Liberalization removes restrictions on markets, fostering competition and encouraging economic growth by allowing more freedom in trade and investment. This process often leads to innovation, lower prices, and increased efficiency, benefiting consumers and businesses alike. Discover how liberalization can transform your economy by exploring key strategies and impacts in the rest of this article.

Table of Comparison

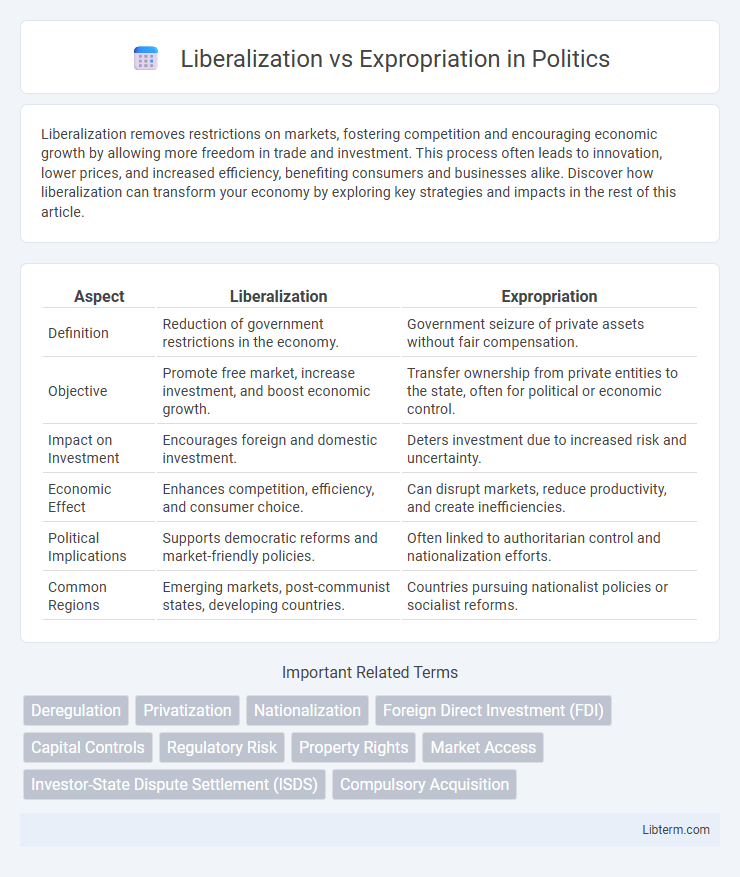

| Aspect | Liberalization | Expropriation |

|---|---|---|

| Definition | Reduction of government restrictions in the economy. | Government seizure of private assets without fair compensation. |

| Objective | Promote free market, increase investment, and boost economic growth. | Transfer ownership from private entities to the state, often for political or economic control. |

| Impact on Investment | Encourages foreign and domestic investment. | Deters investment due to increased risk and uncertainty. |

| Economic Effect | Enhances competition, efficiency, and consumer choice. | Can disrupt markets, reduce productivity, and create inefficiencies. |

| Political Implications | Supports democratic reforms and market-friendly policies. | Often linked to authoritarian control and nationalization efforts. |

| Common Regions | Emerging markets, post-communist states, developing countries. | Countries pursuing nationalist policies or socialist reforms. |

Understanding Liberalization and Expropriation

Liberalization involves reducing government restrictions and promoting free market conditions to encourage investment and economic growth. Expropriation refers to the government seizure of private assets, often without fair compensation, which poses significant risks to investors. Understanding the balance between these concepts is crucial for assessing political risk and investment security in emerging markets.

Historical Contexts of Economic Policy Shifts

Economic liberalization, characterized by reducing state control and promoting free-market policies, gained prominence in the late 20th century as countries like Chile and India transitioned away from protectionist models to stimulate growth and attract foreign investment. In contrast, expropriation, often seen in post-colonial and revolutionary contexts, involved nationalizing foreign-owned assets to assert sovereignty and redistribute wealth, evident in Venezuela under Hugo Chavez and Mexico's oil industry nationalization in 1938. These policy shifts reflect broader geopolitical and ideological struggles, with liberalization aligning with globalization trends and expropriation underscoring assertions of economic independence.

Key Features of Liberalization

Liberalization involves reducing government restrictions and barriers in economic activities, promoting free market competition and increasing foreign direct investment inflows. Key features include deregulation, privatization of state-owned enterprises, easing trade controls, and encouraging private sector participation to stimulate economic growth. This process often leads to enhanced efficiency, innovation, and integration into the global economy.

Core Principles of Expropriation

Expropriation involves the compulsory seizure of private property by the state for public use, subject to the core principles of legality, non-discrimination, due process, and prompt, adequate, and effective compensation. These principles ensure that expropriation actions comply with national laws, apply fairly without targeting foreign investors disproportionately, respect the right to a fair hearing, and provide timely and adequate monetary restitution reflecting the property's fair market value. Upholding these core tenets distinguishes lawful expropriation from arbitrary confiscation, protecting investor rights while enabling sovereign regulatory powers.

Liberalization: Economic Impacts and Outcomes

Liberalization in economic policy fosters increased foreign investment, market efficiency, and competition, which often leads to higher GDP growth and job creation. It encourages innovation and technology transfer by reducing trade barriers and regulatory constraints, enhancing productivity in various sectors. However, liberalization can also result in short-term social disparities while promoting long-term economic diversification and integration into the global economy.

Expropriation: Social and Financial Consequences

Expropriation often leads to severe social unrest as affected communities face displacement, loss of livelihoods, and weakened property rights, resulting in long-term societal instability. Financially, expropriation undermines investor confidence, disrupts capital flows, and can trigger capital flight, thereby negatively impacting economic growth and foreign direct investment. The unpredictable nature of expropriation imposes significant risks on multinational enterprises, increasing the cost of doing business and destabilizing local economies.

Comparing Investment Environments

Liberalization fosters an investment-friendly environment by reducing government restrictions, encouraging foreign direct investment, and promoting private sector growth, whereas expropriation creates uncertainty by imposing risks of asset seizure without fair compensation, deterring investors. Countries with liberalized economies tend to attract more capital inflows due to transparent regulations, property rights protection, and market openness compared to those with frequent expropriations. Stable investment environments driven by liberalization enhance economic development, innovation, and international partnerships, contrasting with the negative impacts of expropriation on investor confidence and economic stability.

Case Studies: Global Examples

Liberalization policies in economies such as India and Mexico have attracted foreign direct investment by reducing government control and opening markets, leading to significant GDP growth and technological advancements. Conversely, expropriation cases in Venezuela and Zimbabwe showcase the risks of state asset seizures, where nationalization of foreign-owned assets resulted in international disputes and capital flight. These global examples highlight the critical balance between market openness and sovereign control affecting investor confidence and economic stability.

Policy Implications for Developing Nations

Liberalization in developing nations facilitates foreign investment by reducing regulatory barriers, enhancing economic growth and infrastructure development. Expropriation, where governments seize assets without adequate compensation, deters investors due to heightened political risk and undermines long-term economic stability. Policies promoting transparent legal frameworks and fair dispute resolution mechanisms balance sovereign rights with investor confidence, crucial for sustainable development.

Future Trends: Balancing Rights and Reforms

Future trends in liberalization versus expropriation emphasize a strategic balance between protecting investor rights and implementing necessary economic reforms. Governments are increasingly adopting transparent regulatory frameworks that encourage foreign direct investment while reserving the right to intervene in strategic sectors for national interests. Technological advancements and international trade agreements are shaping policies to minimize disputes and foster sustainable development through cooperative governance models.

Liberalization Infographic

libterm.com

libterm.com