Distribution in kind involves transferring assets directly to beneficiaries rather than liquidating them into cash. This method can preserve the value of specific assets and minimize tax implications for Your estate or trust. Explore the rest of the article to understand the strategic benefits and considerations of distribution in kind.

Table of Comparison

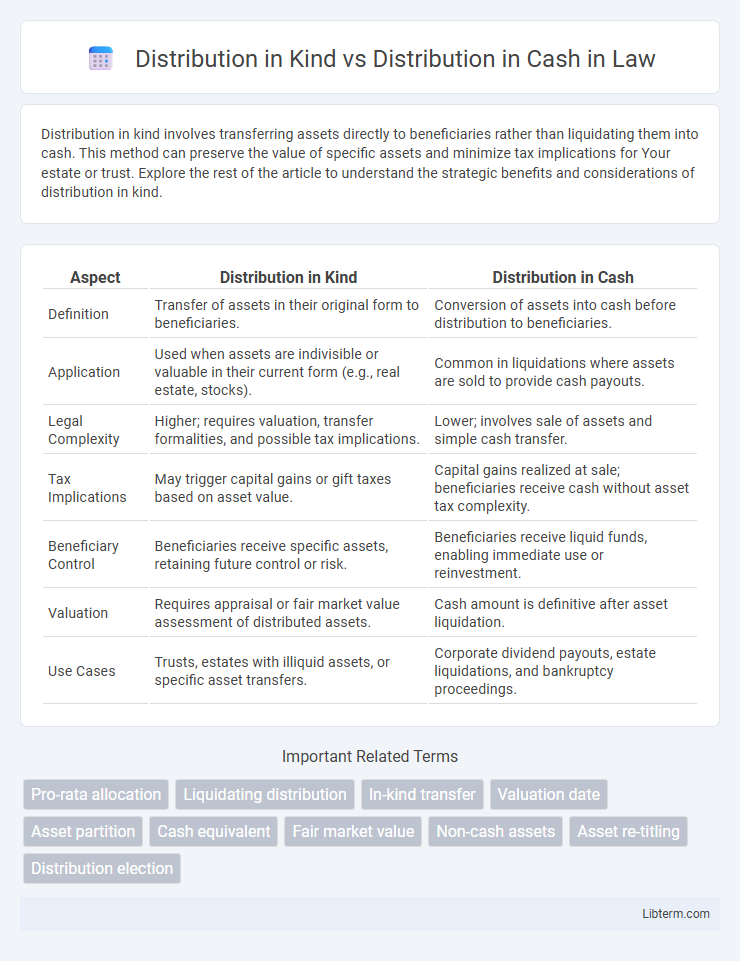

| Aspect | Distribution in Kind | Distribution in Cash |

|---|---|---|

| Definition | Transfer of assets in their original form to beneficiaries. | Conversion of assets into cash before distribution to beneficiaries. |

| Application | Used when assets are indivisible or valuable in their current form (e.g., real estate, stocks). | Common in liquidations where assets are sold to provide cash payouts. |

| Legal Complexity | Higher; requires valuation, transfer formalities, and possible tax implications. | Lower; involves sale of assets and simple cash transfer. |

| Tax Implications | May trigger capital gains or gift taxes based on asset value. | Capital gains realized at sale; beneficiaries receive cash without asset tax complexity. |

| Beneficiary Control | Beneficiaries receive specific assets, retaining future control or risk. | Beneficiaries receive liquid funds, enabling immediate use or reinvestment. |

| Valuation | Requires appraisal or fair market value assessment of distributed assets. | Cash amount is definitive after asset liquidation. |

| Use Cases | Trusts, estates with illiquid assets, or specific asset transfers. | Corporate dividend payouts, estate liquidations, and bankruptcy proceedings. |

Introduction to Estate Distributions

Estate distributions involve transferring assets from a deceased person's estate to beneficiaries, either as Distribution in Kind or Distribution in Cash. Distribution in Kind refers to the allocation of specific assets, such as real estate, stocks, or personal property, directly to beneficiaries without converting them to cash. Distribution in Cash involves liquidating estate assets and distributing the proceeds, providing beneficiaries with immediate liquidity and simplifying asset division.

Understanding Distribution in Kind

Distribution in Kind refers to the transfer of assets or property directly to shareholders or beneficiaries instead of cash, often involving stocks, bonds, or physical property. This method allows recipients to retain ownership of specific assets, which can provide tax advantages by deferring capital gains taxes until the assets are sold. Understanding Distribution in Kind is essential for investors seeking to maintain asset control and potentially optimize tax implications compared to receiving a cash payout.

Defining Distribution in Cash

Distribution in cash refers to the payment of dividends or returns to shareholders in the form of currency rather than assets or stock. This type of distribution provides immediate liquidity and can be easily utilized by investors for personal or reinvestment purposes. Unlike distribution in kind, which involves non-cash assets, distribution in cash simplifies tax reporting and valuation for both companies and shareholders.

Key Differences Between Distribution in Kind and Cash

Distribution in kind involves transferring assets such as stocks, bonds, or property directly to shareholders or beneficiaries rather than liquid cash. Distribution in cash provides immediate liquidity by converting assets into money, facilitating easier reinvestment or spending. Key differences include the impact on tax consequences, valuation complexity, and the type of assets received, with in-kind distributions often carrying a more complex valuation process and potential capital gains implications.

Advantages of Distribution in Kind

Distribution in kind allows shareholders to receive assets directly, preserving their proportional ownership without triggering immediate tax liabilities that typically arise from cash distributions. This method maintains the company's cash reserves for operational needs or growth opportunities, enhancing financial stability. Investors benefit from increased control over their portfolio by holding specific securities rather than liquidating cash payouts.

Benefits of Distribution in Cash

Distribution in cash offers immediate liquidity, enabling beneficiaries to utilize funds for diverse needs without delay. It simplifies tax reporting and administration compared to distribution in kind, which often requires valuation and can lead to complex tax consequences. Cash distribution also avoids the challenges of asset management and potential market fluctuations associated with in-kind transfers.

Tax Implications for Both Distribution Methods

Distribution in kind involves transferring assets such as stocks or property directly to shareholders, potentially triggering capital gains tax based on the appreciated value of the assets at the time of distribution. Distribution in cash results in immediate recognition of dividend income by recipients, which is typically taxed at ordinary income rates or qualified dividend rates depending on the shareholder's tax bracket. Tax efficiency depends on the entity's basis in the asset and the recipient's tax situation, making in-kind distributions preferable for deferring taxes, while cash distributions provide liquidity but may incur higher immediate tax liabilities.

Factors Influencing Distribution Choices

Distribution in Kind involves transferring assets directly rather than liquidating them, while Distribution in Cash provides beneficiaries with monetary proceeds. Factors influencing distribution choices include asset liquidity, tax implications, beneficiary preferences, and the nature of the estate or trust assets. Market conditions and legal constraints also play crucial roles in determining whether distributions occur in kind or cash.

Legal Considerations and Requirements

Distribution in kind involves transferring non-cash assets like property or securities directly to beneficiaries, requiring precise valuation and compliance with legal documentation to ensure clear title transfer and avoid disputes. Distribution in cash necessitates adherence to tax regulations and accurate reporting of monetary transfers, with emphasis on liquidity sufficiency to meet obligations without compromising the estate or trust value. Legal considerations mandate thorough accounting, beneficiary notifications, and sometimes court approvals to validate distributions and uphold fiduciary responsibilities.

Choosing the Right Distribution Method

Choosing the right distribution method depends on the nature of assets and shareholder preferences, with distribution in kind transferring specific assets like stocks or property directly to shareholders, preserving liquidity for the company. Distribution in cash provides immediate, flexible funds to shareholders, ideal for those seeking liquidity without altering their portfolio composition. Evaluating tax implications, asset volatility, and corporate cash flow is crucial to determine whether distribution in kind or cash aligns best with both corporate strategic goals and shareholder interests.

Distribution in Kind Infographic

libterm.com

libterm.com