General value encompasses the overall worth or importance of an object, service, or idea based on its utility, quality, and demand. Understanding this concept helps you make informed decisions and maximize benefits in various aspects of life. Explore the rest of the article to discover how assessing general value can enhance your decision-making skills.

Table of Comparison

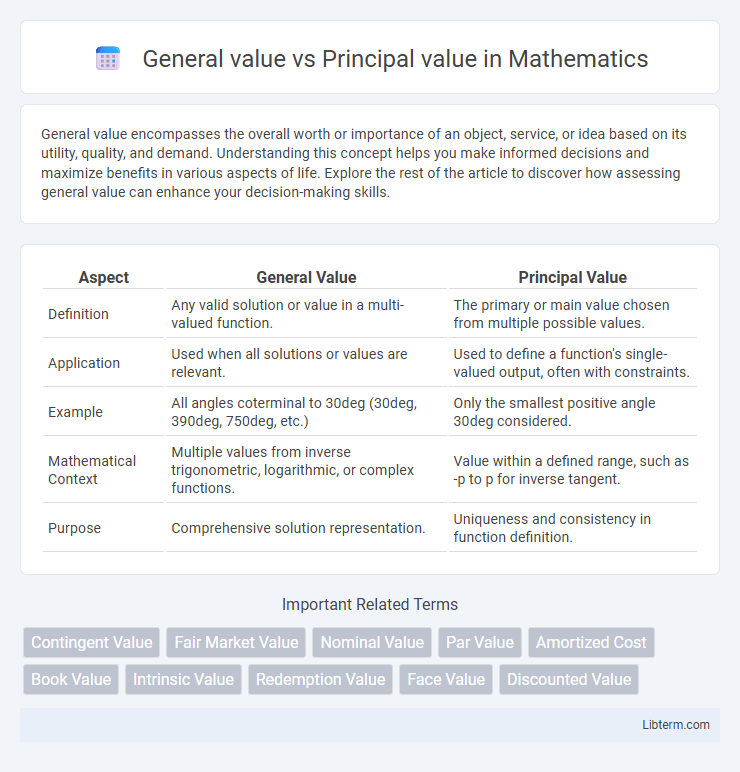

| Aspect | General Value | Principal Value |

|---|---|---|

| Definition | Any valid solution or value in a multi-valued function. | The primary or main value chosen from multiple possible values. |

| Application | Used when all solutions or values are relevant. | Used to define a function's single-valued output, often with constraints. |

| Example | All angles coterminal to 30deg (30deg, 390deg, 750deg, etc.) | Only the smallest positive angle 30deg considered. |

| Mathematical Context | Multiple values from inverse trigonometric, logarithmic, or complex functions. | Value within a defined range, such as -p to p for inverse tangent. |

| Purpose | Comprehensive solution representation. | Uniqueness and consistency in function definition. |

Introduction to General Value and Principal Value

General value represents the broad, overall worth assigned to an asset or investment, encompassing market conditions and future potential. Principal value specifically refers to the original sum of money invested or loaned, excluding any interest or gains. Understanding the distinction clarifies financial analysis and investment strategies by separating core capital from additional earnings or depreciation.

Defining General Value

General value refers to the overall worth or importance of an asset, concept, or entity, considering multiple factors such as market conditions, utility, and emotional significance. It encompasses subjective and objective assessments that contribute to understanding an item's comprehensive relevance. Principal value, in contrast, specifically denotes the core or original monetary amount without additions or deductions.

Understanding Principal Value

Principal value refers to the specific value assigned to a security or financial instrument at the time of issuance, representing its original investment amount or face value. Understanding principal value is crucial for calculating yields, interest payments, and for accurately assessing investment returns over time. Unlike general market value, principal value remains constant unless affected by actions like redemption or amortization.

Key Differences Between General Value and Principal Value

General value refers to the overall worth or market price of an asset considering various factors like demand, condition, and market trends, while principal value specifically denotes the original amount invested or the face value of a financial instrument. The key differences lie in their applications: general value fluctuates based on market conditions, whereas principal value remains fixed and represents the core investment base. Understanding these distinctions is crucial for accurate asset valuation and financial decision-making.

Mathematical Context: General Value vs. Principal Value

The general value of a function at a point includes all possible limits approached from different directions, particularly in complex analysis where multi-valued functions arise. The principal value refers to a specific branch or single-valued solution selected from these general values, often defined by imposing restrictions to maintain continuity and consistency, like the principal value of the complex logarithm or the Cauchy principal value in integrals. Understanding the distinction is crucial for solving complex integrals, evaluating inverse trigonometric functions, and managing branch cuts in multi-valued functions.

Importance in Calculus and Complex Analysis

General value and principal value are crucial concepts in calculus and complex analysis for evaluating integrals and handling singularities. The principal value often provides a finite, well-defined value for otherwise divergent integrals, enabling meaningful interpretation of improper integrals and Cauchy-type integrals. Understanding the distinction allows precise manipulation of integrals in residue theory, contour integration, and solving boundary value problems.

Practical Applications of General and Principal Values

General value refers to the overall worth or market price of an asset, widely used in financial reporting and investment analysis to reflect current market conditions. Principal value denotes the original sum invested or loaned, essential for calculating interest payments and amortization schedules in lending and bond markets. Practical applications of general value include portfolio valuation and financial disclosure, while principal value is critical for tracking loan balances and determining maturity payouts.

Common Mistakes and Misconceptions

Confusing general value with principal value often leads to inaccurate financial assessments, as the general value reflects an asset's market worth while the principal value denotes the original amount invested or loaned. A common mistake is treating these values interchangeably, which can result in errors during interest calculations or asset valuation. Misunderstanding the principal value as a fluctuating figure rather than a fixed baseline causes misjudgment in amortization schedules and investment returns.

Real-World Examples Illustrating Both Concepts

General value represents the broad market worth of an asset, evident in real estate where a home's value varies based on current market trends and buyer demand. Principal value refers to the original amount invested or loaned, as seen in mortgage payments where the borrower repays the initial loan balance over time. In bond investing, the principal value is the face value repaid at maturity, while the general value fluctuates with interest rate changes affecting market price.

Conclusion: Choosing the Right Approach

Selecting between general value and principal value depends on the financial context and objectives of the valuation. Principal value is preferred for its specificity in quantifying ownership stakes, while general value offers broader market perspectives relevant for overall asset assessment. Understanding the purpose of the valuation ensures the correct approach, enhancing accuracy and decision-making effectiveness.

General value Infographic

libterm.com

libterm.com