Traditional budgeting relies on historical financial data to create annual spending plans, often leading to rigid allocations that may not reflect current business needs. This method emphasizes detailed line-item control but can limit flexibility and responsiveness in dynamic markets. Explore the rest of the article to understand how alternative budgeting approaches might better align with your organization's goals.

Table of Comparison

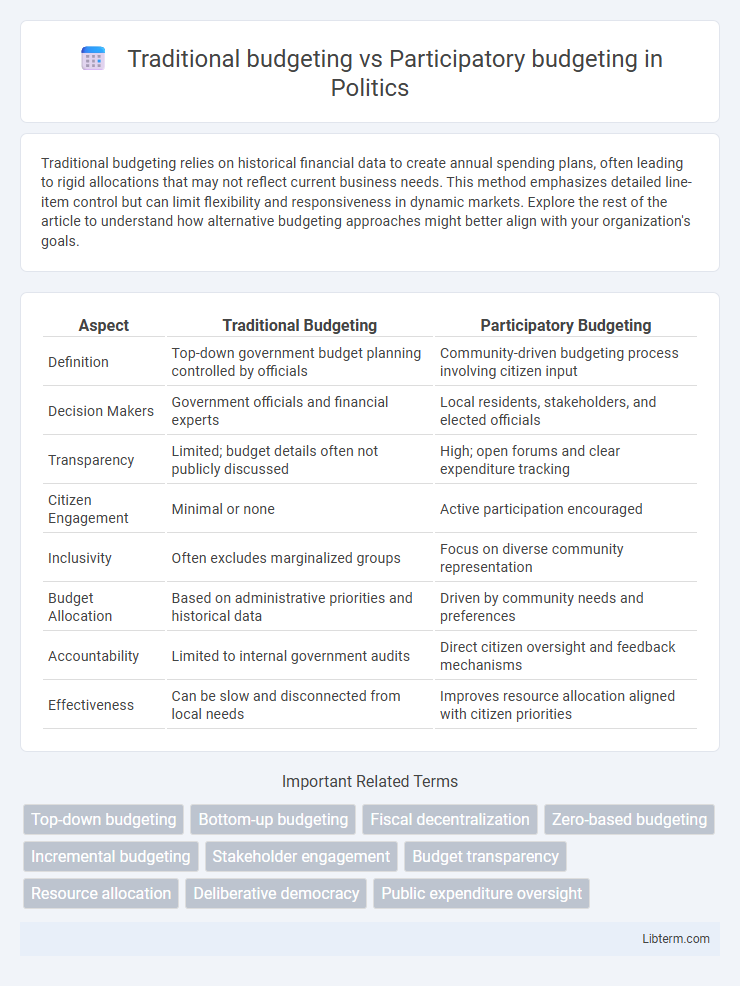

| Aspect | Traditional Budgeting | Participatory Budgeting |

|---|---|---|

| Definition | Top-down government budget planning controlled by officials | Community-driven budgeting process involving citizen input |

| Decision Makers | Government officials and financial experts | Local residents, stakeholders, and elected officials |

| Transparency | Limited; budget details often not publicly discussed | High; open forums and clear expenditure tracking |

| Citizen Engagement | Minimal or none | Active participation encouraged |

| Inclusivity | Often excludes marginalized groups | Focus on diverse community representation |

| Budget Allocation | Based on administrative priorities and historical data | Driven by community needs and preferences |

| Accountability | Limited to internal government audits | Direct citizen oversight and feedback mechanisms |

| Effectiveness | Can be slow and disconnected from local needs | Improves resource allocation aligned with citizen priorities |

Overview: Traditional vs Participatory Budgeting

Traditional budgeting centralizes financial decision-making within top management, often following fixed procedures and historical data, which may limit community input and adaptability. Participatory budgeting engages citizens directly in the allocation of public funds, enhancing transparency, accountability, and responsiveness to local needs by incorporating diverse perspectives. This approach fosters democratic involvement and can lead to more equitable distribution of resources compared to traditional top-down methods.

Definitions and Core Concepts

Traditional budgeting is a top-down financial planning process where organizational leaders allocate resources based on historical data and strategic priorities, emphasizing control and predictability. Participatory budgeting involves community members directly in decision-making to allocate public funds, promoting transparency, inclusiveness, and democratic engagement. Core concepts of traditional budgeting include centralized authority and fixed budgets, while participatory budgeting centers on collaborative deliberation, shared governance, and responsiveness to local needs.

Historical Development of Budgeting Methods

Traditional budgeting originated in the early 20th century, emphasizing top-down financial planning driven by historical expenditure data and rigid control mechanisms. Participatory budgeting emerged in the late 20th century, pioneered in Porto Alegre, Brazil, as a grassroots approach involving citizens directly in budget decision-making to enhance transparency and civic engagement. The shift from traditional to participatory methods reflects growing demands for democratic governance and adaptive fiscal management in public administration.

Key Processes in Traditional Budgeting

Traditional budgeting primarily relies on top-down, incremental allocation where senior management sets budget targets based on prior expenditures and strategic goals. The key processes involve forecasting revenue, analyzing fixed and variable costs, and imposing budget limits department-wise to control spending. This method emphasizes financial discipline and centralized decision-making, often overlooking grassroots input and flexibility.

Principles of Participatory Budgeting

Participatory budgeting centers on transparency, inclusivity, and collaborative decision-making, allowing community members direct input on allocating public funds. Unlike traditional budgeting, which relies on top-down control and expert-driven processes, participatory budgeting empowers citizens to propose, discuss, and prioritize projects that reflect collective needs. This democratic approach fosters accountability and enhances local engagement by ensuring diverse voices influence budgetary outcomes.

Stakeholder Involvement and Engagement

Traditional budgeting processes primarily involve top-down decision-making, limiting stakeholder involvement to senior management and finance departments, which can reduce overall engagement from employees and the community. In contrast, participatory budgeting actively includes diverse stakeholders such as community members, employees, and local organizations, fostering transparency and collaborative decision-making. This inclusive approach empowers participants, improving satisfaction and ensuring budget allocations better reflect the collective needs and priorities.

Advantages and Drawbacks of Traditional Budgeting

Traditional budgeting offers advantages such as simplicity, predictability, and centralized control, enabling companies to allocate resources based on historical data and financial forecasts. However, its drawbacks include limited flexibility, potential misalignment with current organizational goals, and reduced employee engagement due to the top-down approach. This method can hinder innovation and responsiveness, especially in dynamic markets where adaptability is crucial.

Benefits and Challenges of Participatory Budgeting

Participatory budgeting enhances transparency and citizen engagement by allowing community members to directly decide on public fund allocation, fostering greater trust and social inclusion. This approach encourages diverse input and better reflects local priorities but faces challenges such as potential delays in decision-making, the need for effective facilitation, and ensuring equitable participation across socio-economic groups. Compared to traditional budgeting, participatory budgeting promotes democratic governance yet requires significant resources and commitment to maintain sustained involvement and avoid manipulation.

Impact on Organizational Decision-Making

Traditional budgeting centralizes decision-making authority within upper management, often limiting input from lower-level employees and potentially overlooking valuable operational insights. Participatory budgeting enhances organizational decision-making by involving diverse stakeholders, fostering transparency, and encouraging collaborative prioritization of resources that align with broader organizational goals. This inclusive approach can lead to increased employee engagement, improved resource allocation, and a stronger alignment between budgeting outcomes and strategic objectives.

Choosing the Right Budgeting Approach

Traditional budgeting relies on top-down financial planning controlled by senior management, ensuring alignment with organizational goals but often limiting employee input and innovation. Participatory budgeting engages employees or community members directly in the budgeting process, fostering transparency, collaboration, and more responsive resource allocation. Choosing the right budgeting approach depends on organizational culture, stakeholder involvement needs, and the desired balance between control and inclusiveness.

Traditional budgeting Infographic

libterm.com

libterm.com