Proportional taxation applies a consistent tax rate to all income levels, ensuring fairness and simplicity in tax systems. This approach minimizes income distortion and promotes transparency, making it easier for taxpayers to calculate their obligations. Explore the rest of the article to understand how proportional taxation impacts your finances and the broader economy.

Table of Comparison

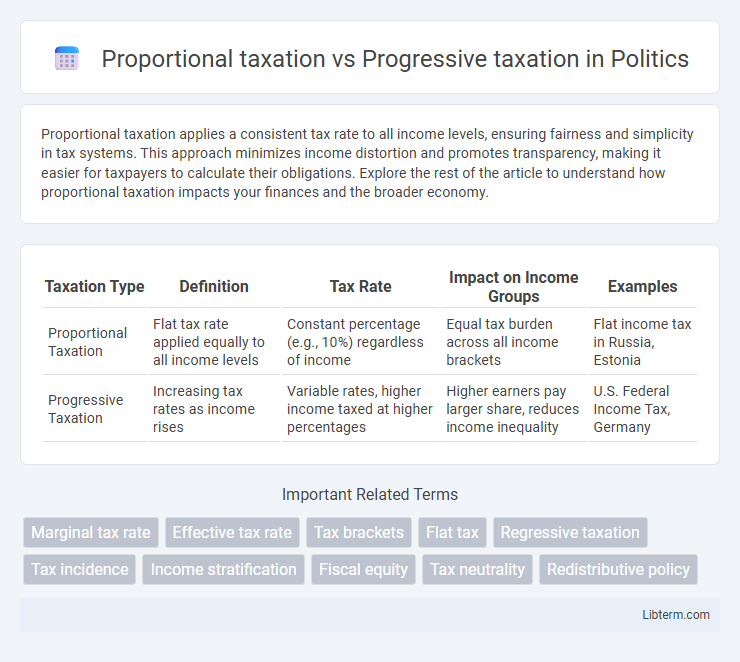

| Taxation Type | Definition | Tax Rate | Impact on Income Groups | Examples |

|---|---|---|---|---|

| Proportional Taxation | Flat tax rate applied equally to all income levels | Constant percentage (e.g., 10%) regardless of income | Equal tax burden across all income brackets | Flat income tax in Russia, Estonia |

| Progressive Taxation | Increasing tax rates as income rises | Variable rates, higher income taxed at higher percentages | Higher earners pay larger share, reduces income inequality | U.S. Federal Income Tax, Germany |

Introduction to Taxation Systems

Proportional taxation imposes a fixed tax rate on all income levels, ensuring taxpayers pay the same percentage regardless of earnings, which simplifies tax administration and maintains fairness through uniformity. Progressive taxation applies increasing tax rates as income rises, aiming to reduce income inequality and fund social programs by taxing higher earners more heavily. Understanding these foundational taxation systems is essential for analyzing government revenue strategies and their socioeconomic impacts.

What is Proportional Taxation?

Proportional taxation is a tax system where the same fixed tax rate applies uniformly to all taxpayers, regardless of their income level. This flat tax structure ensures that everyone pays an equal percentage of their earnings, maintaining simplicity and transparency in tax calculations. Proportional taxes are designed to minimize distortions in economic behavior while generating steady revenue for public services.

What is Progressive Taxation?

Progressive taxation is a tax system where the tax rate increases as the taxable amount increases, meaning higher-income earners pay a larger percentage of their income in taxes compared to lower-income individuals. This system aims to reduce income inequality by imposing heavier tax burdens on wealthier taxpayers, supporting social welfare programs and public services. Progressive tax brackets typically start with low rates for lower incomes, gradually rising to higher rates for the top income levels, ensuring a fair distribution of tax responsibilities.

Key Differences Between Proportional and Progressive Taxation

Proportional taxation imposes a fixed tax rate on all income levels, ensuring that everyone pays the same percentage regardless of earnings, while progressive taxation increases the tax rate as income rises, targeting higher earners with greater rates. The key difference lies in equity: proportional taxes maintain simplicity and uniformity, whereas progressive taxes aim to reduce income inequality by taxing wealthier individuals more. Proportional systems promote predictability and ease of compliance, whereas progressive systems focus on redistribution and social welfare financing.

Economic Impacts of Proportional Taxation

Proportional taxation imposes a uniform tax rate regardless of income, which can simplify compliance and reduce administrative costs for governments. This system tends to have less distorting effects on labor supply and investment decisions compared to progressive taxation, potentially encouraging economic growth and productivity. However, proportional taxation may be less effective at addressing income inequality, as it does not increase the tax burden on higher earners.

Economic Effects of Progressive Taxation

Progressive taxation increases tax rates as income rises, which can reduce income inequality by redistributing wealth from higher earners to fund social programs. This tax structure tends to strengthen social safety nets and boost consumer spending among lower-income groups, supporting overall economic growth. However, excessively high progressive rates may discourage investment and labor participation by diminishing the after-tax return on income.

Social Equity and Income Distribution

Proportional taxation imposes a uniform tax rate on all income levels, maintaining simplicity but often placing a heavier relative burden on lower-income earners, which may exacerbate income inequality. Progressive taxation increases tax rates as income rises, effectively redistributing wealth and promoting social equity by reducing the income gap between the rich and the poor. Studies show that progressive tax systems contribute to more balanced income distribution and improved social welfare outcomes compared to proportional tax models.

Administrative Complexity and Implementation

Proportional taxation features a flat tax rate that simplifies administrative processes and reduces compliance costs, making implementation straightforward for tax authorities. Progressive taxation involves multiple tax brackets with varying rates, increasing administrative complexity due to the need for comprehensive income assessment and enforcement mechanisms. The intricate structure of progressive taxes requires robust systems and skilled personnel to manage accurate calculations and prevent evasion, contrasting with the streamlined approach of proportional taxation.

Global Examples of Taxation Models

Proportional taxation, also known as flat tax, is implemented in countries like Estonia and Russia, where a single tax rate applies regardless of income level, promoting simplicity and uniformity in tax collection. Progressive taxation, exemplified by the United States and Germany, imposes higher tax rates on higher income brackets, aiming to reduce income inequality and increase government revenue for social programs. Nordic countries such as Sweden and Denmark combine progressive tax rates with robust social welfare systems, demonstrating a model where taxation supports extensive public services and wealth redistribution.

Which Tax System is Best?

Proportional taxation imposes a constant tax rate on all income levels, ensuring simplicity and fairness through uniformity, while progressive taxation applies increasing rates as income rises, promoting wealth redistribution and reducing income inequality. The choice between these systems depends on policy goals: proportional taxes enhance transparency and economic efficiency, whereas progressive taxes support social equity and fund public services more robustly. Empirical studies reveal that progressive taxation effectively alleviates poverty without significantly harming economic growth, suggesting it is better suited for societies prioritizing social welfare.

Proportional taxation Infographic

libterm.com

libterm.com