | Article I, Section 7, Clause 1 (U.S. Constitution) |

| Purpose | Grants Congress power to levy taxes, duties, imposts, and excises | Requires all revenue bills to originate in the House of Representatives |

| Scope | Empowers Congress to impose and collect taxes to fund government operations | Restricts the origination of revenue-related legislation to the House only |

| Legislative Process | Applies broadly to all taxation authority exercised by Congress | Focuses on procedural rule for bill origination and amendment in Congress |

| Impact on Bills | Defines what kinds of taxes and revenue Congress can impose | Controls which chamber introduces tax and revenue-related bills first |

| Judicial Interpretation | Supports broad tax authority subject to constitutional limits | Courts often interpret origination clause flexibly regarding amendments |

Overview of the Taxing Clause and Origination Clause

The Taxing Clause grants Congress the power to impose and collect taxes, duties, imposts, and excises necessary to fund government operations and promote public welfare. The Origination Clause mandates that all bills for raising revenue must originate in the House of Representatives, ensuring that taxation proposals begin in the legislative body closest to the people. Together, these clauses balance taxation authority with legislative procedure, defining how revenue laws are initiated and enacted in the United States.

Constitutional Foundations and Textual Comparison

The Taxing Clause grants Congress the power to levy taxes, duties, imposts, and excises, ensuring uniformity across states as outlined in Article I, Section 8 of the U.S. Constitution. The Origination Clause, found in Article I, Section 7, mandates that all bills for raising revenue must originate in the House of Representatives, reflecting the framers' intent to give the directly elected chamber control over taxation measures. Textually, the Taxing Clause specifies the types of revenue Congress may raise, while the Origination Clause focuses on procedural origination requirements, together establishing a constitutional framework balancing legislative authority and accountability in fiscal policy.

Historical Context and Framers’ Intent

The Taxing Clause, found in Article I, Section 8, Clause 1 of the U.S. Constitution, grants Congress the power to levy taxes to provide for the general welfare, reflecting the Framers' intent to enable a stable source of revenue for the federal government following economic challenges under the Articles of Confederation. The Origination Clause, located in Article I, Section 7, Clause 1, requires that all bills for raising revenue originate in the House of Representatives, embodying the Framers' desire to place taxation power closest to the people's representatives, given the House's direct election by citizens. Collectively, these clauses illustrate the balance the Framers sought between empowering the federal government to tax and ensuring popular control over taxation policies.

Scope and Purpose of the Taxing Clause

The Taxing Clause in the U.S. Constitution grants Congress broad authority to impose taxes, duties, imposts, and excises for raising revenue and regulating commerce, emphasizing its extensive scope to fund government operations. Unlike the Origination Clause, which mandates that all revenue-raising bills originate in the House of Representatives, the Taxing Clause defines the fundamental power to levy taxes ensuring federal financial stability. The primary purpose of the Taxing Clause is to empower Congress to generate necessary public funds while enabling economic policy through taxation mechanisms.

Role and Significance of the Origination Clause

The Origination Clause mandates that all bills for raising revenue must originate in the House of Representatives, ensuring that taxation initiatives begin with the chamber most directly accountable to the electorate. Its role is to maintain a democratic check on taxation by empowering the people's representatives to initiate revenue legislation. This clause prevents the Senate from introducing tax laws, preserving the House's primary function in fiscal policy and upholding constitutional balance in legislative processes.

Key Supreme Court Interpretations

The Taxing Clause grants Congress broad power to levy taxes, as upheld in cases like *McCulloch v. Maryland* (1819), which affirmed federal taxing authority as essential to government functions. The Origination Clause, requiring revenue bills to originate in the House of Representatives, was clarified in *S. Ct. cases like Flint v. Stone Tracy Co.* (1911), emphasizing procedural compliance but allowing Senate amendments. Supreme Court rulings balance these clauses by protecting federal taxing power while ensuring procedural requirements in Congress are followed.

Differences in Legislative Procedure

The Taxing Clause authorizes Congress to levy taxes, duties, imposts, and excises, whereas the Origination Clause requires all revenue-raising bills to originate in the House of Representatives. In legislative procedure, revenue bills begin exclusively in the House, reflecting its closer ties to taxpayers, while the Senate may amend these bills but cannot initiate them. This procedural distinction emphasizes the House's primary role in financial legislation versus the broader legislative powers of the Senate.

Impact on Federal Tax Legislation

The Taxing Clause grants Congress broad authority to impose taxes essential for raising revenue, enabling flexible federal tax legislation such as income and excise taxes. The Origination Clause requires all bills for raising revenue to originate in the House of Representatives, ensuring initial legislative control remains with the body closest to the people, impacting the procedural pathway of tax law enactment. Together, these clauses shape the scope and procedural framework for federal taxation, balancing legislative power and federal revenue generation.

Notable Legal Controversies and Cases

The Taxing Clause, granting Congress the power to impose taxes for revenue generation, has sparked notable legal controversies in cases like *Bailey v. Drexel Furniture Co.* (1922), where the Supreme Court struck down a tax deemed a penalty rather than a revenue measure. The Origination Clause mandates that all revenue bills originate in the House of Representatives, leading to disputes such as in *South Carolina v. Carter* (2014), which examined the procedural legitimacy of a Senate bill that was a substitute for a House-passed revenue measure. These cases emphasize the critical balance between legislative procedure and constitutional limits on federal taxation authority.

Contemporary Relevance and Policy Implications

The Taxing Clause grants Congress broad authority to levy taxes for raising revenue, while the Origination Clause mandates that all revenue-raising bills must originate in the House of Representatives. Contemporary debates focus on the balance of power between the House and Senate in tax legislation, impacting fiscal policy efficiency and democratic accountability. Policy implications include ongoing scrutiny of procedural compliance to ensure transparency and uphold constitutional checks on tax lawmaking.

Taxing Clause Infographic

libterm.com

libterm.com