Consumption taxation directly impacts the prices you pay for goods and services by imposing taxes at the point of sale, influencing consumer behavior and spending patterns. Efficient consumption tax systems can generate significant government revenue while promoting economic fairness through targeted exemptions and progressive rates. Explore the full article to understand how consumption taxation shapes your financial decisions and the broader economy.

Table of Comparison

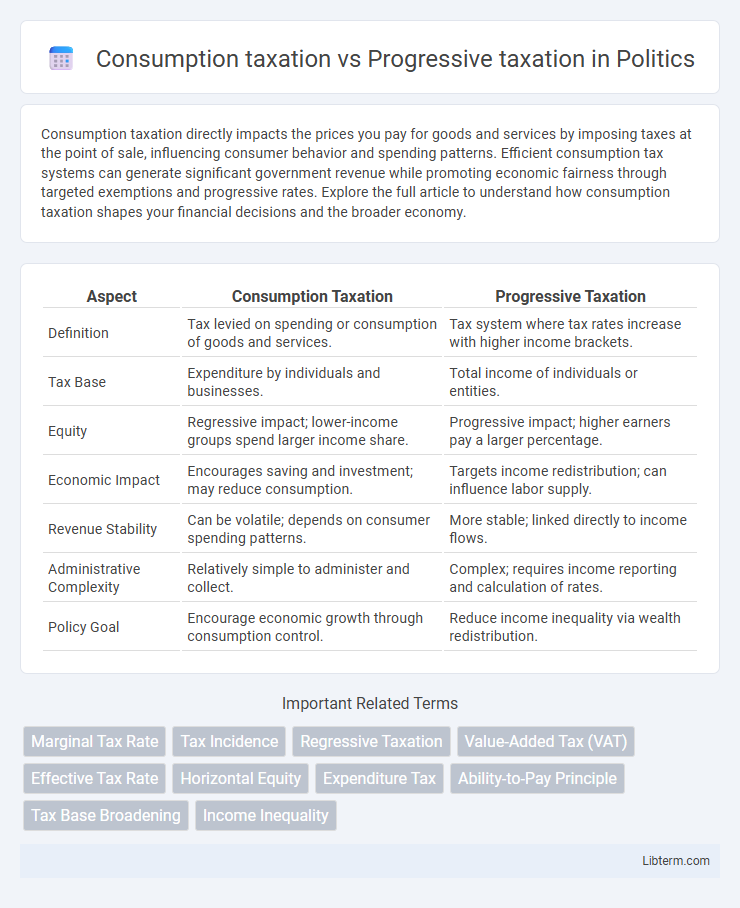

| Aspect | Consumption Taxation | Progressive Taxation |

|---|---|---|

| Definition | Tax levied on spending or consumption of goods and services. | Tax system where tax rates increase with higher income brackets. |

| Tax Base | Expenditure by individuals and businesses. | Total income of individuals or entities. |

| Equity | Regressive impact; lower-income groups spend larger income share. | Progressive impact; higher earners pay a larger percentage. |

| Economic Impact | Encourages saving and investment; may reduce consumption. | Targets income redistribution; can influence labor supply. |

| Revenue Stability | Can be volatile; depends on consumer spending patterns. | More stable; linked directly to income flows. |

| Administrative Complexity | Relatively simple to administer and collect. | Complex; requires income reporting and calculation of rates. |

| Policy Goal | Encourage economic growth through consumption control. | Reduce income inequality via wealth redistribution. |

Introduction to Taxation Systems

Consumption taxation applies taxes on goods and services at the point of purchase, influencing consumer behavior and generating consistent revenue streams. Progressive taxation imposes higher tax rates on increased income brackets, aiming to reduce income inequality and fund social programs. Both systems reflect different fiscal policies affecting economic equity and government funding strategies.

Defining Consumption Taxation

Consumption taxation refers to a system where taxes are levied on the purchase of goods and services rather than on income or profits. Common examples include value-added tax (VAT), sales tax, and excise duties, which encourage saving and investment by taxing spending instead of earnings. This contrasts with progressive taxation, where tax rates increase with higher income levels, aiming to redistribute wealth and reduce income inequality.

Understanding Progressive Taxation

Progressive taxation imposes higher tax rates on individuals with higher incomes, ensuring that those who earn more contribute a larger share of their earnings to public revenues. This system aims to reduce income inequality by redistributing wealth through graduated tax brackets, where tax rates increase incrementally as income rises. Unlike consumption taxation, which primarily taxes spending regardless of income level, progressive taxation targets the ability to pay, making it a key tool for social equity and fiscal policy.

Key Differences Between Consumption and Progressive Taxes

Consumption taxation imposes taxes on spending, such as sales or value-added taxes, affecting all consumers regardless of income level but often considered regressive since lower-income individuals spend a higher proportion of their income. Progressive taxation targets income or wealth with tax rates increasing as income rises, aiming to reduce income inequality by placing a higher burden on wealthier individuals. Key differences include the tax base--expenditure versus income--and the distributional impact, where progressive taxes are designed to be equitable by taxing ability to pay, while consumption taxes tend to be less income-sensitive.

Economic Impacts of Consumption Taxation

Consumption taxation often leads to a more stable revenue base as it is less sensitive to economic fluctuations compared to progressive income taxation. This type of tax can encourage savings and investment, promoting long-term economic growth by taxing spending rather than earnings. However, consumption taxes may be regressive, disproportionately affecting lower-income households and potentially reducing overall consumer demand.

Social Effects of Progressive Taxation

Progressive taxation reduces income inequality by imposing higher tax rates on wealthier individuals, which can enhance social cohesion and fund public services benefiting lower-income groups. It promotes wealth redistribution, improving access to education, healthcare, and social safety nets that contribute to poverty alleviation. This tax system also encourages social mobility by mitigating disparities in economic opportunity among different social classes.

Equity and Fairness in Taxation

Consumption taxation primarily targets spending, often placing a heavier burden on lower-income individuals who spend a larger portion of their income, raising concerns about equity and fairness. Progressive taxation imposes higher tax rates on higher income brackets, promoting vertical equity by aligning tax liability with the taxpayer's ability to pay. Balancing these systems involves addressing regressive effects of consumption taxes while leveraging progressive tax structures to enhance fairness in wealth distribution.

Administrative Complexity and Efficiency

Consumption taxation typically offers lower administrative complexity due to straightforward collection at points of sale and reduced need for detailed income tracking. Progressive taxation requires extensive record-keeping and verification to accurately assess income levels and apply varying tax rates, increasing administrative burdens. Efficiency in consumption taxes is enhanced by predictable revenue streams and minimized evasion opportunities, while progressive taxes often face challenges with compliance and costly enforcement measures.

Global Trends in Tax Policy Adoption

Global trends in tax policy reveal a growing shift towards consumption taxation, such as value-added tax (VAT) and goods and services tax (GST), favored for their efficiency and broad base. Progressive taxation remains central in developed economies to address income inequality, with countries like Sweden and Canada implementing steep marginal tax rates on higher incomes. Emerging markets balance these approaches, adopting consumption taxes to boost revenue while gradually increasing progressivity to fund social programs and reduce poverty.

Choosing the Right Taxation Model for Economic Growth

Consumption taxation encourages spending and investment by taxing expenditures rather than income, which can stimulate economic growth through increased consumer demand. Progressive taxation, which imposes higher rates on higher income brackets, aims to reduce income inequality and fund social programs but may reduce incentives for high earners to invest or expand businesses. Selecting the appropriate taxation model involves balancing economic growth objectives with equity considerations, where consumption taxes typically favor growth and progressive taxes emphasize redistribution.

Consumption taxation Infographic

libterm.com

libterm.com