A warranty deed guarantees that the seller holds clear title to a property and has the legal right to transfer ownership to the buyer. It provides protection by assuring that the property is free from claims or liens, giving you peace of mind during real estate transactions. Discover everything you need to know about warranty deeds and how they safeguard your investment in the full article.

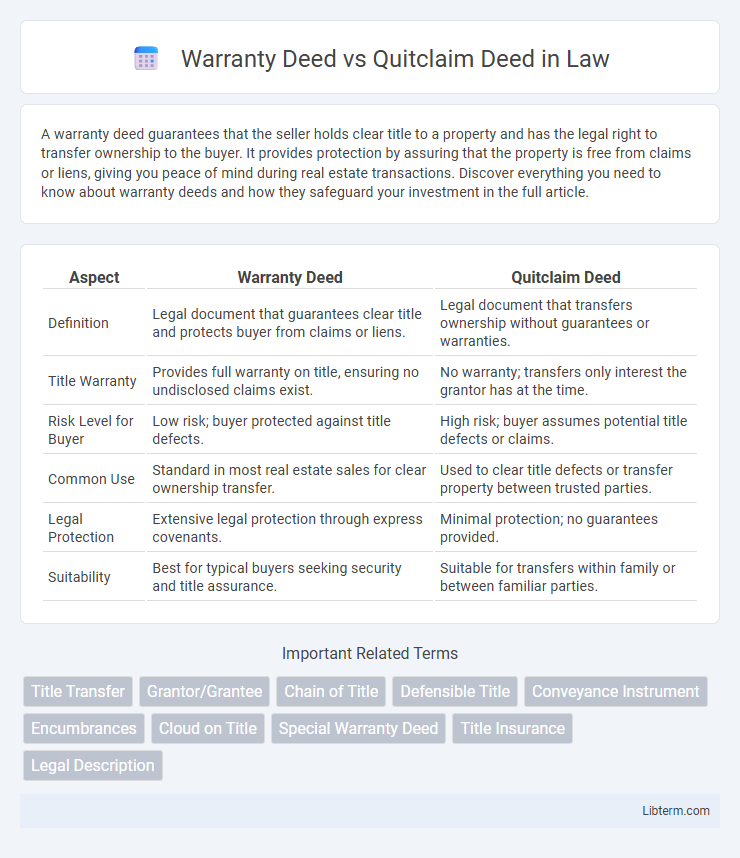

Table of Comparison

| Aspect | Warranty Deed | Quitclaim Deed |

|---|---|---|

| Definition | Legal document that guarantees clear title and protects buyer from claims or liens. | Legal document that transfers ownership without guarantees or warranties. |

| Title Warranty | Provides full warranty on title, ensuring no undisclosed claims exist. | No warranty; transfers only interest the grantor has at the time. |

| Risk Level for Buyer | Low risk; buyer protected against title defects. | High risk; buyer assumes potential title defects or claims. |

| Common Use | Standard in most real estate sales for clear ownership transfer. | Used to clear title defects or transfer property between trusted parties. |

| Legal Protection | Extensive legal protection through express covenants. | Minimal protection; no guarantees provided. |

| Suitability | Best for typical buyers seeking security and title assurance. | Suitable for transfers within family or between familiar parties. |

Introduction to Property Deeds

Property deeds serve as legal documents that transfer ownership of real estate, with Warranty Deeds providing a full guarantee against title defects, ensuring the grantor has clear ownership and the right to sell. Quitclaim Deeds transfer whatever interest the grantor may have without warranties, making them commonly used for transferring property between family members or resolving title issues. Understanding the differences in liability and protection is crucial when choosing between these types of deeds for property transactions.

What is a Warranty Deed?

A Warranty Deed is a legal document that guarantees the seller holds clear title to the property and has the right to sell it, providing the buyer with full protection against any future claims or liens. It includes specific covenants that assure the property is free of encumbrances, ensuring the buyer receives undisputed ownership. This type of deed offers the highest level of security in real estate transactions compared to other deed types like a Quitclaim Deed.

What is a Quitclaim Deed?

A Quitclaim Deed transfers a property owner's interest without guaranteeing the title's validity or existence, often used between family members or to clear up title issues. Unlike a Warranty Deed, it offers no warranty against liens or claims on the property. This type of deed provides a simple way to convey ownership but carries higher risks for the buyer due to the lack of title protection.

Key Differences Between Warranty and Quitclaim Deeds

Warranty deeds provide the strongest protection by guaranteeing clear title and legal ownership, including warranties against any future claims. Quitclaim deeds transfer whatever interest the grantor has without any warranties or guarantees, making them riskier for the grantee if disputes arise. The key difference lies in the level of title assurance and liability the grantor assumes, affecting buyer protection and transaction security.

Legal Protections and Buyer Security

A Warranty Deed offers comprehensive legal protections by guaranteeing that the seller holds clear title to the property and has the right to transfer ownership, shielding the buyer from future claims or liens. In contrast, a Quitclaim Deed transfers whatever interest the seller may have without warranties, providing minimal buyer security and leaving the buyer vulnerable to potential title defects. Buyers seeking maximum security should prioritize Warranty Deeds due to their explicit guarantees against title disputes.

Common Uses for Warranty Deeds

Warranty deeds are commonly used in real estate transactions to provide buyers with full assurance of clear ownership and title protection against any future claims. They guarantee that the seller holds a valid title free of encumbrances, making them ideal for traditional home sales and mortgage financing. These deeds offer legal recourse if title defects arise, ensuring buyer confidence and transactional security.

Common Uses for Quitclaim Deeds

Quitclaim deeds are commonly used to transfer property ownership between family members, clear up title issues, or remove a spouse's interest after a divorce. These deeds offer no guarantees or warranties about the title's validity, making them ideal for low-risk transactions where the parties have existing trust or knowledge of the property's status. They facilitate quick and straightforward transfers without the complexity of title insurance or extended title searches.

Advantages and Disadvantages of Each Deed

Warranty Deeds provide the strongest protection for buyers by guaranteeing clear title and defending against past claims, making them ideal for secure property transactions, but they typically require extensive title searches and higher costs. Quitclaim Deeds offer a faster, simpler way to transfer property interests without warranties, which can be advantageous for intra-family transfers or clearing title issues, yet they carry the risk of undisclosed claims and limited buyer protection. Choosing between these deeds depends on balancing the need for legal assurance against the speed and cost of transfer in real estate transactions.

Which Deed Should You Choose?

Choosing between a Warranty Deed and a Quitclaim Deed depends on the level of protection desired during property transfers. A Warranty Deed provides the grantee with guaranteed clear title and legal rights against any prior claims, making it ideal for traditional real estate sales. Quitclaim Deeds transfer whatever interest the grantor holds without warranties, best suited for transfers between family members or clearing title defects.

Final Thoughts on Deed Selection

Choosing between a Warranty Deed and a Quitclaim Deed depends on the level of protection desired in a property transfer. Warranty Deeds offer comprehensive guarantees against title defects, making them ideal for traditional sales, while Quitclaim Deeds provide no such warranties and are often used in family transfers or quick property changes. Carefully assessing the circumstances, potential risks, and the relationship between parties ensures the most appropriate and secure deed selection.

Warranty Deed Infographic

libterm.com

libterm.com