Sole ownership grants you complete control and responsibility over a property or business, allowing for straightforward decision-making and management. This ownership type simplifies legal and financial obligations but also means you bear all risks and liabilities alone. Discover how sole ownership could impact your investments and learn key considerations in the rest of this article.

Table of Comparison

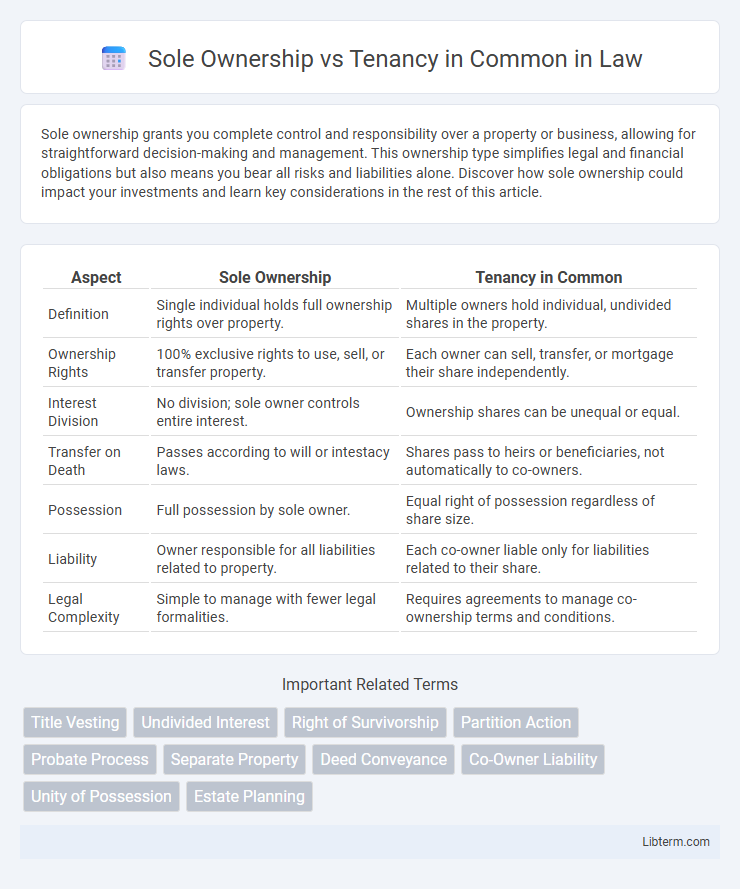

| Aspect | Sole Ownership | Tenancy in Common |

|---|---|---|

| Definition | Single individual holds full ownership rights over property. | Multiple owners hold individual, undivided shares in the property. |

| Ownership Rights | 100% exclusive rights to use, sell, or transfer property. | Each owner can sell, transfer, or mortgage their share independently. |

| Interest Division | No division; sole owner controls entire interest. | Ownership shares can be unequal or equal. |

| Transfer on Death | Passes according to will or intestacy laws. | Shares pass to heirs or beneficiaries, not automatically to co-owners. |

| Possession | Full possession by sole owner. | Equal right of possession regardless of share size. |

| Liability | Owner responsible for all liabilities related to property. | Each co-owner liable only for liabilities related to their share. |

| Legal Complexity | Simple to manage with fewer legal formalities. | Requires agreements to manage co-ownership terms and conditions. |

Understanding Sole Ownership: Definition and Key Features

Sole ownership refers to legal possession of property by a single individual who holds complete control and rights to manage, use, and transfer the asset without requiring consent from others. Key features include exclusive decision-making authority, sole responsibility for liabilities, and the ability to bequeath the property through a will. This form of ownership provides clear title and simplifies transactions but excludes co-owners from having any legal interest or claim.

What is Tenancy in Common? Core Characteristics Explained

Tenancy in Common is a form of property co-ownership where each owner holds an individual, undivided interest that can vary in size and is inheritable. Unlike sole ownership, tenants in common have separate shares, allowing each party to sell, transfer, or bequeath their interest independently without affecting the others. Core characteristics include the absence of the right of survivorship, distinct ownership percentages, and flexibility in managing shared property rights among co-owners.

Legal Distinctions: Sole Ownership vs Tenancy in Common

Sole ownership grants one person full legal title and control over the entire property, allowing unrestricted rights to sell, transfer, or encumber the asset. Tenancy in Common involves two or more individuals holding undivided fractional interests, each with distinct ownership percentages and the ability to transfer their share independently. Unlike joint tenancy, tenancy in common does not include the right of survivorship, meaning each owner's interest passes according to their will or estate plan upon death.

Rights and Responsibilities of Sole Owners

Sole ownership grants an individual complete control over property decisions, including the right to sell, lease, or modify assets without requiring consent from others, ensuring full autonomy and responsibility. Sole owners bear singular liability for property debts, taxes, and maintenance costs, which necessitates diligent financial management and legal compliance. Unlike tenants in common, sole owners cannot transfer ownership shares without selling the entire property, making estate planning and succession critical considerations.

Rights and Responsibilities of Tenants in Common

Tenants in common each hold an individual, undivided ownership interest in a property, allowing them to independently sell, transfer, or bequeath their share without the consent of other co-owners. Each tenant in common has the right to possess and use the entire property, despite owning a specific fractional interest, and is responsible for their proportionate share of expenses such as property taxes, mortgage payments, and maintenance costs. Unlike sole ownership, tenancy in common does not provide the right of survivorship, meaning a deceased tenant's interest passes according to their will or state inheritance laws.

Property Transfer and Inheritance Implications

Sole ownership allows an individual to have complete control over property transfer and inheritance, enabling them to will the property according to personal wishes without requiring consent from others. In contrast, tenancy in common involves multiple owners holding distinct shares, each with the right to transfer or bequeath their interest independently, which can lead to multiple heirs owning fractional property interests. This distinction significantly affects estate planning, as sole ownership simplifies probate, while tenancy in common may complicate inheritance due to separate ownership interests and potential disputes among co-owners.

Financial Considerations: Taxes, Loans, and Liabilities

Sole ownership allows for straightforward tax reporting and full control over loan applications, but it places all financial liabilities on one person, increasing personal risk. Tenancy in common divides ownership percentages, requiring coordinated tax filings and potentially complicating loan approvals as lenders assess multiple borrowers' creditworthiness. Liabilities in tenancy in common are shared proportionally, which can mitigate individual financial exposure but necessitate clear agreements to prevent disputes over debt responsibility.

Conflict Resolution Mechanisms for Co-Owners

Conflict resolution mechanisms for co-owners under Tenancy in Common typically involve mediation, negotiation, and, if necessary, court intervention to address disputes over use, management, or sale of the property. Sole Ownership eliminates internal conflicts since a single party holds full legal title and decision-making authority, streamlining conflict resolution by avoiding disputes among co-owners. Legal tools like partition actions for Tenancy in Common allow co-owners to compel sale or division of property when amicable agreements cannot be reached.

Pros and Cons: Sole Ownership vs Tenancy in Common

Sole ownership offers complete control over the property, allowing the owner to make decisions without consultation, but it carries the risk of probate delay and full liability for debts. Tenancy in common enables multiple owners to hold distinct shares and transfer interests independently, providing flexibility and shared financial responsibility, yet it may lead to disputes and requires unanimous consent for major decisions. While sole ownership simplifies management, tenancy in common promotes investment collaboration but demands clear agreements to prevent conflicts.

Choosing the Right Ownership Structure for Your Needs

Sole ownership offers complete control and responsibility over property, ideal for individuals seeking full authority without shared decision-making. Tenancy in common provides flexible ownership shares and allows multiple parties to hold undivided interests, suitable for investors or family members wanting individualized stakes. Evaluating factors like control, transferability, liability, and estate planning ensures choosing the right ownership structure aligns with personal or financial goals.

Sole Ownership Infographic

libterm.com

libterm.com