Contribution shapes the foundation of progress by offering valuable skills, resources, and support to collective efforts. Your active participation enhances community growth and drives meaningful change. Explore the rest of this article to discover how your contributions can make a lasting impact.

Table of Comparison

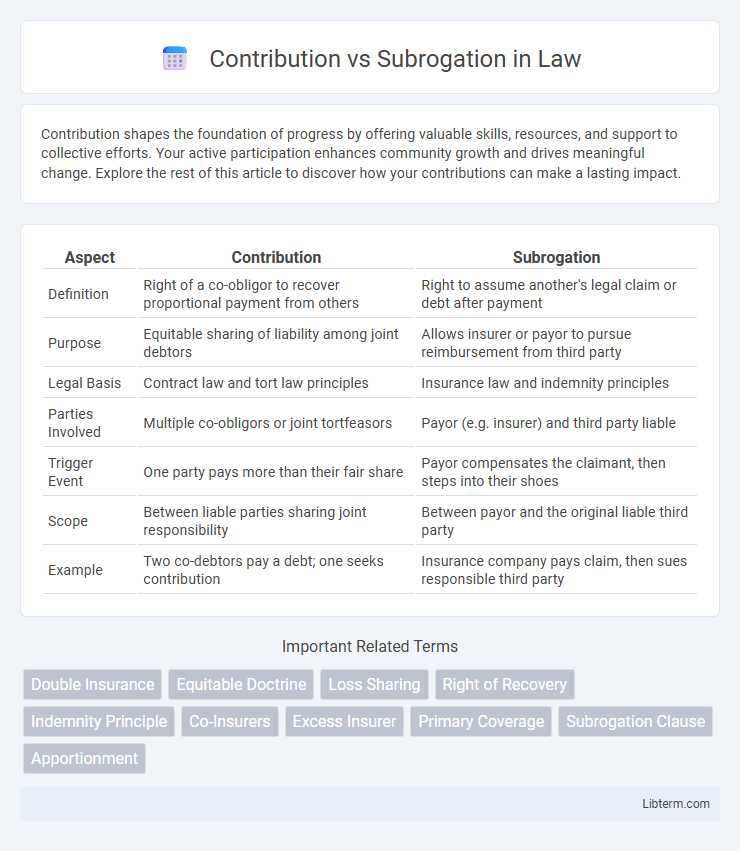

| Aspect | Contribution | Subrogation |

|---|---|---|

| Definition | Right of a co-obligor to recover proportional payment from others | Right to assume another's legal claim or debt after payment |

| Purpose | Equitable sharing of liability among joint debtors | Allows insurer or payor to pursue reimbursement from third party |

| Legal Basis | Contract law and tort law principles | Insurance law and indemnity principles |

| Parties Involved | Multiple co-obligors or joint tortfeasors | Payor (e.g. insurer) and third party liable |

| Trigger Event | One party pays more than their fair share | Payor compensates the claimant, then steps into their shoes |

| Scope | Between liable parties sharing joint responsibility | Between payor and the original liable third party |

| Example | Two co-debtors pay a debt; one seeks contribution | Insurance company pays claim, then sues responsible third party |

Understanding Contribution and Subrogation

Understanding contribution involves the principle where multiple parties sharing liability distribute the financial burden proportionally after a loss, ensuring no single party pays more than their fair share. Subrogation occurs when an insurer, after compensating the insured for a loss, acquires the insured's legal right to pursue recovery from a third party responsible for the damage. Both concepts are crucial in insurance claims to prevent double recovery and maintain equitable financial responsibility among liable parties.

Definition of Contribution

Contribution refers to the principle where multiple parties who are liable for the same loss share the financial burden proportionately to their responsibility or benefit. It ensures fairness by requiring each liable party to pay an equitable share, preventing one party from bearing the entire cost. This concept is commonly applied in insurance claims and tort law to distribute compensation among co-obligors.

Definition of Subrogation

Subrogation is a legal mechanism where one party, typically an insurer, assumes the rights and remedies of another party to recover costs after indemnifying a loss. It allows the insurer to pursue third parties responsible for the damage, thereby preventing the insured from receiving double compensation. Unlike contribution, which involves sharing loss among multiple insurers, subrogation enables a single insurer to seek reimbursement from liable parties.

Key Differences Between Contribution and Subrogation

Contribution involves multiple parties sharing liability for a loss based on their respective shares, ensuring equitable distribution of financial responsibility among co-obligors. Subrogation allows an insurer who has compensated the insured to step into the insured's shoes and recover costs from a third party responsible for the loss, effectively transferring the right of recovery. Key differences lie in their purpose: contribution addresses sharing of liability between jointly liable parties, while subrogation focuses on reimbursement from a third party after indemnification.

Legal Principles Governing Contribution

The legal principles governing contribution emphasize the equitable distribution of liability among parties who are jointly responsible for a loss, ensuring that each party pays their fair share based on the degree of fault or obligation. Contribution arises after one party has paid more than their proportionate share and seeks reimbursement from others liable for the same obligation, reflecting principles of fairness and proportionality. Subrogation, distinct from contribution, involves a party stepping into the shoes of another to recover costs from a third party, but does not alter the underlying proportional liability between co-obligors.

Legal Principles Governing Subrogation

The legal principles governing subrogation establish that a party who pays a debt or claim on behalf of another gains the right to step into the shoes of the creditor to recover the amount from the responsible party. Subrogation is rooted in equity, preventing unjust enrichment by ensuring the paying party is reimbursed without imposing double liability on the debtor. Unlike contribution, which involves shared liability among joint obligors, subrogation transfers the right of recovery to the paying party after full discharge of the debt.

Practical Examples: Contribution in Insurance

Contribution in insurance occurs when multiple insurers cover the same risk and share the loss payment proportionately, preventing the insured from claiming full compensation from each policy. For example, if a homeowner holds two insurance policies covering fire damage totaling $500,000 and suffers $300,000 in losses, both insurers will contribute according to their policy limits, such as 60% and 40% respectively. This ensures equitable distribution of liability among insurers, maintaining fairness and avoiding overpayment.

Practical Examples: Subrogation in Insurance

Subrogation in insurance allows an insurer to step into the shoes of the insured to recover costs from a third party responsible for the loss, such as when a car owner files a claim with their insurer after an accident caused by another driver, and the insurer subsequently pursues the at-fault driver for reimbursement. Contribution involves multiple insurers sharing the compensation payment when more than one policy covers the same loss, such as when two insurance companies provide overlapping liability coverage and must proportionally divide the claim payout. A practical example of subrogation is when a homeowner's insurer pays for fire damage caused by a contractor's negligence and then seeks reimbursement from the contractor's liability insurer.

Impact of Contribution and Subrogation on Claims Handling

Contribution and subrogation significantly influence claims handling by determining the allocation of financial responsibility among insurers and claimants. Contribution allows multiple insurers sharing risk to proportionally share claim costs, reducing individual liability and promoting equitable cost distribution. Subrogation empowers an insurer to recover payments from a liable third party, minimizing overall losses and encouraging accurate identification of fault in the claims process.

Common Challenges and Solutions in Application

Common challenges in contribution and subrogation include determining the proportional liability among multiple parties and navigating complex legal frameworks that vary by jurisdiction. Solutions involve clear contractual agreements, thorough documentation of claims, and employing dispute resolution mechanisms such as mediation or arbitration to streamline recovery processes. Effective communication between insurers and claimants enhances accurate allocation of financial responsibility and prevents overlapping or denied payments.

Contribution Infographic

libterm.com

libterm.com