Indemnity protects you from financial loss by compensating for damages or claims arising from specific risks or liabilities. It plays a vital role in contracts, insurance policies, and legal agreements to allocate responsibility and ensure security. Explore the article to understand how indemnity can safeguard your interests effectively.

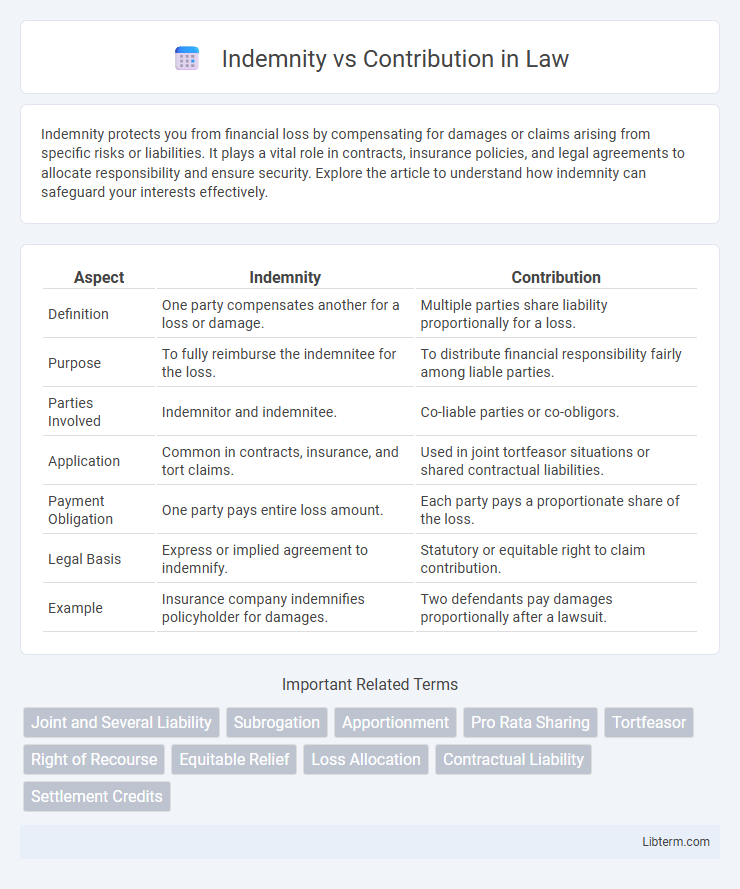

Table of Comparison

| Aspect | Indemnity | Contribution |

|---|---|---|

| Definition | One party compensates another for a loss or damage. | Multiple parties share liability proportionally for a loss. |

| Purpose | To fully reimburse the indemnitee for the loss. | To distribute financial responsibility fairly among liable parties. |

| Parties Involved | Indemnitor and indemnitee. | Co-liable parties or co-obligors. |

| Application | Common in contracts, insurance, and tort claims. | Used in joint tortfeasor situations or shared contractual liabilities. |

| Payment Obligation | One party pays entire loss amount. | Each party pays a proportionate share of the loss. |

| Legal Basis | Express or implied agreement to indemnify. | Statutory or equitable right to claim contribution. |

| Example | Insurance company indemnifies policyholder for damages. | Two defendants pay damages proportionally after a lawsuit. |

Understanding Indemnity: Definition and Key Concepts

Indemnity refers to a contractual obligation where one party agrees to compensate another for any losses or damages incurred, effectively shifting financial responsibility. It is a primary legal concept in risk management and insurance, ensuring the indemnified party is restored to their pre-loss position without suffering a financial burden. Understanding indemnity involves recognizing its role in risk allocation, coverage scope, and the conditions under which compensation is provided.

What Is Contribution? Meaning and Legal Basis

Contribution refers to the legal principle where two or more parties share the financial burden when one party has paid more than their fair share of a liability or debt. Its legal basis is rooted in the doctrine of equitable distribution, ensuring that parties who are jointly liable for an obligation each pay their proportionate share. Contribution is commonly applied in cases involving joint tortfeasors, co-debtors, or co-insurers, preventing unjust enrichment by requiring reimbursement between parties.

Indemnity vs Contribution: Core Differences

Indemnity involves one party fully compensating another for loss or damage incurred, often based on a contractual obligation. Contribution requires multiple parties sharing liability proportionally when they are jointly responsible for the same loss. The core difference lies in indemnity being a complete reimbursement by one party, whereas contribution ensures equitable distribution of the financial burden among liable parties.

When Is Indemnity Applicable? Common Scenarios

Indemnity is applicable when one party agrees to compensate another for losses or damages arising from specific risks or breaches, often seen in contract disputes, liability claims, and property damage cases. Common scenarios include construction contracts where subcontractors indemnify general contractors against accidents, insurance policies protecting insured parties from third-party claims, and employment agreements covering legal costs from employee actions. This mechanism shifts financial responsibility to the indemnitor, ensuring the indemnitee is made whole without bearing the loss.

Situations Warranting Contribution between Parties

Situations warranting contribution between parties typically arise when multiple parties share liability for the same loss or damage, requiring them to proportionally share the financial burden. Contribution ensures that no party pays more than their fair share, especially in cases involving joint tortfeasors or co-obligors under a contract. This mechanism contrasts with indemnity, where one party bears full responsibility to compensate another, making contribution essential for equitable cost distribution among responsible parties.

Legal Framework: Indemnity in Contract and Tort Law

Indemnity in contract law involves one party agreeing to compensate the other for specified losses or damages arising from defined risks, creating a direct obligation independent of fault. In tort law, indemnity may arise when one party is held liable for another's wrongdoing and seeks reimbursement for damages paid. Legal frameworks differentiate indemnity from contribution, where contribution involves sharing liability proportionally among multiple parties responsible for the same damage.

Contribution Rights: Statutes and Case Law Examples

Contribution rights arise when multiple parties share liability, allowing one party who has paid more than their share to recover from others. Statutes such as the Uniform Contribution Among Tortfeasors Act (UCATA) provide a framework for equitable distribution of damages, while case law examples like *Estate of Garcia v. Wellman* demonstrate courts enforcing contribution claims to prevent unjust enrichment. Jurisdictions vary in application, but statutory and judicial precedents consistently uphold contribution as a means to allocate fault and financial responsibility among liable parties.

Practical Implications: Choosing Indemnity or Contribution

Selecting indemnity or contribution clauses significantly impacts risk allocation and financial responsibility in contracts. Indemnity agreements require one party to fully compensate for losses, offering clearer protection but potentially greater liability exposure. Contribution clauses distribute losses among multiple parties proportionally, reducing individual risk but complicating claims settlement and enforcement.

Drafting Contracts: Indemnity and Contribution Clauses

Drafting contracts with clear indemnity clauses ensures one party agrees to compensate the other for specific losses, limiting liability exposure. Contribution clauses, by contrast, allocate financial responsibility proportionally among multiple parties when shared fault occurs in damages or claims. Precise language in indemnity and contribution provisions minimizes disputes and clarifies each party's obligations during enforcement.

Resolving Disputes: Enforcing Indemnity and Contribution Claims

Resolving disputes involving indemnity and contribution claims requires a clear understanding of contract terms and legal principles governing liability allocation. Enforcing indemnity claims often depends on explicit contractual language obligating one party to compensate another for specific losses, whereas contribution claims involve sharing liability among multiple parties who are jointly responsible for damages. Courts examine evidence of fault, proportional responsibility, and the scope of indemnity agreements to determine the extent of enforcement and recovery in such disputes.

Indemnity Infographic

libterm.com

libterm.com