Fraud involves deliberate deception to secure unfair or unlawful gain, impacting individuals and organizations alike. Understanding the various types, warning signs, and prevention strategies is crucial to protect your assets and reputation. Explore the rest of the article to learn how to identify and safeguard against fraud effectively.

Table of Comparison

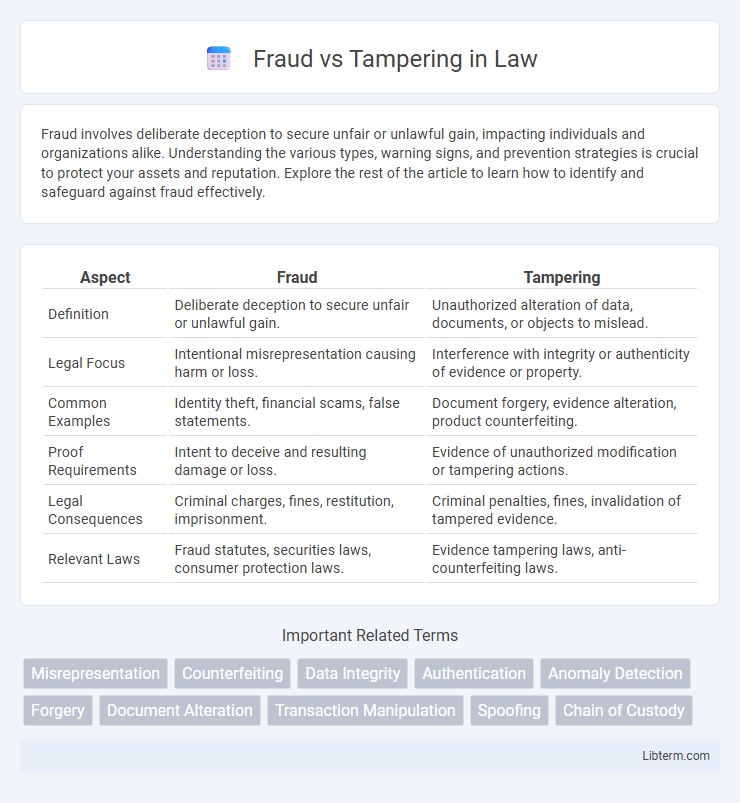

| Aspect | Fraud | Tampering |

|---|---|---|

| Definition | Deliberate deception to secure unfair or unlawful gain. | Unauthorized alteration of data, documents, or objects to mislead. |

| Legal Focus | Intentional misrepresentation causing harm or loss. | Interference with integrity or authenticity of evidence or property. |

| Common Examples | Identity theft, financial scams, false statements. | Document forgery, evidence alteration, product counterfeiting. |

| Proof Requirements | Intent to deceive and resulting damage or loss. | Evidence of unauthorized modification or tampering actions. |

| Legal Consequences | Criminal charges, fines, restitution, imprisonment. | Criminal penalties, fines, invalidation of tampered evidence. |

| Relevant Laws | Fraud statutes, securities laws, consumer protection laws. | Evidence tampering laws, anti-counterfeiting laws. |

Understanding Fraud: Definition and Key Characteristics

Fraud involves deliberate deception to secure unfair or unlawful gain, characterized by intentional misrepresentation, concealment of facts, or false statements. Key characteristics include premeditation, intent to deceive, and causing harm or loss to another party. Unlike tampering, which often refers to unauthorized alteration or interference with physical evidence or data, fraud centers on manipulating trust for personal or financial advantage.

What is Tampering? An Overview

Tampering refers to the deliberate alteration, manipulation, or interference with a product, data, or system to cause unauthorized changes or damage. It commonly involves physical manipulation, such as opening sealed packaging or modifying electronic components, and can compromise the integrity, safety, or functionality of the affected item. Tampering is distinct from fraud as it focuses on unauthorized interference rather than deceptive practices aimed at financial gain.

Types of Fraud: Common Methods and Tactics

Common types of fraud include identity theft, credit card fraud, and insurance fraud, each utilizing tactics such as phishing, social engineering, and document forgery to deceive victims. Tampering involves unauthorized alterations to systems or data, often seen in product counterfeiting, election interference, and cybersecurity breaches through malware or manipulation of software code. Both fraud and tampering exploit vulnerabilities to achieve financial gain or disrupt trust, necessitating robust detection and prevention measures.

Types of Tampering: Techniques and Examples

Tampering involves altering, manipulating, or interfering with data, devices, or systems to achieve unauthorized outcomes, commonly seen in software, hardware, and documentation. Techniques include data tampering, such as modifying database entries or transaction records; hardware tampering, like implanting malicious chips or circuit modifications; and code tampering, where attackers inject malware or modify source code to bypass security. Examples range from altering financial records to insert fraudulent transactions, physically manipulating ATM machines to steal card data, and injecting malicious code into applications for unauthorized access.

Motivations Behind Fraud and Tampering

Fraud is primarily motivated by financial gain, personal advantage, or deception to manipulate outcomes for illicit profit, often involving deliberate false representation. Tampering's motivation typically centers on altering, damaging, or interfering with data or systems to disrupt processes, sabotage evidence, or conceal wrongdoing. Both acts compromise integrity but differ in intent: fraud aims at deceptive benefit, while tampering focuses on manipulation or obstruction.

Key Differences Between Fraud and Tampering

Fraud involves intentional deception to gain an unfair or unlawful advantage, often targeting financial transactions or personal information, whereas tampering specifically refers to unauthorized interference or alteration of objects, data, or systems. Fraud typically relies on manipulating facts or documents to mislead victims, while tampering is characterized by physical or digital modification to compromise integrity or functionality. Understanding these distinctions is crucial for legal classification and implementing appropriate security measures against each threat.

Legal Implications: Fraud vs Tampering

Fraud involves intentional deception to secure unfair or unlawful gain, often leading to criminal charges and significant civil penalties under laws like wire fraud statutes and the False Claims Act. Tampering refers to the deliberate alteration or interference with products, documents, or systems, frequently prosecuted under statutes related to product tampering, evidence tampering, or computer crimes. Legal implications for fraud typically result in harsher sentencing due to its broader impact on trust and financial loss, whereas tampering charges focus on the integrity and safety of the affected items or information.

Detection Methods for Fraud and Tampering

Detection methods for fraud often involve pattern recognition algorithms, anomaly detection systems, and transactional monitoring to identify unusual behaviors indicative of deceit or manipulation. Tampering detection relies heavily on forensic analysis techniques, such as checksum verification, sensor data integrity checks, and digital watermarking to uncover unauthorized alterations in data or physical materials. Advanced AI-driven models and machine learning enable real-time identification of both fraud and tampering by analyzing vast datasets and flagging inconsistencies.

Real-World Cases: Comparing Fraud and Tampering

Real-world cases of fraud often involve intentional deception for financial gain, such as Ponzi schemes and accounting fraud, whereas tampering typically refers to unauthorized alterations of products or data, seen in examples like food contamination or election result manipulation. Fraud cases focus on misrepresentation and victim deception, while tampering emphasizes physical or digital interference to disrupt trust or safety. High-profile fraud case studies include the Enron scandal, contrasting with tampering incidents like vaccine vial contamination, both demonstrating significant legal and ethical ramifications.

Best Practices for Prevention and Risk Management

Implementing strong authentication protocols and regular audits are essential best practices for preventing fraud and tampering in financial and operational systems. Utilizing advanced encryption methods along with real-time monitoring tools can significantly reduce the risk of unauthorized access and data manipulation. Comprehensive employee training combined with strict access controls ensures early detection and mitigation of fraudulent activities and tampering attempts.

Fraud Infographic

libterm.com

libterm.com