An administrator plays a crucial role in managing organizational operations, ensuring smooth workflows, and maintaining effective communication between departments. Your ability to oversee resources, coordinate tasks, and implement policies directly impacts productivity and success. Explore the article to discover essential skills and strategies to excel as an administrator.

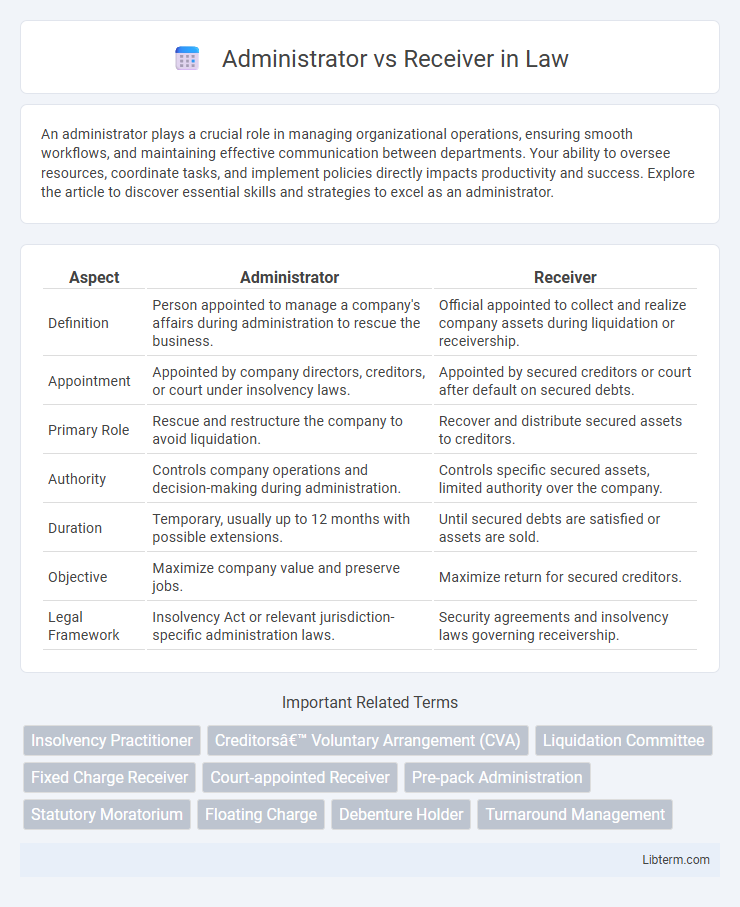

Table of Comparison

| Aspect | Administrator | Receiver |

|---|---|---|

| Definition | Person appointed to manage a company's affairs during administration to rescue the business. | Official appointed to collect and realize company assets during liquidation or receivership. |

| Appointment | Appointed by company directors, creditors, or court under insolvency laws. | Appointed by secured creditors or court after default on secured debts. |

| Primary Role | Rescue and restructure the company to avoid liquidation. | Recover and distribute secured assets to creditors. |

| Authority | Controls company operations and decision-making during administration. | Controls specific secured assets, limited authority over the company. |

| Duration | Temporary, usually up to 12 months with possible extensions. | Until secured debts are satisfied or assets are sold. |

| Objective | Maximize company value and preserve jobs. | Maximize return for secured creditors. |

| Legal Framework | Insolvency Act or relevant jurisdiction-specific administration laws. | Security agreements and insolvency laws governing receivership. |

Introduction to Administrator and Receiver Roles

Administrators manage the day-to-day operations of a company during insolvency, ensuring business continuity and working to maximize returns for creditors. Receivers are appointed by secured creditors to take control of specific assets or the entire company, focusing on the recovery of debts owed to those creditors. Both roles involve fiduciary duties but differ in scope, appointment authority, and objectives within insolvency proceedings.

Legal Definitions: Administrator vs Receiver

An administrator is a court-appointed official responsible for managing the estate of a deceased person who died intestate or without a valid will, ensuring debts are paid and assets distributed according to law. A receiver is a neutral third party appointed by a court or secured creditor to take control of property or assets during litigation or insolvency, with the primary duty of preserving and protecting the value of the assets. Legal distinctions focus on their authority scope, with administrators managing estates post-mortem, while receivers oversee assets often in cases of financial distress or disputes.

Appointment Process for Administrators and Receivers

The appointment process for an administrator involves the court granting a grant of administration when a deceased person dies intestate, allowing the administrator to manage and distribute the estate according to probate law. A receiver is typically appointed by the court in specific legal disputes or insolvency cases to take custody of property or assets, with the appointment focused on protecting and preserving assets during litigation or restructuring. Administrators are appointed through probate procedures related to estate administration, whereas receivership appointments stem from court orders in broader legal or financial contexts.

Key Responsibilities and Duties

An Administrator manages the day-to-day operations and financial affairs of a company in insolvency, focusing on restructuring and rescuing the business while protecting creditors' interests. A Receiver is appointed to recover funds for secured creditors by taking control and selling company assets, prioritizing the creditor's security over business rescue. Administrators aim for company revival through operational decisions, whereas Receivers concentrate on asset liquidation to satisfy debt obligations.

Powers Granted to Administrators and Receivers

Administrators possess broad powers granted by the court to manage and distribute assets during insolvency, including realizing property, operating the business, and negotiating with creditors. Receivers have more limited, specific powers typically appointed by secured creditors to take control of particular assets and ensure debt recovery. The administrator's authority often overrides individual creditor rights, whereas receivers act primarily to protect the interests of their appointing creditor within their defined scope.

Differences in Objectives and Goals

An administrator primarily manages the ongoing operations and ensures the organization functions smoothly while maintaining compliance with laws and policies. In contrast, a receiver's objective centers on protecting creditors' interests by taking control of assets, preserving value, and restructuring or liquidating the entity during financial distress. The administrator aims to balance stakeholder interests to facilitate recovery or continued business viability, whereas the receiver focuses on maximizing asset realization and mitigating losses.

Impact on Creditors and Stakeholders

An administrator's appointment aims to rescue the company, allowing continued operations and maximizing returns through restructuring, which often preserves more value for creditors and stakeholders compared to immediate liquidation. A receiver's primary role is to realize secured assets quickly for the benefit of secured creditors, frequently resulting in limited or no returns for unsecured creditors and other stakeholders. The administrator's process provides a more organized and potentially beneficial recovery framework, whereas receivership typically leads to asset disposal with minimal stakeholder involvement.

Termination and Conclusion of Appointment

The termination of an Administrator's appointment typically occurs through court order, expiration of the estate administration period, or completion of the estate distribution, whereas a Receiver's appointment concludes once the court resolves the underlying dispute or the specific assets under receivership are properly managed or liquidated. Administrators are often appointed in probate cases to manage and distribute decedent's assets, and their role ends upon final estate settlement and court discharge. Receivers, appointed in civil litigation or insolvency cases, see their duties terminated by court instructions after fulfilling asset preservation or dispute resolution objectives.

Case Studies: Administrator vs Receiver in Practice

Case studies of Administrator vs Receiver reveal critical differences in approach and authority during insolvency proceedings. Administrators manage company operations to rescue the business as a going concern, reflecting outcomes in reorganization success rates. Receivers, often appointed by secured creditors, focus on asset realization to repay debts, highlighting contrasting priorities evidenced in financial recovery cases.

Choosing Between Administrator and Receiver

Choosing between an Administrator and a Receiver depends on the nature of the company's financial distress and the desired outcome. An Administrator is appointed to rescue the company as a going concern, aiming to reorganize its affairs and avoid liquidation. A Receiver is typically appointed by secured creditors to recover funds from specific assets, often leading to asset realization rather than corporate rescue.

Administrator Infographic

libterm.com

libterm.com