Trust forms the foundation of successful relationships and effective communication, fostering reliability and mutual respect. Establishing trust requires consistency, honesty, and transparency to build a strong connection over time. Explore the rest of this article to learn how trust can transform your personal and professional interactions.

Table of Comparison

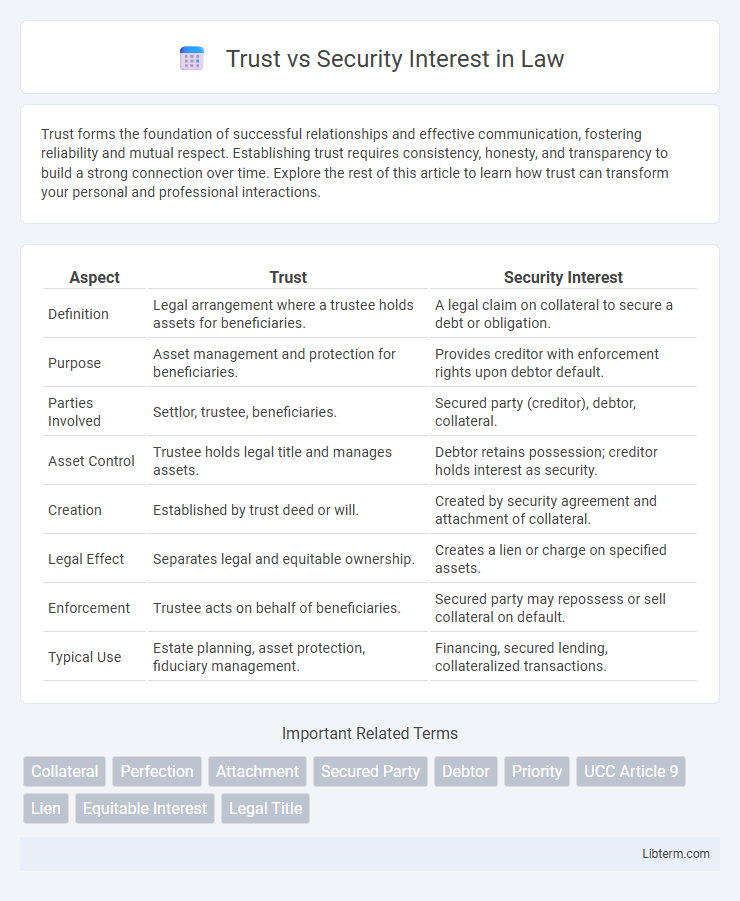

| Aspect | Trust | Security Interest |

|---|---|---|

| Definition | Legal arrangement where a trustee holds assets for beneficiaries. | A legal claim on collateral to secure a debt or obligation. |

| Purpose | Asset management and protection for beneficiaries. | Provides creditor with enforcement rights upon debtor default. |

| Parties Involved | Settlor, trustee, beneficiaries. | Secured party (creditor), debtor, collateral. |

| Asset Control | Trustee holds legal title and manages assets. | Debtor retains possession; creditor holds interest as security. |

| Creation | Established by trust deed or will. | Created by security agreement and attachment of collateral. |

| Legal Effect | Separates legal and equitable ownership. | Creates a lien or charge on specified assets. |

| Enforcement | Trustee acts on behalf of beneficiaries. | Secured party may repossess or sell collateral on default. |

| Typical Use | Estate planning, asset protection, fiduciary management. | Financing, secured lending, collateralized transactions. |

Introduction to Trust vs Security Interest

A trust is a legal relationship where a trustee holds property for the benefit of beneficiaries, creating fiduciary duties and equitable interests. A security interest is a legal claim granted by a debtor to a creditor on collateral, ensuring the creditor's right to satisfy debts if the debtor defaults. Understanding the distinction is essential for asset protection, financing, and property rights enforcement.

Definitions: Trust and Security Interest

A trust is a legal arrangement where a trustee holds and manages assets on behalf of beneficiaries according to the terms set by the trustor. A security interest is a legal claim or lien on collateral granted by a debtor to a creditor to secure the repayment of a debt or performance of an obligation. While trusts involve ownership and fiduciary duties, security interests focus on creditor protection and priority in case of debtor default.

Key Legal Distinctions

Trust involves the legal arrangement where a trustee holds property for the benefit of beneficiaries, creating equitable rights, whereas security interest grants a creditor a legal claim on collateral to secure a debt. In trust law, fiduciary duties bind the trustee to act in the best interests of beneficiaries, while security interests are governed by the Uniform Commercial Code (UCC) and require attachment and perfection to be enforceable. The key legal distinction lies in the nature of rights: trusts create equitable ownership without transfer of title, whereas security interests represent a conditional ownership transferring specific rights upon default.

Roles and Responsibilities of Parties

Trust involves a fiduciary relationship where the trustee manages assets on behalf of the beneficiary, ensuring loyalty and care in asset administration. Security interest grants a lender a legal claim on a borrower's collateral until the debt is repaid, with the lender responsible for enforcing this claim in case of default. Both roles require clear documentation, with trustees maintaining asset integrity and secured parties protecting their financial interests through proper registration and compliance.

Creation and Formation Requirements

Trusts require a clear declaration by the settlor, identifiable trust property, and a definite beneficiary or purpose to be validly created, often necessitating a written instrument depending on jurisdiction. Security interests must attach to collateral through a consensual agreement, the debtor's rights in the collateral, and value given by the secured party, with perfection typically achieved by filing or possession to protect against third parties. Both mechanisms depend on precise formation criteria to establish enforceable rights and prioritize claims in asset management or debt transactions.

Priority and Enforceability Issues

Priority in trust involves the rightful order in which beneficiaries receive assets, while security interest priority determines which creditor claims collateral first in default. Enforceability issues arise when trust terms conflict with creditor rights, often requiring courts to balance equitable interests against statutory security interests. Understanding jurisdiction-specific laws and filing requirements is crucial for resolving disputes over priority and ensuring enforceability of security interests versus trust claims.

Typical Uses and Practical Applications

Trusts are commonly used to manage and protect assets for beneficiaries, facilitate estate planning, and ensure the smooth transfer of property after death. Security interests are typically employed in financing arrangements, allowing lenders to secure collateral--such as real estate, equipment, or inventory--against loans to mitigate credit risk. Practical applications of trusts include managing family wealth and charitable giving, while security interests are crucial in securing business loans and preventing default losses.

Risks and Advantages for Lenders and Borrowers

Trust agreements simplify asset management by allowing lenders to control collateral without transferring ownership, reducing administrative risks and accelerating loan processing. Security interests provide lenders with a legally enforceable claim on collateral, enhancing protection against borrower default but may involve complex registration and costs. Borrowers benefit from trust structures by maintaining asset ownership and flexibility, while security interests may limit asset use but offer clearer legal remedies in default scenarios.

Relevant Case Law and Statutory Provisions

Trusts are equitable interests governed primarily by established case law such as *Knight v Knight* [1840] 3 Beav 148, which outlines the three certainties necessary for a valid trust, while security interests are statutory rights created under instruments like the Uniform Commercial Code (UCC) Article 9 in the United States, providing creditors a lien on debtor's collateral. The distinction between trust and security interest is further clarified in landmark cases like *Barton v Armstrong* [1976] AC 104, emphasizing the fiduciary nature of trusts compared to the contractual basis of security interests. Statutory provisions such as the UCC's perfection rules and priority disputes underscore the operational mechanics of security interests, contrasting with equitable principles applied in trust enforcement.

Conclusion: Choosing Between Trust and Security Interest

Choosing between a trust and a security interest depends on the desired level of control and protection over assets. Trusts provide a structured way to manage and protect assets for beneficiaries with potential tax benefits, while security interests offer creditors a legal claim to collateral to secure debt repayment. Assessing the specific financial goals, asset types, and risk tolerance is essential for determining the optimal legal tool for asset management or debt security.

Trust Infographic

libterm.com

libterm.com