Express trust offers a streamlined solution for transferring assets efficiently while minimizing legal complexities and probate costs. It ensures your beneficiaries receive their inheritance promptly and according to your specific wishes. Explore the full benefits of an express trust and how it can secure your estate's future in the rest of this article.

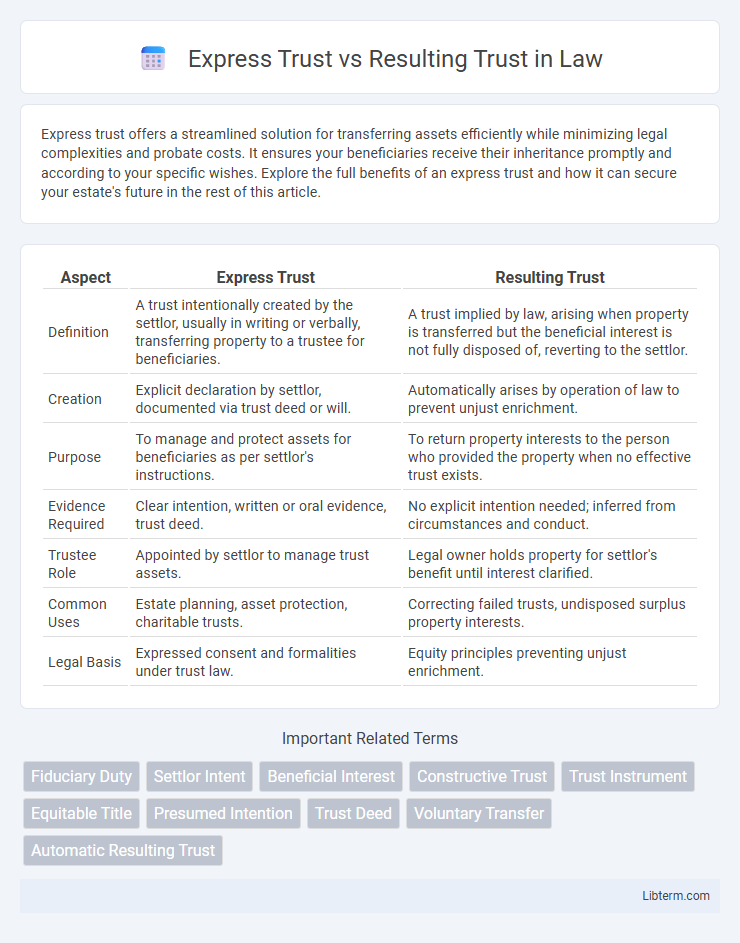

Table of Comparison

| Aspect | Express Trust | Resulting Trust |

|---|---|---|

| Definition | A trust intentionally created by the settlor, usually in writing or verbally, transferring property to a trustee for beneficiaries. | A trust implied by law, arising when property is transferred but the beneficial interest is not fully disposed of, reverting to the settlor. |

| Creation | Explicit declaration by settlor, documented via trust deed or will. | Automatically arises by operation of law to prevent unjust enrichment. |

| Purpose | To manage and protect assets for beneficiaries as per settlor's instructions. | To return property interests to the person who provided the property when no effective trust exists. |

| Evidence Required | Clear intention, written or oral evidence, trust deed. | No explicit intention needed; inferred from circumstances and conduct. |

| Trustee Role | Appointed by settlor to manage trust assets. | Legal owner holds property for settlor's benefit until interest clarified. |

| Common Uses | Estate planning, asset protection, charitable trusts. | Correcting failed trusts, undisposed surplus property interests. |

| Legal Basis | Expressed consent and formalities under trust law. | Equity principles preventing unjust enrichment. |

Introduction to Trusts: Express vs Resulting

Express trusts are deliberately created by a settlor through clear instructions, usually documented in writing, specifying the trust's purpose, beneficiaries, and trustee powers. Resulting trusts arise by operation of law when the intentions of the parties are unclear or when property transfer does not fulfill the settlor's intent, leading the property to "result" back to the settlor or their estate. Understanding the distinction is pivotal in trust law, as express trusts reflect explicit intentions, whereas resulting trusts address implied or incomplete intentions.

Defining Express Trusts

Express trusts are deliberately created legal arrangements in which a settlor explicitly transfers property to a trustee to hold for the benefit of specified beneficiaries, clearly outlining the terms and intentions in a written or oral declaration. These trusts require clear manifestation of the settlor's intent, a defined trust property, an identifiable trustee, and ascertainable beneficiaries to ensure proper administration and enforcement. Resulting trusts, by contrast, arise by operation of law when property is transferred under circumstances suggesting the transferor did not intend to benefit the transferee, typically filling gaps where express trusts fail or are incomplete.

Key Elements of Resulting Trusts

Resulting trusts arise when property is transferred under circumstances suggesting the transferor did not intend to part with beneficial ownership, often due to lack of consideration or failed express trusts. Key elements include the presumption of intention that the beneficial interest returns to the transferor, the absence of an explicit trust declaration, and the equitable remedy addressing situations where legal title does not align with beneficial ownership. This contrasts with express trusts, which depend on clear, intentional trust declarations and defined trustee duties.

Legal Distinctions Between Express and Resulting Trusts

Express trusts are intentionally created by the settlor, clearly outlining the trust's terms, beneficiaries, and trustee duties, and are typically formalized through written documentation or declarations. Resulting trusts arise by operation of law when property is transferred under circumstances suggesting the transferor did not intend to benefit the transferee, often filling gaps where no express trust exists or where an express trust fails. The key legal distinction lies in express trusts being based on explicit settlor intention, whereas resulting trusts depend on inferred intent and equitable principles to prevent unjust enrichment.

Creation and Formation of Express Trusts

Creation of express trusts requires a clear intention by the settlor to transfer legal title to a trustee for the benefit of beneficiaries, typically documented through a written trust deed or declaration of trust. Express trusts form when the trustee accepts the role, establishing fiduciary duties and equitable responsibilities governed by trust law. Unlike resulting trusts, which arise by operation of law to reflect presumed intentions, express trusts depend on explicit, deliberate acts and formalities to be valid and enforceable.

Circumstances Leading to Resulting Trusts

Resulting trusts typically arise when express trusts fail or do not exhaust the trust property, causing the equity to revert to the settlor or their estate. Common circumstances include situations where the trust purpose is not fulfilled, or when there is an incomplete disposition of trust assets, prompting courts to infer an intention to preserve the settlor's beneficial interest. These trusts are crucial in preventing unjust enrichment by ensuring property is held for the rightful equitable owner when no explicit trust terms apply.

Rights and Duties of Trustees in Both Trust Types

Express trusts impose explicit duties on trustees to manage trust property according to the settlor's instructions, ensuring fiduciary responsibilities such as loyalty, prudence, and impartiality towards beneficiaries. Resulting trusts arise by operation of law, with trustees holding property for the settlor or intended beneficiary when express intentions are unclear, and their duties primarily involve preserving the trust property and accounting for its management. Both trust types require trustees to act in good faith, avoid conflicts of interest, and uphold the equitable rights of beneficiaries, though express trusts typically entail more detailed and formalized obligations.

Case Law: Notable Express and Resulting Trust Decisions

In Express Trust cases, landmark decisions such as Knight v Knight (1840) established the three certainties essential for valid trust creation: intention, subject matter, and objects. Resulting Trusts have been shaped by rulings like Vandervell v Inland Revenue Commissioners (1967), which clarified when beneficial interests revert to the settlor due to failure of express trust terms. The distinction between these trust types is further elaborated in Westdeutsche Landesbank Girozentrale v Islington LBC (1996), emphasizing the role of intention and resulting trust principles in proprietary claims.

Practical Examples: Express Trusts vs Resulting Trusts

Express trusts arise from clear, intentional declarations, such as a property owner explicitly stating in a will that a trustee holds land for a beneficiary's benefit; resulting trusts occur when property is transferred but the transferor's intention to retain beneficial interest is inferred, like when one pays for property but titles it in another's name. For example, a settlor creates an express trust by formally transferring assets to a trustee to manage for a child's education, while a resulting trust may be established when an individual purchases a home but places it in a relative's name without gifting intent, implying the purchaser retains equitable interest. The primary distinction lies in express trusts being deliberately established to benefit others, whereas resulting trusts reflect an implied return of property interest due to absence of intent to gift.

Choosing the Right Trust: Factors to Consider

Choosing the right trust involves evaluating the grantor's intentions, the clarity of trust terms, and the specific asset protection needs. Express trusts are deliberately created with explicit instructions, offering clear control and management of assets, while resulting trusts arise by operation of law to reflect presumed intent when express trusts fail or are incomplete. Consider the purpose, legal requirements, and desired outcomes to determine whether an express or resulting trust best aligns with estate planning goals and fiduciary duties.

Express Trust Infographic

libterm.com

libterm.com