The Rule Against Accumulations restricts the length of time for which property income can be accumulated rather than distributed to beneficiaries. It aims to prevent the undue control of property over extended periods, ensuring fair and timely benefits. Explore the rest of the article to understand how this rule impacts your estate planning and property management.

Table of Comparison

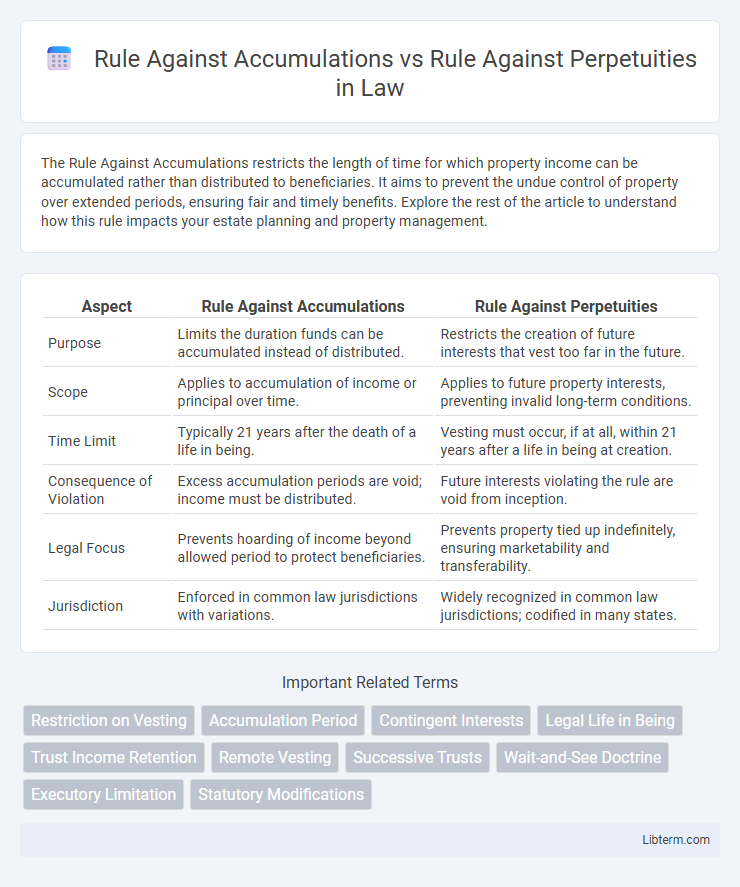

| Aspect | Rule Against Accumulations | Rule Against Perpetuities |

|---|---|---|

| Purpose | Limits the duration funds can be accumulated instead of distributed. | Restricts the creation of future interests that vest too far in the future. |

| Scope | Applies to accumulation of income or principal over time. | Applies to future property interests, preventing invalid long-term conditions. |

| Time Limit | Typically 21 years after the death of a life in being. | Vesting must occur, if at all, within 21 years after a life in being at creation. |

| Consequence of Violation | Excess accumulation periods are void; income must be distributed. | Future interests violating the rule are void from inception. |

| Legal Focus | Prevents hoarding of income beyond allowed period to protect beneficiaries. | Prevents property tied up indefinitely, ensuring marketability and transferability. |

| Jurisdiction | Enforced in common law jurisdictions with variations. | Widely recognized in common law jurisdictions; codified in many states. |

Introduction to Rule Against Accumulations and Rule Against Perpetuities

The Rule Against Accumulations restricts the duration for which income or capital from a trust can be accumulated, preventing the indefinite hoarding of assets that might otherwise benefit future beneficiaries. The Rule Against Perpetuities limits the time period within which future interests in property must vest, ensuring that property remains transferable and does not remain tied up under contingent conditions for excessive generations. Both rules serve to promote the free alienability of property and to protect against long-term restrictions on ownership and control.

Historical Background and Legal Origins

The Rule Against Perpetuities originated in English common law during the 17th century to prevent the indefinite control of property through future interests, ensuring timely vesting of estates. The Rule Against Accumulations evolved as a corollary, limiting the period for accumulating income from trusts to prevent wealth hoarding across generations. Both doctrines reflect legal efforts to promote the free transfer of property and economic productivity by restricting long-term restraints.

Definition of Rule Against Accumulations

The Rule Against Accumulations limits the period during which income from a trust or estate can be accumulated rather than distributed, typically restricting accumulation to 21 years from the death of a measuring life or a specified event. This rule prevents the indefinite buildup of income, ensuring that beneficiaries receive timely distributions. In contrast, the Rule Against Perpetuities restricts the creation of future interests that may vest beyond a certain period, often measured as "lives in being plus 21 years," focusing on the validity of property interests rather than income accumulation.

Definition of Rule Against Perpetuities

The Rule Against Perpetuities is a legal doctrine that limits the duration during which property interests can vest, typically requiring that interests must vest, if at all, no later than 21 years after the death of a relevant life in being at the creation of the interest. This rule prevents the indefinite tying up of property and ensures its transferability by invalidating future interests that might vest too far in the future. In contrast, the Rule Against Accumulations restricts the period during which income from property can be accumulated rather than distributed, focusing specifically on limiting accumulation rather than the vesting of interests.

Key Differences Between the Two Rules

The Rule Against Accumulations limits the time period during which income from a trust or estate can be accumulated, generally restricting accumulation to 21 years after the death of a relevant life in being. The Rule Against Perpetuities focuses on invalidating future interests in property that may vest beyond 21 years plus a life in being, ensuring property transfers occur within a reasonable time. Key differences include that the Rule Against Accumulations governs income retention periods, while the Rule Against Perpetuities governs the validity of future interests in property ownership.

Purpose and Rationale Behind Each Rule

The Rule Against Accumulations restricts the length of time income from a trust can be accumulated rather than distributed to prevent the unreasonable concentration of wealth and ensure beneficiaries receive timely benefits. The Rule Against Perpetuities limits the duration for which property interests can vest, aiming to avoid indefinite control over property and promote its free transferability. Both rules work to balance long-term estate planning with public policy interests in preventing excessive delays in property transfer and the undue restriction of assets.

Legal Consequences of Violation

Violations of the Rule Against Accumulations result in voiding the portion of a trust or will that allows income to accumulate beyond the permitted period, typically requiring immediate distribution of funds. Breaching the Rule Against Perpetuities causes invalidation of future interests in property that may vest too remotely, often rendering affected gifts or trusts void from inception. Courts enforce these rules strictly to maintain temporal limits on property interests, ensuring legal certainty and preventing indefinite control over assets.

Notable Case Law and Judicial Interpretations

The Rule Against Accumulations restricts the duration for which income can be accumulated rather than distributed, prominently affirmed in the English case Duke of Norfolk's Case (1682), which established its foundation in common law. The Rule Against Perpetuities, limiting the vesting of future interests beyond 21 years after a life in being, found clarification in the landmark case of St. Leonard's Estate (1959), where judicial interpretation refined the applicability of vesting periods in trust and estate law. Courts have often distinguished these rules by emphasizing the Rule Against Accumulation's focus on income duration, as seen in Re: Earl of Ancaster's Settlement Trusts (1983), contrasting with the Rule Against Perpetuities' prevention of indefinite future interest control.

Modern Reforms and Statutory Modifications

Modern reforms of the Rule Against Accumulations often involve explicit statutory provisions limiting the time period for income or principal accumulation to a fixed number of years, typically 21 years after some life in being, aligning closely with reforms to the Rule Against Perpetuities. Jurisdictions have frequently adopted the Uniform Statutory Rule Against Perpetuities (USRAP), which introduces a 90-year vesting period as a flexible alternative to the traditional RAP, effectively reducing disputes and increasing certainty for both rules. Statutory modifications enhance predictability by replacing common law complexities with clear legislative durations, thereby facilitating efficient estate and trust planning while preserving the original intent to prevent property from being tied up indefinitely.

Practical Implications for Estate Planning and Trusts

The Rule Against Accumulations restricts the period during which income can be accumulated in a trust, typically limiting it to the life of a measuring life plus 21 years, thereby ensuring timely distribution to beneficiaries. The Rule Against Perpetuities, on the other hand, prohibits future interests in property from vesting beyond a certain timeframe, generally measured as 21 years after the death of a relevant life in being, safeguarding against indefinite control of assets. Understanding these rules helps estate planners structure trusts that comply with legal limits, optimize tax benefits, and provide clear timelines for distribution to minimize litigation risks.

Rule Against Accumulations Infographic

libterm.com

libterm.com