A grant deed is a legal document used to transfer ownership of real estate from one party to another, ensuring the property is free from encumbrances or liens. It typically includes a guarantee that the seller has the right to convey the property and that it hasn't been sold to anyone else. Explore the full article to understand how a grant deed protects your property rights and its role in real estate transactions.

Table of Comparison

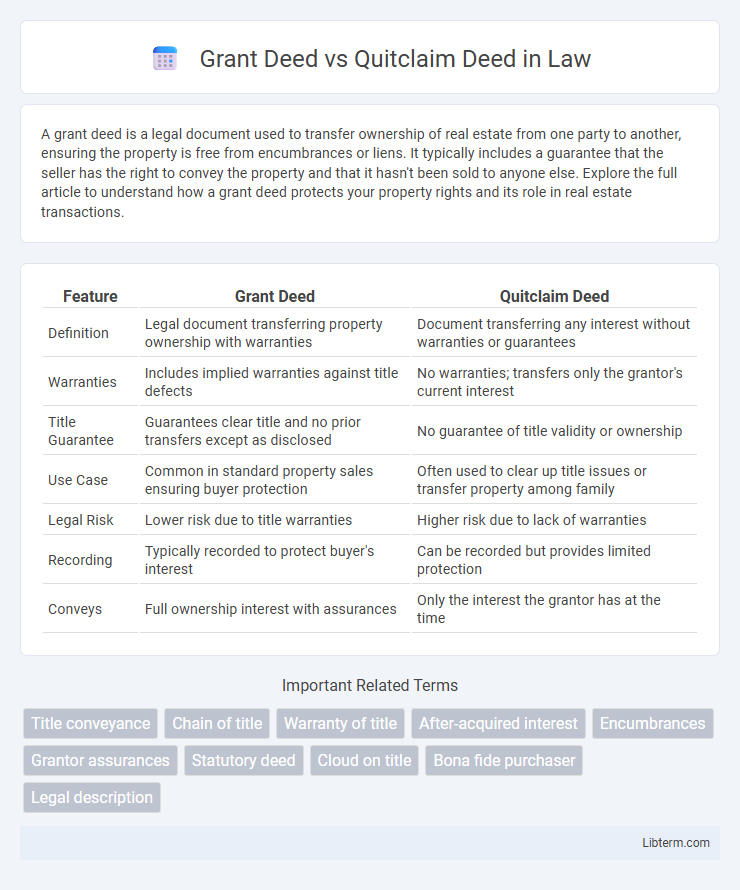

| Feature | Grant Deed | Quitclaim Deed |

|---|---|---|

| Definition | Legal document transferring property ownership with warranties | Document transferring any interest without warranties or guarantees |

| Warranties | Includes implied warranties against title defects | No warranties; transfers only the grantor's current interest |

| Title Guarantee | Guarantees clear title and no prior transfers except as disclosed | No guarantee of title validity or ownership |

| Use Case | Common in standard property sales ensuring buyer protection | Often used to clear up title issues or transfer property among family |

| Legal Risk | Lower risk due to title warranties | Higher risk due to lack of warranties |

| Recording | Typically recorded to protect buyer's interest | Can be recorded but provides limited protection |

| Conveys | Full ownership interest with assurances | Only the interest the grantor has at the time |

Introduction to Property Deeds

Grant deeds provide buyers with warranties that the property title is free from undisclosed encumbrances, ensuring legal ownership protection. Quitclaim deeds transfer any ownership interest the grantor has without warranties, often used between family members or to clear title issues. Understanding the distinctions between these property deeds is crucial for secure real estate transactions and title clarity.

What is a Grant Deed?

A Grant Deed is a legal document used in real estate transactions that guarantees the seller holds clear title to the property and has not transferred it to anyone else. It provides certain warranties, ensuring that the property is free from undisclosed encumbrances or liens during the time the seller owned it. This type of deed offers more protection to the buyer compared to a Quitclaim Deed, which transfers only whatever interest the grantor may have without guarantees.

What is a Quitclaim Deed?

A Quitclaim Deed is a legal instrument used to transfer any ownership interest a grantor may have in a property without providing warranties or guarantees about the title's validity. It is commonly utilized in situations such as transferring property between family members, clearing up title issues, or adding a new owner to the deed. Unlike a Grant Deed, a Quitclaim Deed offers no protection against potential title defects or claims from other parties.

Key Differences Between Grant Deed and Quitclaim Deed

Grant deeds provide a legal guarantee that the property has not been sold to anyone else and is free of undisclosed encumbrances, ensuring the grantee's ownership is clear. Quitclaim deeds transfer whatever interest the grantor has in the property without any warranties, making them riskier for the grantee due to potential title defects or claims. The key difference lies in the level of buyer protection, with grant deeds offering more security through implied guarantees and quitclaim deeds offering no such assurances.

Legal Protections and Warranties

A Grant Deed provides legal protections by guaranteeing that the grantor holds clear title to the property and has not transferred it to others, offering warranties against any undisclosed encumbrances. In contrast, a Quitclaim Deed transfers only whatever interest the grantor currently holds without any warranties, meaning the grantee assumes the risk of potential title defects. Legal professionals often recommend Grant Deeds for secure property transactions due to their explicit assurances and title guarantees.

Common Uses for Grant Deeds

Grant deeds are commonly used in real estate transactions to transfer ownership with guarantees that the property has not been sold to others and is free from undisclosed encumbrances. These deeds provide buyers with legal protection by ensuring the seller holds clear title to the property, making them ideal for traditional home sales and refinancing. In contrast, quitclaim deeds are typically reserved for transferring property between family members or in situations where no warranty of title is required.

Common Uses for Quitclaim Deeds

Quitclaim deeds are commonly used to transfer property between family members or to clear up title issues, such as removing a spouse's name after a divorce. These deeds provide no warranty on the title, making them ideal for situations where trust is established and a quick transfer is needed. Real estate transactions involving inheritance or adding a co-owner often utilize quitclaim deeds for their simplicity and speed.

Pros and Cons of Grant Deeds

Grant deeds provide a higher level of buyer protection by guaranteeing the property is free from undisclosed encumbrances and that the seller has legal ownership. They typically require a title search, reducing the risk of title disputes and making them preferable for traditional real estate transactions. However, grant deeds may involve higher costs and longer processing times compared to quitclaim deeds, which transfer ownership without guarantees.

Pros and Cons of Quitclaim Deeds

Quitclaim deeds offer a fast and simple way to transfer property ownership without warranties, reducing the risk of legal claims, but they provide no guarantee against title defects or liens. They are ideal for transfers between trusted parties, such as family members or divorcing spouses, where the risk of title issues is low. However, their primary drawback is the lack of title protection, making them unsuitable for traditional real estate transactions or purchases involving unknown parties.

Choosing the Right Deed for Your Property Transfer

Selecting the right deed for your property transfer hinges on the level of protection and warranty you require; a grant deed guarantees the title is clear of any undisclosed encumbrances, while a quitclaim deed transfers whatever interest the grantor holds without warranties. Grant deeds are preferred in traditional sales and purchases because they offer a legal assurance to the buyer, whereas quitclaim deeds are commonly used among family members or in less formal property transfers. Understanding the distinctions in title guarantees and potential risks helps ensure a smooth and secure property transaction.

Grant Deed Infographic

libterm.com

libterm.com