Contingency fee arrangements allow you to hire a lawyer without upfront costs, paying only if the case is won, typically as a percentage of the settlement or judgment. This fee structure aligns the lawyer's interests with yours, offering access to legal representation even when funds are limited. Explore the rest of the article to understand how contingency fees work and whether they are the right choice for your case.

Table of Comparison

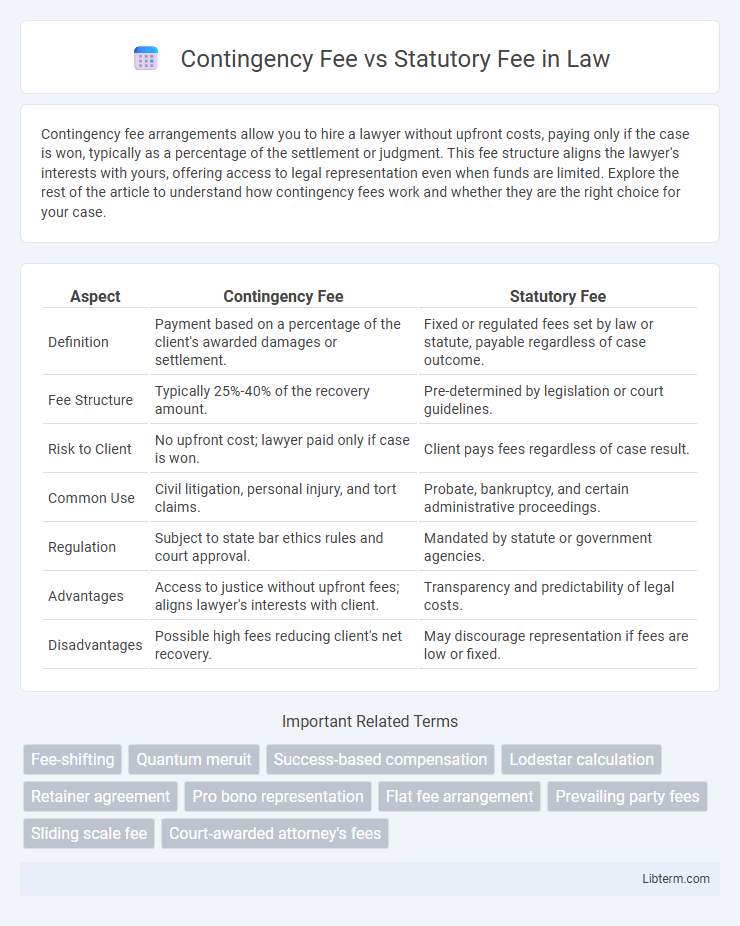

| Aspect | Contingency Fee | Statutory Fee |

|---|---|---|

| Definition | Payment based on a percentage of the client's awarded damages or settlement. | Fixed or regulated fees set by law or statute, payable regardless of case outcome. |

| Fee Structure | Typically 25%-40% of the recovery amount. | Pre-determined by legislation or court guidelines. |

| Risk to Client | No upfront cost; lawyer paid only if case is won. | Client pays fees regardless of case result. |

| Common Use | Civil litigation, personal injury, and tort claims. | Probate, bankruptcy, and certain administrative proceedings. |

| Regulation | Subject to state bar ethics rules and court approval. | Mandated by statute or government agencies. |

| Advantages | Access to justice without upfront fees; aligns lawyer's interests with client. | Transparency and predictability of legal costs. |

| Disadvantages | Possible high fees reducing client's net recovery. | May discourage representation if fees are low or fixed. |

Introduction to Legal Fee Structures

Legal fee structures typically include contingency fees and statutory fees, each serving distinct purposes in legal representation. Contingency fees are commonly used in personal injury and civil cases, where the attorney receives a percentage of the client's awarded damages only upon a successful outcome. Statutory fees, often found in bankruptcy or probate law, are fixed by law or court rules, ensuring predictable legal costs regardless of case results.

What is a Contingency Fee?

A contingency fee is a payment arrangement where an attorney receives a percentage of the client's awarded damages only if the case is successful, typically ranging from 25% to 40%. This fee structure aligns the lawyer's incentives with the client's outcome, making legal representation accessible without upfront costs. Contingency fees are common in personal injury, wrongful death, and class action lawsuits, contrasting with statutory fees that are fixed by law regardless of case results.

What is a Statutory Fee?

A statutory fee is a fixed amount set by law that must be paid for specific legal services, ensuring transparency and consistency in billing. Unlike contingency fees, which depend on the outcome of a case, statutory fees are predetermined regardless of the case result. These fees often apply in government-related legal matters, probate, or court filing charges, protecting clients from unpredictable legal costs.

Key Differences Between Contingency and Statutory Fees

Contingency fees are calculated as a percentage of the client's awarded damages, typically ranging from 25% to 40%, and are only payable if the case is won. Statutory fees, on the other hand, are fixed by law or statute, applying predetermined rates regardless of the case outcome. Key differences include payment structure, risk allocation, and fee determination, with contingency fees incentivizing attorneys to secure higher settlements, while statutory fees provide predictable, mandated compensation.

Pros and Cons of Contingency Fees

Contingency fees allow clients to access legal representation without upfront costs, making justice attainable for those with limited financial resources, but they often result in a higher overall payment if the case is successful. Lawyers are incentivized to win under contingency arrangements, which can lead to diligent case management, yet this model may lead to the rejection of cases with low financial returns despite their legitimacy. Conversely, statutory fees provide predictable costs set by law but require clients to pay regardless of outcome, limiting access for those unable to afford initial expenses.

Pros and Cons of Statutory Fees

Statutory fees provide a transparent and regulated payment structure, ensuring clients pay a fixed percentage set by law, which offers predictability and protection from inflated legal costs. However, these fees can be inflexible, often leading to higher costs for clients in straightforward cases compared to contingency fees that align attorney payment with case success. The rigid nature of statutory fees may discourage attorneys from taking on high-risk cases, limiting access to legal representation for some clients.

Common Legal Cases for Contingency Fees

Contingency fees are commonly used in personal injury, medical malpractice, and workers' compensation cases, where lawyers receive a percentage of the client's awarded damages only if the case is won. Statutory fees, on the other hand, are fixed or regulated fees set by law, often applied in bankruptcy or probate cases, ensuring standardized payment regardless of the case outcome. Clients in common legal cases such as accident claims or wrongful death lawsuits often prefer contingency fee arrangements to minimize upfront legal costs.

Common Legal Cases for Statutory Fees

Common legal cases involving statutory fees typically include probate, bankruptcy, and family law matters such as divorce or child custody disputes. Statutory fees are fixed or capped by law, ensuring predictable costs and often applying in cases where legal services are mandated or regulated by specific statutes. Contingency fees, in contrast, are common in personal injury or tort claims where attorneys receive a percentage of the awarded damages only if the case is won.

How to Choose the Right Fee Structure

Choosing between contingency fee and statutory fee structures depends largely on financial risk tolerance and case type. Contingency fees are ideal for plaintiffs who cannot afford upfront legal costs and are willing to pay only upon winning, typically ranging from 25% to 40% of the recovery amount. Statutory fees, often fixed by law for specific cases like bankruptcy or social security claims, provide predictable costs and are preferable when fee regulations and case certainty are key considerations.

Conclusion: Making an Informed Decision

Choosing between contingency fee and statutory fee structures depends on your financial situation and case specifics. Contingency fees offer risk-free access to legal services by charging a percentage of the recovery, ideal for plaintiffs with limited upfront funds. Statutory fees provide clarity and predictability through fixed or court-determined amounts, beneficial in cases with set fee guidelines or government involvement.

Contingency Fee Infographic

libterm.com

libterm.com