Foreclosure occurs when a homeowner fails to make mortgage payments, leading the lender to seize and sell the property to recover the loan balance. Understanding the foreclosure process, potential consequences, and possible alternatives can help you protect your credit and financial future. Explore the full article to learn how to navigate foreclosure and safeguard your home.

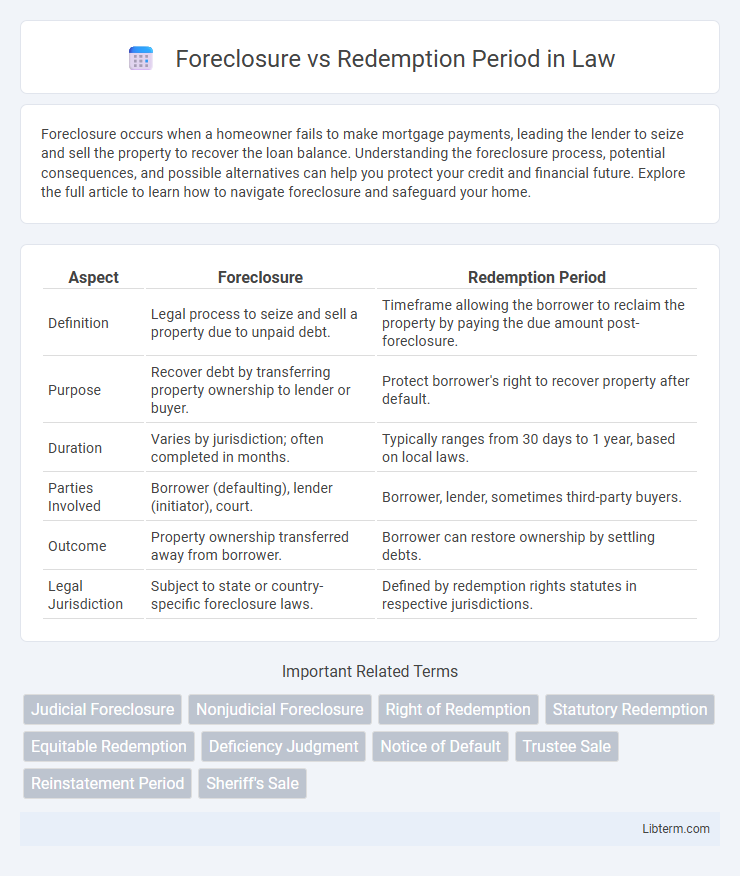

Table of Comparison

| Aspect | Foreclosure | Redemption Period |

|---|---|---|

| Definition | Legal process to seize and sell a property due to unpaid debt. | Timeframe allowing the borrower to reclaim the property by paying the due amount post-foreclosure. |

| Purpose | Recover debt by transferring property ownership to lender or buyer. | Protect borrower's right to recover property after default. |

| Duration | Varies by jurisdiction; often completed in months. | Typically ranges from 30 days to 1 year, based on local laws. |

| Parties Involved | Borrower (defaulting), lender (initiator), court. | Borrower, lender, sometimes third-party buyers. |

| Outcome | Property ownership transferred away from borrower. | Borrower can restore ownership by settling debts. |

| Legal Jurisdiction | Subject to state or country-specific foreclosure laws. | Defined by redemption rights statutes in respective jurisdictions. |

Understanding Foreclosure: Key Concepts

Foreclosure is a legal process where a lender attempts to recover the balance of a loan from a borrower who has stopped making payments by forcing the sale of the asset used as collateral, typically a home. The redemption period is a specific timeframe after the foreclosure sale during which the borrower can reclaim the property by paying the full amount owed, including fees and interest. Understanding these key concepts helps borrowers grasp their rights and the deadlines involved in the foreclosure and potential property recovery process.

What is the Redemption Period?

The redemption period is a legally defined timeframe after a foreclosure sale during which the original homeowner can reclaim their property by paying the full amount owed, including taxes, fees, and interest. This period varies by state law but typically ranges from a few months to a year, offering a last chance to avoid loss of ownership. Understanding the redemption period is crucial for homeowners facing foreclosure, as it provides an opportunity to recover the property and avoid eviction.

Foreclosure Process Explained

The foreclosure process initiates when a borrower defaults on mortgage payments, leading the lender to file a public notice of default. This typically proceeds with a series of legal steps including notice of sale and auction, where the property is sold to recover the owed debt. The redemption period, varying by state law, allows the borrower limited time after the sale to reclaim the property by paying the full amount owed, including fees and interest.

Steps Involved in the Redemption Period

The redemption period in foreclosure allows homeowners to reclaim their property by paying the full amount owed, including back payments, interest, and fees, following a foreclosure sale. To initiate this process, the homeowner must first notify the foreclosure trustee and then submit the redemption payment within the legally defined timeframe, which varies by state. Failure to complete these steps results in the permanent transfer of ownership to the winning bidder at the foreclosure auction.

Foreclosure Laws: State-by-State Differences

Foreclosure laws vary significantly across states, influencing the duration and process of the foreclosure and redemption periods. Some states follow a judicial foreclosure process requiring court approval, while others allow non-judicial foreclosure, expediting property repossession. Redemption periods, during which homeowners can reclaim their property by paying the debt, also differ, ranging from a few days to over a year depending on state statutes.

Borrower Rights During Foreclosure

During the foreclosure process, borrowers retain specific rights that protect their interests, including the redemption period, which allows them to reclaim their property by paying off the outstanding debt. The redemption period varies by jurisdiction but typically ranges from a few months to over a year, providing borrowers time to settle arrears or negotiate alternatives. Understanding these rights is crucial for borrowers to potentially avoid permanent loss of their home during foreclosure proceedings.

How the Redemption Period Impacts Homeowners

The redemption period allows homeowners a critical timeframe to reclaim their property after foreclosure by paying off the owed debt, which can prevent immediate loss of their home. This window varies by state but typically ranges from a few months to a year, offering financial breathing room for homeowners to secure funds or negotiate repayment. Without the redemption period, homeowners face irreversible title transfer, increasing the risk of losing all equity built in the home.

Key Differences Between Foreclosure and Redemption

Foreclosure is the legal process where a lender seizes and sells a property due to the borrower's failure to pay the mortgage, resulting in the loss of ownership rights. The redemption period is a specific timeframe after foreclosure during which the borrower can reclaim the property by paying the full amount owed, including fees. Key differences include foreclosure terminating the homeowner's rights, while the redemption period provides a last chance to prevent permanent loss by fulfilling debt obligations.

Strategies to Avoid Foreclosure

Implementing a budget plan and negotiating loan modifications with lenders are effective strategies to avoid foreclosure during the redemption period. Homeowners can seek mortgage forbearance or refinance options to manage payments better and protect their property rights. Utilizing state-specific foreclosure prevention programs and consulting with housing counselors also increase the chances of retaining ownership before the redemption period expires.

FAQs: Foreclosure and Redemption Period

The foreclosure process legally transfers property ownership from a borrower to a lender after loan default, often culminating in a public auction. The redemption period is a defined timeframe post-foreclosure during which the original homeowner can reclaim the property by paying the full amount owed, including fees and penalties. Key FAQs address the length of redemption periods, which vary by state, and the financial obligations required to redeem the property successfully.

Foreclosure Infographic

libterm.com

libterm.com